Synthèse

The global market for sports nutrition supplements is growing significantly, with a projected CAGR of 6% to 2024. According to a study by Research Dive, the market size was valued at US$13.9 billion and is expected to reach US$35.35 billion by 2026. This expansion is fuelled by an increase in the number of health-conscious people, and a rise in the number of people taking part in gym and fitness activities. Manufacturers and retailers identify three key customer segments: professional bodybuilders/athletes, regular athletes and "lifestyle" consumers. The market has adapted to these diverse needs by expanding the product range, developing more specialized supplements such as vegan and "clean label" options. Influencers and social media marketing have played an important role in driving demand, with popular fitness industry figures partnering with or creating their own supplement brands. The sector is also characterized by a wide range of offerings, from whey proteins and BCAAs to creatine and mass gainers, catering to diverse athletic needs. Despite a complex pricing landscape, the sector is thriving, with affluent consumers willing to pay top dollar for the quality and benefits these products bring.

Trends and key figures in the sports nutrition supplements market.

Demand for dietary supplements among athletes has been characterized by several key trends, with a general increase in the propensity of athletes to incorporate these products into their routines. Notably, around 40-45% of athletes are reported to consume sports supplements, indicating a significant level of adoption within the athletic community. This trend appears to increase with age, with athletes aged 30-40 representing the largest segment, with over 60% regularly incorporating supplements into their diets. Several factors have been identified to explain the consumption of dietary supplements in sport. One of the main motivations, cited by a third of athletes, is to combat fatigue and push their limits during exercise. In addition, around 20% of athletes take supplements to make up for specific nutrient deficiencies. It's interesting to note that, while less than 10% of athletes use dietary supplements specifically to enhance stamina or power, these statistics reflect a broad spectrum of athletes practicing different sports.this suggests that the quest for strength or power may be more important in certain groups, such as weightlifters or rugby players. In terms of sources of information on dietary supplements, a large proportion of athletes - over 20% - are influenced by sports advice found in magazines or online, even before seeking advice from coaches, trainers or health professionals. This highlights the important role of self-medication among athletes, with less than 35% following the advice of a healthcare professional when choosing dietary supplements.

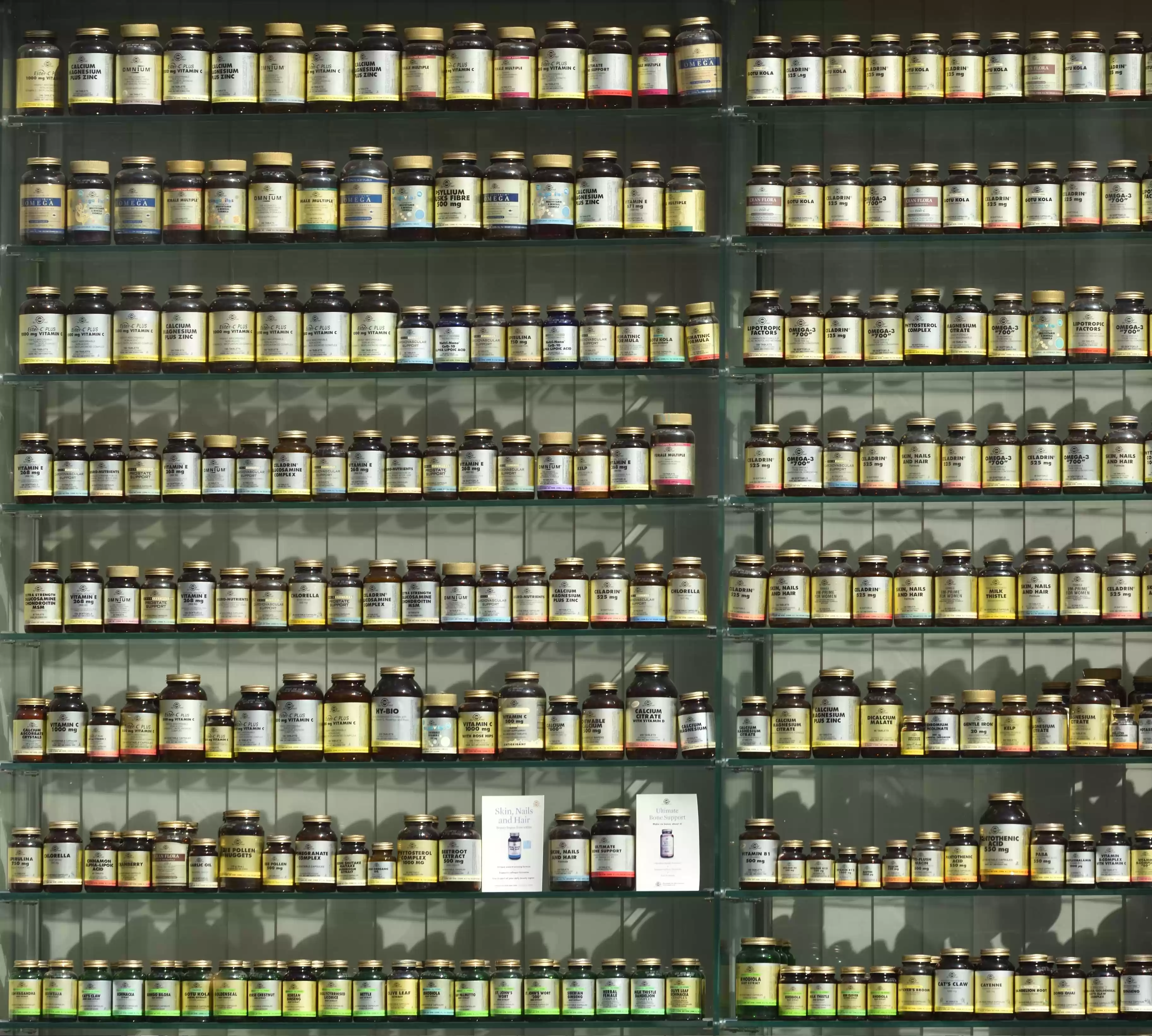

The structure of the sports supplements market comprises three main categories, namely bodybuilders and professional athletes, regular non-professional athletes and lifestyle consumers, with the emphasis on the latter two groups. Companies target regular athletes and the general athletic population, indicating a strategy to reach individuals with moderate-to-high incomes and regular sports routines. Among the drivers of demand for dietary supplements, theincrease in the number of athletes and fitness centers stands out. From 2015 to 2018, the number of athletes registered with federations jumped from around 15 to 20 million. This expansion of sports facilities and participants not only fosters greater access to exercise equipment, but also increased demand for specialized dietary supplements. Urbanization and digitization are also important factors influencing the market. The French population, which accounts for more than 80% of urban dwellers, is adopting more sedentary lifestyles, encouraging the consumption of dietary supplements as a means of achieving their sporting or personal goals. In addition, the influence of key players in the sports supplements industry is significant

The sports supplements market is both diversified and saturated, with numerous brands vying for dominance. The major players in this fast-growing sector not only compete in terms of product variety and efficacy, but also wage an ongoing battle to win consumer trust through quality and compliance with strict regulatory standards.

- MyProtein: Initially sponsored by influencer Tibo InShape, MyProtein has made a name for itself as one of the leading suppliers of protein and other training supplements. Known for its wide range of products including whey proteins, amino acids and vegan options, MyProtein resonates with athletes and fitness enthusiasts from all walks of life. The company's growth and popularity are testament to its commitment to quality.

- InShape Nutrition: Founded by Tibo InShape after his partnership with MyProtein, InShape Nutrition has established itself as a strong competitor in the market. With its range of tailor-made supplements, it leverages the popularity and influence of its founder to build credibility and appeal to a younger, fitness-oriented audience.

- AM Nutrition: All Musculation's own brand, AM Nutrition has carved out a place for itself by offering products that prioritize purity and supply. It emphasizes the importance of muscle growth and recovery, targeting bodybuilders and serious athletes.

- Nutrition and health, Isostar: As specialists in sports nutrition, they have long been recognized for providing athletes with high-performance products that promote endurance and effective recovery. Their experience in the market has given them an authoritative and loyal customer base.

- EA Pharma with Eafit: Coming from the pharmaceutical industry, EA Pharma with Eafit combines scientific rigor with sports nutrition. Their approach often appeals to consumers who are wary of the quality and efficacy of dietary supplements.

- Prozis: A leading online retailer that not only sells various brands, but also produces its own range of dietary supplements. With competitive prices and a wide range of products, Prozis has become a reference point for many customers looking for convenience and variety.

- Fitness Boutique: Synonymous with high-quality sports nutrition and fitness equipment, Fitness Boutique offers brand-name products, such as its own whey protein, for those seeking supplements that support intense training regimes.

- Super Physique Nutrition: Founded by Rudy Coia, Super Physique Nutrition emphasizes the synergy between fitness expertise and product development. This brand is aimed at consumers who appreciate the advice of a well-known personality in the fitness world.

- Natura Force, Justine Gallice Fitness and Marine Leuleu with MyProtein, Les trois Chênes laboratory These brands and their products are benchmarks in the fitness world

à la compréhension de ce marché

Détail du contenu

Informations

Informations

- Nombre de pages : 30 pages

- Format : Version digitale et PDF

- Dernière mise à jour : 11/05/2023

Sommaire et extraits

Sommaire et extraits

1 Market overview

1.1 Categories and uses of food supplements for athletes

Food supplements are concentrates of various substances (vitamins, minerals, plant extracts...) in edible or drinkable form, with a nutritional or physiological effect as defined by the European Parliament Directive 2002/46/EC. They are between food and medicine, supposed to complement the former while avoiding the consumption of the latter.

Sportsmen and women, whether athletes or occasional, often have a much more demanding lifestyle than non-sportsmen and women. Their daily needs, especially in minerals, proteins and carbohydrates, are greater than those of inactive people. Supplements allow them to :

- Make up for their nutritional deficits

- Improve their performance, before, during and after exercise

There are 3 main categories of food supplements for athletes:

- Those that have an effect on health, they provide the body with nutrients that the body may lack due to unbalanced nutrition;

- Those consumed during the effort, they serve to maintain or even improve performance for a certain period of time;

- Those allowing a better recovery.

The market for sports food supplements is booming and is expected to grow at an average annual rate of 6% by 2024. The growth of the French market follows the global growth of dietary supplements for sports.

This study does not cover energy/energy drinks (see the study on the Energy Drinks Market) nor sports food products (cereal bars, gels, enriched meals, etc.).

1.2 An explosion in global growth

As detailed below, the global market is growing. Explanatory factors include a growing awareness of the importance of exercising (***).

In recent decades, sedentary lifestyles and increased access to food have led to a sharp increase in the number of obese people worldwide: **% of adults are overweight and **% of adults are obese ...

1.3 Consequences of COVID-19 on the dietary supplements market according to a market expert

This interview was conducted by a Businesscoot analyst with a sector expert validated by our teams

Please note: this interview concerns the dietary supplements market in general and not only dietary supplements for sports

What is your vision of the market?

The dietary supplements market is growing at a rate of ...

1.4 A growing French market

There is no exact data regarding the size of the sports nutrition supplements market, so we will estimate the size of this market using the same process as the global market.

How much do the French spend on sports nutrition supplements?

A study published by My Protein in November **** classified the ...

1.5 A trade balance in surplus

For this part we consider the customs code closest to the category "food supplements" which is ******** " Food preparations, n.e. s., containing by weight *.*% milk fat, *% sucrose or isoglucose, *% glucose or starch ". It should be noted that the scope of the customs code considered is the closest to our study object ...

2 Analysis of the demand

2.1 Profile of the average consumer

The average consumer of sports supplements is a young male from Generation Z or a millennial, born after ****. Typically from affluent families, or earning comfortably in the case of millenials, typical consumers are more likely to be members of a fitness club.[***]

It is important to note that the graphs below ...

2.2 Manufacturers identify 3 main areas of demand

The manufacturers and sellers of food supplements for sports distinguish * main categories in which they are particularly interested:

Bodybuilders and professional athletes: with the objective of improving their performance, they consume supplements to strengthen the effects of their training. Regular athletes: generally passionate but not professional, they do not push the ...

2.3 Main demand drivers

We can identify several factors that determine the consumption of dietary supplements, which also suggest a robust growth for the industry:

The increasing number of sportsmen

The rapid increase in the number of fitness centers and practitioners of this activity (***) allows for greater access to sports machines, generates an increased demand ...

2.4 Women consuming dietary supplements for sports: a trend that is still not well addressed by brands

The advertising of sports nutrition supplements is mainly directed towards men, with a strong emphasis on mass gain and bodybuilding.

However, as the graph below shows, almost as many women as men consume sports supplements on a regular basis.

Share of athletes consuming dietary supplements for sport, by gender France, ****, in ...

2.5 A demand for vegan food supplements in sports

While many sports nutrition supplements contain animal proteins (***), there is a growing demand for vegan supplements, using vegetable proteins to obtain results similar to "traditional" protein supplements.

Evolution of the use of vegetable proteins in protein powders Europe, ****-****, in % Source: ****

In fact, the graph below shows that soy, rice and ...

3 Market structure

3.1 General organization of the sector

Organization of the sector

The market corresponds to a classic market, in which the product passes by a manufacturer then a distributor before reaching the consumer. However, there is a growing trend towards direct sales, from manufacturers to consumers through online sales sites.

Two main categories share the market for the ...

3.2 A production system that meets precise quality standards

Large laboratories and companies have appropriated the production of food supplements for sports. Often derived from natural products (***), the strength of these supplements lies in their concentration in active ingredients.

In order to be ingested effectively, the role of the industrialist will be to isolate the molecule sought or to synthesize ...

3.3 Distribution

Distributors

A **** report from the European Commission details the preferred sales channels in Europe. Although this study is dated and does not only concern France, it allows us to roughly evaluate the weight of each distribution channel mentioned in the table above. However, it should be borne in mind that the ...

4 Analysis of the offer

4.1 An expanded offer to reach a larger audience

The sports nutrition market has a long and painful history, tainted by doping scandals, but has gradually reinvented itself. For some people, food supplements for sportsmen have almost become everyday products. Progressively, manufacturers and distributors are multiplying the number of products available on the market in order to reach a wider ...

4.2 New offers

A notable trend is the change in communication by distribution and manufacturing companies. Companies are increasingly highlighting the protein source of sports supplements (***).

At the same time, we are seeing the development of products for people who want to live a healthy lifestyle (***). The rise of the vegan movement coincides with ...

4.3 A multitude of products to meet many needs

One of the characteristics of dietary supplements for sports is the multitude of products available, not only by the number of brands on the market, but also by the type of products they offer. By the appearance and composition, the products are different from each other. Here is a list of ...

4.4 Price analysis

It is quite complex to give the average price of a sports food supplement, given the variety available on the market. From the analysis of some retailer sites (***), it is nevertheless possible to make a topology of prices:

These few price ranges show that prices tend to be relatively high, for ...

5 Regulation

5.1 Current regulations

Regulations set up at national and European level establish a list of authorized ingredients in the manufacture of food supplements, as well as the maximum dose not to exceed for vitamins and minerals.

However, unlike drugs on the market, the marketing of these food supplements for sports does not require specific ...

5.2 The role of ANSES

In France, the national health security agency is responsible for assessing the risks associated with the consumption of supplements and has the role of setting legal limits of concentration in food supplements. In order to fulfill this mission, ANSES has set up a nutrivigilance system that collects data from health professionals ...

6 Companies

6.1 Company segmentation

- Nutrition et Santé (marque Isostar)

- Diete Sport France (Overestim.s)

- Laboratoire Les Trois Chênes

- EA Pharma Olyos (Eafit, Granions, Punch Power)

- Menarini group (Marque Isoxan)

- Apurna (Lactalis)

- Nutrimeo

- Prozis

- Glanbia

- My Protein (The Hut Group)

- Nutrimuscle

- Nutripure

- Power Nutrition

- Nutrisport

- Krissport

- Coca-Cola European Partners CCEP Groupe Powerade

- AM Nutrition - N4BRANDS Groupe

- Atlet TCA

- Biotech USA Group

- Eric Favre (Les 3 Chênes)

- Laboratoire Les Trois Chênes (Eric Fabre)

- Meltonic

- Myprotein

- Nutergia

- Overstims

- Scitec Nutrition (BiotechUSA Group)

- STC Nutrition (Laboratoire Ineldea)

- Ta Energy

Liste des graphiques

Liste des graphiques

- Taille du marché mondial de la nutrition sportive

- Consommation de compléments alimentaires chez les sportifs

- Objectif de la consommation de compléments alimentaires pour le sport

- Origine de la recommandation du complément alimentaire pour le sport

- Part des sportifs consommant des compléments alimentaires pour le sport, par catégorie d'âge

Toutes nos études sont disponible en ligne et en PDF

Nous vous proposons de consulter un exemple de notre travail d'étude sur un autre marché !

Dernières actualités

Entreprises citées dans cette étude

Cette étude contient un panorama complet des entreprises du marché avec les derniers chiffres et actualités de chaque entreprise :

Choisir cette étude c'est :

Choisir cette étude c'est :

Accéder à plus de 35 heures de travail

Nos études sont le résultat de plus de 35 heures de recherches et d'analyses. Utiliser nos études vous permet de consacrer plus de temps et de valeur ajoutée à vos projets.

Profiter de 6 années d'expérience et de plus de 1500 études sectorielles déjà produites

Notre expertise nous permet de produire des études complètes dans tous les secteurs, y compris des marchés de niche ou naissants.

Notre savoir-faire et notre méthodologie nous permet de produire des études avec un rapport qualité-prix unique

Accéder à plusieurs milliers d'articles et données payantes

Businesscoot a accès à l'ensemble de la presse économique payante ainsi qu'à des bases de données exclusives pour réaliser ses études de marché (+ 30 000 articles et sources privées).

Afin d'enrichir nos études, nos analystes utilisent également des indicateurs web (semrush, trends…) pour identifier les tendances sur un marché et les stratégies des entreprises. (Consulter nos sources payantes)

Un accompagnement garanti après votre achat

Une équipe dédiée au service après-vente, pour vous garantir un niveau de satisfaction élevé. (+33) 9 70 46 55 00

Un format digital pensé pour nos utilisateurs

Vous accédez à un PDF mais aussi à une version digitale pensée pour nos clients. Cette version vous permet d’accéder aux sources, aux données au format Excel et aux graphiques. Le contenu de l'étude peut ainsi être facilement récupéré et adapté pour vos supports.

Nos offres :

Nos offres :

the market for sports nutrition supplements | France

- Quels sont les chiffres sur la taille et la croissance du marché ?

- Quels leviers tirent la croissance du marché et leur évolution ?

- Quel est le positionnement des entreprises sur la chaine de valeur ?

- Comment se différencient les entreprises du marché ?

- Données issues de plusieurs dizaines de bases de données

Pack 5 études (-15%) France

- 5 études au prix de 75,6€HT par étude à choisir parmi nos 800 titres sur le catalogue France pendant 12 mois

- Conservez -15% sur les études supplémentaires achetées

- Choisissez le remboursement des crédits non consommés au terme des 12 mois (durée du pack)

Consultez les conditions du pack et de remboursement des crédits non consommés.

- 01/03/2024 - Mise à jour des données financières de l'entreprise Glanbia

- 01/03/2024 - Mise à jour des données financières de l'entreprise EA Pharma Olyos (Eafit, Granions, Punch Power)

- 01/03/2024 - Mise à jour des données financières de l'entreprise Nutrimeo

- 01/03/2024 - Mise à jour des données financières de l'entreprise Apurna (Lactalis)

- 01/03/2024 - Mise à jour des données financières de l'entreprise Coca-Cola European Partners CCEP Groupe Powerade

- 01/03/2024 - Mise à jour des données financières de l'entreprise Nutrition et Santé (marque Isostar)

- 01/03/2024 - Mise à jour des données financières de l'entreprise Diete Sport France (Overestim.s)

- 01/03/2024 - Mise à jour des données financières de l'entreprise Laboratoire Les Trois Chênes

- 01/03/2024 - Mise à jour des données financières de l'entreprise Menarini group (Marque Isoxan)

- 04/11/2023 - Mise à jour des données financières de l'entreprise Glanbia

- 04/11/2023 - Mise à jour des données financières de l'entreprise EA Pharma (Eafit)

- 04/11/2023 - Mise à jour des données financières de l'entreprise Nutrimeo

- 04/11/2023 - Mise à jour des données financières de l'entreprise Coca-Cola European Partners CCEP Groupe Powerade

- 04/11/2023 - Mise à jour des données financières de l'entreprise Apurna (Lactalis)

- 04/11/2023 - Mise à jour des données financières de l'entreprise Menarini group (Marque Isoxan)

- 04/11/2023 - Mise à jour des données financières de l'entreprise Nutrition et Santé (marque Isostar)

- 04/11/2023 - Mise à jour des données financières de l'entreprise Diete Sport France (Overestim.s)

- 04/11/2023 - Mise à jour des données financières de l'entreprise Laboratoire Les Trois Chênes

- 03/08/2023 - Mise à jour des données financières de l'entreprise Glanbia

- 03/08/2023 - Mise à jour des données financières de l'entreprise EA Pharma (Eafit)

- 03/08/2023 - Mise à jour des données financières de l'entreprise Nutrimeo

- 03/08/2023 - Mise à jour des données financières de l'entreprise Coca-Cola European Partners CCEP Groupe Powerade

- 03/08/2023 - Mise à jour des données financières de l'entreprise Menarini group (Marque Isoxan)

- 03/08/2023 - Mise à jour des données financières de l'entreprise Laboratoire Les Trois Chênes

- 03/08/2023 - Mise à jour des données financières de l'entreprise Diete Sport France (Overestim.s)

- 03/08/2023 - Mise à jour des données financières de l'entreprise Nutrition et Santé (marque Isostar)

- 28/07/2023 - Mise à jour des données financières de l'entreprise Apurna (Lactalis)

- 06/07/2023 - Ajout des informations de l'entreprise Ta Energy

- 06/07/2023 - Ajout des informations de l'entreprise STC Nutrition

- 06/07/2023 - Ajout des informations de l'entreprise Scitec Nutrition

- 06/07/2023 - Ajout des informations de l'entreprise Overstims

- 06/07/2023 - Ajout des informations de l'entreprise Nutergia

- 06/07/2023 - Ajout des informations de l'entreprise Myprotein

- 06/07/2023 - Ajout des informations de l'entreprise Meltonic

- 06/07/2023 - Ajout des informations de l'entreprise Laboratoire Les Trois Chênes (Eric Fabre)

- 06/07/2023 - Ajout des informations de l'entreprise Eric Favre (Les 3 Chênes)

- 06/07/2023 - Ajout des informations de l'entreprise Biotech USA

- 06/07/2023 - Ajout des informations de l'entreprise Atlet

- 06/07/2023 - Ajout des informations de l'entreprise AM Nutrition

- 03/07/2023 - Ajout des informations de l'entreprise Coca-Cola European Partners CCEP Groupe Powerade

- 29/05/2023 - Ajout des informations de l'entreprise Krissport

- 28/05/2023 - Ajout des informations de l'entreprise Nutrisport

- 15/05/2023 - Ajout des informations de l'entreprise Power Nutrition

- 10/05/2023 - Ajout des informations de l'entreprise Green Whey

- 10/05/2023 - Ajout des informations de l'entreprise Nutripure

- 10/05/2023 - Ajout des informations de l'entreprise Nutrimuscle

- 02/05/2023 - Mise à jour des données financières de l'entreprise Glanbia

- 02/05/2023 - Mise à jour des données financières de l'entreprise EA Pharma (Eafit)

- 02/05/2023 - Mise à jour des données financières de l'entreprise Nutrimeo

- 02/05/2023 - Mise à jour des données financières de l'entreprise Menarini group (Marque Isoxan)

Pharmacie : les Granions d'Olyos Group à la conquête de l'Amérique - 30/11/2023

Pharmacie : les Granions d'Olyos Group à la conquête de l'Amérique - 30/11/2023

Overstim.s, spécialiste de la nutrition sportive, anticipe un effet - 28/09/2023

Overstim.s, spécialiste de la nutrition sportive, anticipe un effet - 28/09/2023

Ardrian et Bpifrance investissent dans Nutripure - 19/05/2022

Ardrian et Bpifrance investissent dans Nutripure - 19/05/2022

Complément alimentaires : cure de croissance pour Les Trois Chênes - 01/12/2021

Complément alimentaires : cure de croissance pour Les Trois Chênes - 01/12/2021