Detailed content of our market study

Inforamtion

Inforamtion

- Number of pages : 35 pages

- Format : Digital and PDF versions

- Last update :

Summary and extracts

Summary and extracts

1 Market overview

1.1 Market overview and definition

Cosmetics are defined by the Public Health Code as "any product intended to be placed in contact with the superficial parts of the human body with a view to cleaning them, perfuming them, modifying their appearance, protecting them, maintaining them in good condition or correcting body odors". Men's cosmetics are adapted to the specific needs of men's skin and bodies.

The men's cosmetics market can be broken down into several major segments:

- hygiene products (shower gels, shampoos, deodorants, etc.) ;

- skincare products (creams, cleansers, aftershaves, etc.);

- beauty products (make-up, perfumes).

Sales in this sector have been rising for several years, and are set to continue to do so in the future: worldwide, their CAGR (compound annual growth rate) is estimated at 5.6% over the period 2024-2032. In France, men's cosmetics represent around 5% of the overall cosmetics market, but their growth potential is significant.

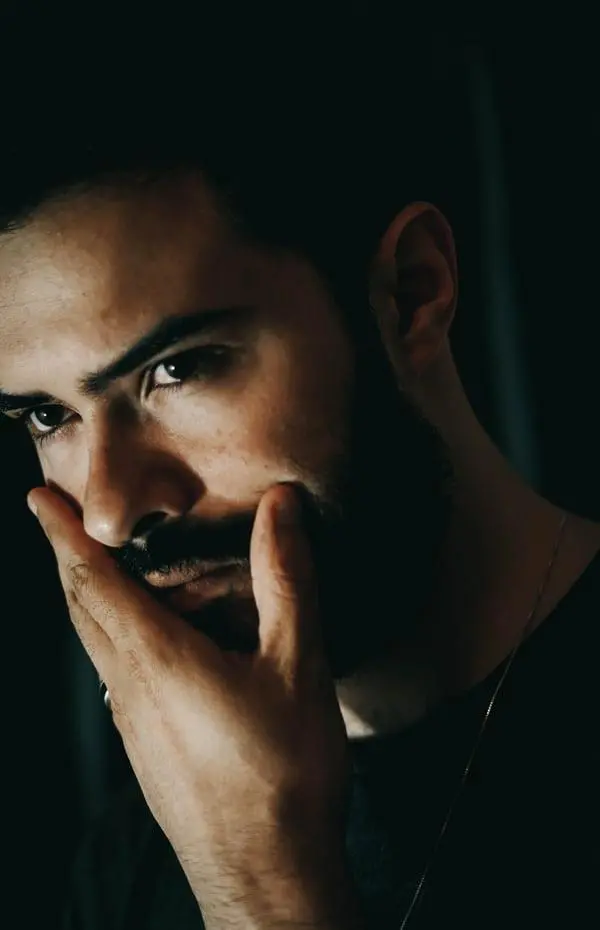

This is due to men's growing interest in their appearance and well-being. More and more male consumers are turning to cosmetics to feel better, boost their self-confidence or combat ageing. In France, around 50% of men now use these products. The success of certain fashions, such as beards, also plays in the sector's favor: men want to take better care of their beards, and are ready to buy new tools or dedicated care products to do so.

The market is also boosted by the many brands that have appeared in recent years. For a long time, the range of products was dependent on the sector's major manufacturers, whose catalogs for men remained limited, but these new players have started to offer more specific products, such as organic and natural products. In France, L'Oréal Men Expert and Nivea Men account for more than three-quarters of sales.

1.2 Global market

the global market for men's cosmetics and personal care products (***) of *.*% over the period.

Sales forecasts for the men's cosmetics and skincare market World, ****-****, in billions of dollars Source: ****

The Asia-Pacific region appears to be the main market territory, with sales of $**.* billion in **** (***). Europe should follow suit, with an estimated CAGR of *% to ****, with Germany playing a leading role.

Geographical breakdown of the men's cosmetics and skincare market World, ****, in billions of dollars Source: ****

This general craze can be explained by"a change in attitude towards men's grooming, a wider acceptance of men's personal grooming routines, and the increased influence of social media. [***]

1.3 French market

In ****, the Fédération des entreprises de la beauté (***) estimated the French cosmetics manufacturing market at **.* billion euros, up **% on ****.

trend in the size of the cosmetics manufacturing market France, ****-****, in billions of euros Source: ****

The men's beauty segment represents around *.* billion euros, or *% of the French cosmetics market. It remains a niche segment, but one with major development opportunities. "The market is infinitely smaller than that for women, but with far greater growth potential," says Alexis de Guitaut, director of the online sales site Rasage Classique. [***]

Share of men's beauty products in the cosmetics market France, ****, in Source: ****

Apart from this global estimate, there are few precise figures on the French market for men's cosmetics. However, some segments can be analyzed in greater detail, such as shaving. In ****, it was close to *** million euros, but had been experiencing declining volumes for several years. "The French shave less often during the week. The decline has been much more marked over the last five years", commented Cécile Minier, Beauty Director at Kantar. [***]

Breakdown of the French shaving market France, ****, in millions of euros Source: ****

Aftershave products are holding up well, with ** million euros and +*.*% growth in value, and a ...

1.4 French trade balance in cosmetics

Based on data from the UN Comtrade database, in particular code **** (***), it can be seen that France has a largely positive trade balance in this sector. In ****, it exported $**.* billion in value, up *.*% on ****, against $*.* billion in imports.

France's strength in the cosmetics trade appears to be a positive sign, given the potential of the global men's cosmetics market. France is ideally placed to participate in the sector's growth.

Cosmetics market trade balance France, ****-****, in billions of dollars Source: ****

This feeling is reinforced by the main countries to which France exports its cosmetics, where we find several promising territories in the men's cosmetics market, notably the United States, Germany and Asian countries (***).

Main countries where France exports cosmetics France, ****, in billions of euros Source: ****

On the import side, France's main partners are in Europe (***).

Main countries from which France imports cosmetics France, ****, in billions of euros Source: ****

2 Demand analysis

2.1 The groom boom, or when men take better care of themselves

French men tend to take more and more care of themselves: this trend is known as the groom boom. By ****, nearly one French man in two will be using cosmetics. [***]

Moisturizers, used by **% of French men, and cleansers, **%, are the most popular products among male consumers. [***]

Appearance and the desire to take care of oneself are major reasons for adopting a beauty routine. The playful and innovative side of such an approach also shines through in the responses.

Main reasons for using skincare products and adopting a skincare routine among men France, ****, in % Source: ****

This appetence for skincare is also reflected in the significant proportion of men who are willing to seek professional aesthetic care. **% are inclined to opt for a massage, **% for a facial and **% for a manicure or pedicure. In France, the four types of treatment most booked by men on the Treatwell platform in **** were haircuts, manicures, waxing and beard trimming. According to the same study, **% of men consider beauty to be important. [***]

While all types of men are concerned, younger men seem particularly receptive."Individuals from the new generations (***) are the most important target for [***]

2.2 More than a quarter of men wear make-up

More thanone in four French men wear make-up occasionally, and **% several times a week. Among the reasons given are the desire to feel better, for **% of enthusiasts, and camouflaging minor skin imperfections, for **%. "Make-up is particularly popular with the under-**s, and looks set to become a permanent fixture in French beauty routines", stresses ** minutes.

Proportion of men using make-up, by frequency France, ****, in Source: ****

Family members and beauty professionals are the two main prescribers, but influencers and web videographers also play an important role, cited by **% of respondents.

Type of people influencing men's make-up purchases France, ****, in Source: ****

2.3 French people who wear beards and care for them

Nine out of ten French people aged **-** have a beard, according to the Fédération des entreprises de la beauté. And more and more of them want to take care of it, especially since the Covid-** crisis. "During confinements and multiple video meetings, men saw their faces on their screens for several hours a day, a rare occurrence in normal times", explains Emmanuel Guichard, General Delegate of the Federation, to justify the surge in sales of products dedicated to beard care. At men's cosmetics specialist Horace, figures for this category "are up **% on average each year, despite a short range consisting of one shampoo and three oils", says Marc Briant-Terlet, co-founder of the brand. [***]

This growth in the beard care market is also fueled by an evolution in terms of the tools used to care for it: the French like to change their style, and are buying more tools to meet their needs.

Number of tools used by men for beard care France, ****-**** LSA

2.4 Natural and organic: criteria that matter to men

The natural or even organic aspect of cosmetics is important to French consumers. In ****, **% prefer sustainable, environmentally-friendly beauty products, and **% prefer organic ingredients.

Beauty product consumer expectations France, ****, % of total Source: ****

Men are particularly sensitive to these issues. "According to a study by Le Sybarite, a men's cosmetics website, men prefer natural and organic products, and are prepared to pay more for top-quality products", notes Les Echos. "More and more men are interested in clean beauty", confirmed Claire Long, Nivea Men product manager, back in **** in Cosmétique magazine. These expectations are shaping the product offering, and helping to attract and retain a segment of the clientele more inclined to adopt natural skincare products.

3 Market structure

3.1 Market value chain

The value chain of the men's cosmetics market is broadly similar to that of the cosmetics market:

suppliers of raw materials and ingredients supply cosmetics manufacturers according to their needs; cosmetics manufacturers are at the heart of the chain, carrying out the various tasks surrounding the product: R&D, design, production, marketing, etc. They may also sell directly to end consumers, without intermediaries; distributors are responsible for marketing products. Several types coexist: generalists (***), pure players operating online, etc. Some distributors may specialize in men's cosmetics and offer only this type of product.

3.2 Production

The men's cosmetics market is dominated by two major brands: L'Oréal Men Expert (***), which account for more than three-quarters of the sector, thanks in particular to their wide distribution in supermarkets.

Men's cosmetics market share France, ****, in Source: ****

Other major groups are also present in the segment:

Unilever with its Dove Men+Care brand; Procter & Gamble with Gillette ; Edgewell with Wilkinson and Bulldog; Shiseido ; L'Occitane ; etc.

"[***]

Behind these giants, the market dynamic is sustained above all by the multitude of brands that have emerged in recent years, increasing the number and specialization of products on offer. The table below lists some of these French brands. Several can be considered DNVBs(***), i.e.they were born on the Internet and manage their own distribution, mainly via e-commerce, without going through traditional intermediaries.

This abundance of young players suggests thata concentration movement could be underway, with manufacturers buying up the most promising brands. "In this phase of market consolidation, the pioneers who helped create their category are generally in the process of merging with or joining forces with ganaël Bascoul, founder and CEO of Monsieur Barbier, explains in early ****. [***]

This is what has already happened to Bulldog, a brand of ...

3.3 Distribution

There are several main distribution channels in the cosmetics sector:

the selective channel (***) ; pharmacies and parapharmacies supermarkets and hypermarkets; brand names; online sales.

In ****, cosmetics purchases were mainly made in supermarkets, with more than half of sales taking place in this channel.

Breakdown of cosmetics sales by distribution channel France, ****, in Source: ****

Men are also part of this trend, with**% of them buying their hygiene-beauty products from supermarkets. [***]

However, market trends could change this. Men's growing interest in these products could encourage them to turn more towards more specialized channels, where they would benefit from better support. "Men, more than women, need sound advice before buying a beauty product", stresses Les Echos. Cosmetics boutiques and brand names could therefore benefit from this need for expertise, like Horace, which has opened ** boutiques in five years - including one in London - and claims a place in the top * of the French market. [***]

Specialized channels can also draw on a much broader and more specialized offer than mass retailers. In the facial care segment, the number of references and brands on offer is much higher on specialized sites (***) than on those of supermarkets or parapharmacies.

Number of references and brands of men's facial ...

4 Offer analysis

4.1 Offer and product segments

The Fédération des entreprises de la beauté divides the cosmetics market into seven main categories. Beauty and skincare products account for **% of sales, followed by perfume at **% and hygiene and toiletry products at **%.

Breakdown of cosmetics sales by category France, ****, % of sales Source: ****

Men's cosmetics fit into this category, as they are adapted to the specific needs of the male body. The market can therefore be divided into three main segments:

hygiene products (***) ; skincare products (***) ; beauty products (***).

Then there are specific sub-segments not found among women, such as beard care products.

4.2 Price trends and differences

After a period of stability between **** and ****, inflation has weighed on cosmetics prices. The consumer price index rose by ** points in three years, from ***.** in **** to ***.** in ****. This rise may have worked against the market, prompting consumers to reduce their cosmetics purchases.

change in annual consumer price index for nomenclature "**.*.*.*.* - Make-up and skin care products" France, ****-**** Source: ****

Price analysis also reveals differences between brands and distribution channels. For facial cleansers, brands sold in supermarkets and sourced from major manufacturers, such as Bulldog, Nivea Men or L'Oréal Men Expert, have lower prices than smaller, independent brands. The chart below also shows that Bivouak clearly assumes a top-of-the-range positioning with its organic and natural products, which are sold at a much higher price than its competitors.

Price per ***ml of men's facial cleanser by brand France, ****, in euros Source: ****

For beard oil, BcomBIO, a brand owned by Laboratoires Sicobel, stands out as the most affordable parapharmacy brand. Mass-market brands come next, before independent players are generally more expensive.

Price per **ml of beard oil by brand France, ****, in euros Source: ****

4.3 Organic, natural, made in France: commitments valued by brands

"Consumers appreciate the fact that our products are made with natural ingredients", says Evguenia Letellier, Bulldog Product Manager. Organic, natural, eco-responsible and made in France products are also very popular with consumers. Such positioning is mainly supported by small market brands, which seek to differentiate themselves from manufacturers, and specialized distribution channels.

On the specialized website Comptoir de l'homme, which lists over ** facial care brands, *.*% of the range is labelled "organic". By contrast, the filter for searching only organic products among men's cosmetics doesn't even exist on the Carrefour or E.Leclerc websites.

Breakdown of organic and conventional offerings in men's facial care on the specialized Comptoir de l'homme website France, ****, in Source: ****

The various organic and natural French brands launched on the men's cosmetics market in recent years confirm the attractiveness of this positioning.

In response to public expectations, manufacturers are also beginning to offer alternatives, enabling organic and natural products to enter traditional distribution channels. In ****, Nivea Men launched a Sensitive Pro range with organic hemp oil. "We want to continue innovating, and natural offers are still very little present in men's skincare," said Nivea Marketing Director Sabine Pradeau at the time. [***] At Léa Nature, the So Bio ...

4.4 Specialize to assert your expertise

While the majority of brands position themselves on the market by offering a fairly varied catalog of products (***), others choose to specialize, either completely or in part, in a precise segment. In this way, they can concentrate on a particular type of item and claim greater expertise. Distribution is also impacted by this phenomenon, with the emergence of ultra-specialized sites such as Le Coin du barbier, focused on beard products.

Beards are a popular segment for specialization, so much so that some barbershop chains have decided to launch their own brands, such as Grizzly Barbershop's Grrr, or La Barbière de Paris. "The Parisian SME, which has four salons in Paris and ** employees, is still in its infancy, but its products are such a success that next spring the boss will be moving his historic salon, still in the **th arrondissement but to a space twice as big, to open a boutique," reports Les Echos in January **** about Grizzly Barbershop. [***]

Other companies choose to specialize in different segments: The Bold Club and Botak, for example, focus on cosmetics for bald and shaven heads, while Lofeka targets black and mixed-race men. "On the market, there are no products really adapted to black ...

4.5 Influencers, potential relays of weight

Influencers are playing an increasingly important role in the cosmetics market. "Influencer campaigns are now an integral part of brand communication. More and more ultra-specialized profiles are enabling brands to work on the specifics of their offers", indicated LSA at the beginning of ****. Manny Gutierrez, an American YouTuber, has become the official mascara face for Maybelline, while instagrammer James Charles, who has more than ** million subscribers, has also become the mascara face for CoverGirl. In France, Amoudax, an influencer with ***,*** followers on Instagram, has been approached by Léa Nature and its Eau thermale Jonzac brand in ****. [***]

Men are proving receptive to this type of communication, since in ****, **% ranked YouTube videos as the third most important source of prescriptions when buying beauty products.[***]

In France, in the men's beauty sector, big names in influence are emerging, with hundreds of thousands of followers. They can thus represent important relays for brands wishing to appeal to the male public.

Number of followers on Instagram of leading French male beauty influencers France, ****, in thousands of followers Source: ****

5 Regulations

5.1 European regulations governing marketing conditions

Regulation (***) N°****/**** repealed the "Cosmetics Directive" **/***/EEC on **/**/****. The aims of this regulation are "to ensure a high level of consumer health protection, to simplify and harmonize notification procedures, to clarify responsibilities, to guarantee product traceability, and to promote and protect the health of consumers".claration procedures, clarify responsibilities, guarantee product traceability, and promote and monitor their marketing within the European market", according toANSM.

The marketing of a cosmetic product is not conditional on obtaining a marketing authorization. As of the "Cosmetics Directive", responsibility is therefore assumed by manufacturers, importers or others responsible for marketing, according to the CNRS. Negative and positive lists of substances are also included in the regulations.

The **** European regulation introduces additional requirements for pre-marketing safety reports, the obligation to declare a responsible person for each product on the market, and notifications of serious adverse reactions. It also defines compliant labels and packaging.

In short, brands must meet several obligations to comply with current regulations:

Appoint a responsible person. establish precise specifications for product composition. Ensure the quality of cosmetic products throughout the manufacturing process. Assess product safety. Provide a complete product file to the authorities (***). Respect the ban on animal testing in cosmetics. Implement transparent product ...

5.2 Labeling cosmetic products

Cosmetic product labeling meets regulatory requirements designed to protect consumers and provide them with fair, transparent information. Regulation (***) n°***/**** of July **, ****, which establishes the uniform criteria that claims relating to cosmetic products must meet in order to be used.

The regulations concerning the labeling of cosmetic products stipulate the mandatory information that must appear on them. This information must be clearly visible, legible and indelibly written in French. Consumers must be able to find the following information on the label:

Name and address of a contact within the European Union: this information enables consumers to report any problems or undesirable effects associated with the product. Country of manufacture if the product is manufactured outside the European Union. Nominal content (***) of the product. Precautions for use: these indicate the safety measures to be taken when using the product. Dates : Minimum durability date: mandatory if the product's durability is less than ** months. It is indicated with the words "Best before..." or an hourglass symbol, specifying the recommended use-by date. Post-opening period : mandatory if the product's shelf life exceeds ** months. It is represented by an open jar symbol accompanied by the number of months or years during which the product can be used safely ...

6 Positioning the players

6.1 Segmentation

- Shiseido

- L'Occitane Groupe

- Bulldog Skincare

- Horace

- 66°30

- Bivouak

- Botak

- Into The Beard

- Monsieur Barbier

- Sapiens

- Big Moustache

- Comptoir de l'homme

- L'Oréal Groupe

- Unilever Groupe

- Procter & Gamble

- Beiersdorf

- Edgewell Personnal Care Group - Wilkinson

- Man's Beard (Tendances Coiffures)

All our studies are available online in PDF format

Take a look at an example of our research on another market!

Choosing this study means :

Choosing this study means :

Access to more than 35 hours of work

Our studies are the result of over 35 hours of research and analysis. Using our studies allows you to devote more time and added value to your projects.

Benefit from 6 years' experience and over 1,500 industry reports already produced

Our expertise enables us to produce comprehensive studies in all sectors, including niche and emerging markets.

Our know-how and methodology enable us to produce reports that offer unique value for money.

Access to several thousand articles and paid-for data

Businesscoot has access to all the paid economic press as well as exclusive databases to carry out its market research (over 30,000 articles and private sources).

To enhance our research, our analysts also use web indicators (semrush, trends, etc.) to identify market trends and company strategies. (Consult our paying sources)

Guaranteed support after your purchase

A team dedicated to after-sales service, to guarantee you a high level of satisfaction. +44 238 097 0676

A digital format designed for our users

Not only do you have access to a PDF, but also to a digital version designed for our customers. This version gives you access to sources, data in Excel format and graphics. The content of the study can therefore be easily retrieved and adapted for your specific needs.

Our offers :

Our offers :

the men's cosmetics market | France

- What are the figures on the size and growth of the market?

- What is driving the growth of the market and its evolution?

- What is the positioning of companies in the value chain?

- Data from several dozen databases

Pack 5 études (-25%) France

- 5 études au prix de 74 €HT par étude à choisir parmi nos 1200 titres sur le catalogue

- Conservez -25% sur les études supplémentaires achetées

- Choisissez le remboursement des crédits non consommés au terme des 12 mois (durée du pack)

Consultez notre catalogue d’études sectorielles