Summary of our market study

The French market for electronic components exceeds €15 billion

The global market for electronic components is valued at over $500 billion.

The global market for electronic components is growing strongly, driven by the development of 5G, electric vehicles, the increasing adoption of renewable energies, the rise of remote working and the intensification of data center activity.

The French market

The automotive industry accounts for 36% of the electronic components market, and the industrial sector for around 37%.

Connected objects and the Internet of Things (IoT) are another booming area contributing to market growth. The market for connected objects in France is valued at between 10 and 20 billion euros, with the smart home holding 28% of the market value, industrial applications 23%, and transportation 20%.

The French market encompasses producers of various electronic components, assembly designers and software developers for electronic system design.

The French electronics industry benefits from an extensive network of highly specialized laboratories, schools and universities.

Market demand is mainly driven by the growing use of nanoelectronics and power electronics.

All industries are looking to exploit the potential of their products or processes by integrating electronic components to facilitate data transmission and processing.

A few global players.

- Intel is a giant in the field of microprocessors and integrated circuits.

- Samsung Electronics is another colossal player

- Qualcomm is renowned for its innovations in wireless technology,

- TSMC, or Taiwan Semiconductor Manufacturing Company, is the world's largest independent semiconductor foundry.

- The Thales Group, with a strong presence in the defense, aerospace and security markets.

- STMicroelectronics, Europe's leading player.

- Gemalto, now part of the Thales group, continues to be recognized for its expertise in digital security

- Morpho/Idemia, renowned for its biometric technologies

- Actia Group, Composants Electroniques Lyonnais (CEL) and Secre Composants Electronse are small players in the French market

to understand this market

Detailed content of our market study

Inforamtion

Inforamtion

- Number of pages : 35 pages

- Format : Digital and PDF versions

- Last update :

Summary and extracts

Summary and extracts

1 Market summary

1.1 Market definition and structure

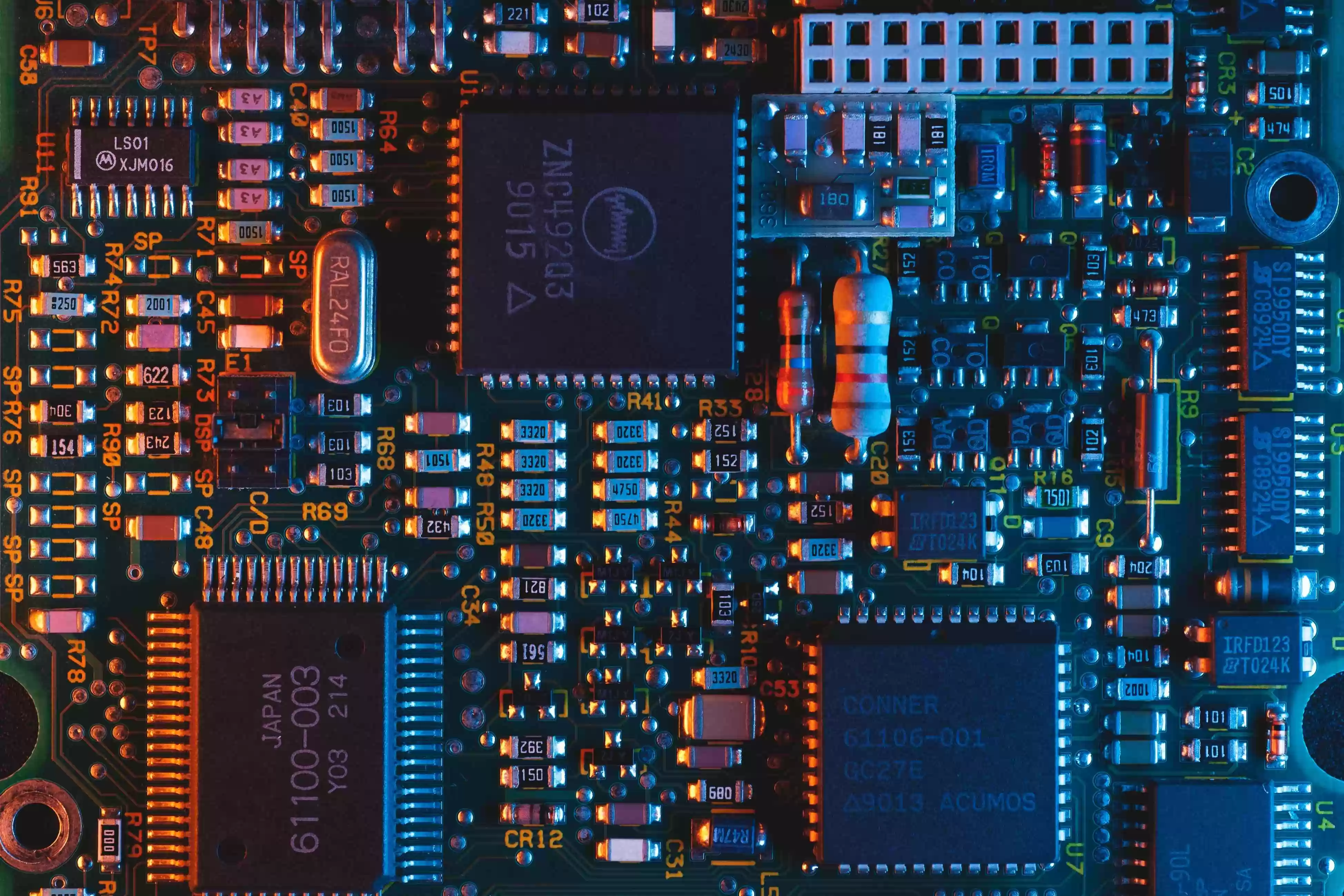

The electronic components market is a very large market. We consider that an electronic component is an element intended to be assembled with others in order to realize one or more electronic functions. The components form many types and categories, they meet various industrial needs, especially because of their electrical characteristics. The assembly of these electronic components is defined beforehand in a layout diagram which precedes the installation of these components in an electronic circuit.

We traditionally distinguish two categories of components, the active components (diode, transistor, integrated circuit, etc.) and the passive components (resistance, capacitors, etc.). Active components are electronic components that increase the power of a signal (voltage or current), while passive components do not increase the power of a signal, and can even reduce this power in some cases.

On a global scale, it is possible to observe that the world market for electronic components has been doing well for several years. on a global scale, the market is worth nearly $1,400 billion.

Indeed, the printed circuit board and semiconductor segments are relatively dynamic, driven by the rapid development of several innovations such as 5G, electronic cars or the democratization of renewable energy. Due to the complexity of production methods, the electronic components market is largely concentrated and a few international players share the majority of market shares. Thus, among the leaders of this market, we can name Intel, Samsung Electronics or Qualcomm and TSMC.

The market is largely driven by the many electronic and technological innovations that are available on many markets for very diverse productions. In France, the electronic components market is of strategic importance. While the major foreign players, who account for most of the world's market share, play an important role in the French market, a number of local players such as Thales and STMicroelectronics also play an important role at the national and European levels.

1.2 A healthy global market

According to the WSTS, the global electronic components market will grow strongly in ****, with growth of *.*%, following a **** year in which the market grew by only *.*%. Indeed, Asian production continues to drive the market upwards. In addition, the COVID-** crisis has finally had a positive effect on the global market by accelerating demand for active components. The massive use of teleworking has strengthened the activity of clouds and datacenters on the one hand, and on the other hand driven the demand for hardware including electronic components (***). The market is also supported by the democratization of radical innovations: electric cars, chips for *G smartphones, IoT connected objects, etc. Technological developments are therefore indirectly benefiting manufacturers and distributors of electronic components.

Today, the electronic components market represents more than **% of the world GDP and is the subject of colossal investments by all the world's major powers, each having understood that this sector is crucial for the development of its economy. Thus, European players are subject to strong competition from the United States, Japan, South Korea, Taiwan and China.

World market for electronic components World, **** - ****, in billions of euros WSTS

Historically, the electronic components market is booming. In fact, as we can see ...

1.3 The French market is at the forefront of electronic components

The French electronics industry brings together various players:

producers of electronic components, connectors or printed circuits, designers and assemblers of electronic boards and sub-assemblies, distributors or publishers of embedded software and software tools for the design of electronic systems.

The electronics industry is fed upstream by a dense network of laboratories, schools and universities in fields of expertise ranging from cutting-edge materials for micro-, nano- and optoelectronics to the creation and development of complex tools to assist in the design of circuits and systems.

The electronic components industry is an asset for France, being a source of innovation for the entire industry. Other component technologies are also mastered in France: in connector technology, five of the world's top ten manufacturers have R&D and manufacturing operations in France.

France can therefore rely on a leading-edge industry in the field of electronic technologies and components, with high R&D intensity and significant added value. This industry works mainly on an international scale, which reflects its competitiveness on the export market. The design and production of electronic boards and sub-assemblies are also widely represented in France through a dense network of SMEs and ETIs. France ranks first in Europe in electronic production services. ...

1.4 The impact of the COVID-19 crisis on the electronic components market

Semiconductors are present in billions of electronic devices. Indeed, all computer systems are composed of small silicon chips that allow information to flow through their circuits. In the spring of ****, lockdown measures caused an explosion in demand for computer hardware to telecommute or entertain at home. More than *** million PCs were sold in ****, for example.

Since the beginning of ****, a worldwide shortage of electronic components has forced many global manufacturers to slow down their factories due to the lack of semiconductors.

Thus, one of the consequences of the COVID-** crisis is an explosion in demand for electronic components. These demand levels have threatened global supply. Sino-American tensions have also contributed to the overall pressure on the global market, notably with Huawei's ban on supplies. The Chinese company then chose to build up very large stocks and its competitors have imitated it. Last November, Apple had to reallocate components normally intended for the iPad to the iPhone ** Pro to maintain its production rate.

The global shortage has extended into ****, with a big impact on the automotive industry in particular. Ford, PSA, General Motors, Toyota, Volkswagen, etc. Most of the major multinationals had to slow down or stop production in the face of ...

2 Demand analysis

2.1 The demand for electronic components, at the heart of the digital revolution

The electronic components market is the essential industrial base for the digital revolution and the energy transition, through nanoelectronics and power electronics technologies to assembly and integration. The market for electronic components is the essential industrial base for the digital revolution and the energy transition, from nanoelectronics and power electronics technologies to assembly and integration activities. Major markets are seeing their demand for electronics increase, sometimes exponentially, as it is currently the case for the automotive industry with the advent of electric and autonomous vehicles.

At the same time, new customers are turning to the industry to develop the intelligence of their products or processes and to develop new uses based on the transmission and processing of data. The acceleration of the integration of electronic components is based on * complementary trends:

Electronic technologies and components including smart sensors to create data, Connected objects capable of processing and transmitting data and developing associated services, Power electronics to support the energy transition and the development of electric mobility (***) Cybersecurity to build the confidence necessary for the development of electronic technologies in industry. This is a major competitive challenge, particularly for the ground transportation, aeronautics and defense industries, as well as for the factory ...

2.2 The rise of the electric car accelerates the integration of electronic components

The electric car segment has been booming in recent years, driven by the radical change in motorists' habits and the search for new modes of mobility. In addition, the robotization of upstream production methods is strengthening the sector's position as one of the main outlets for the electronic components market, with **% of the market value. The automotive sector has experienced a very favorable dynamic in recent years, before coming to a sudden halt due to the COVID-** crisis.

Indeed, as it can be seen below, French automotive production grew between **** and **** before collapsing in **** due to the COVID-** crisis, falling by **.*% between **** and ****. For comparison, the European automotive industry collapsed by **% over the same period.

Automotive industry production Europe, **** - *****, volume index base *** in **** INSEE, Eurostat

Nevertheless, more than just the evolution of French and European automotive production, the demand for electronic components and boards in the sector is determined by two structural trends, reinforced by the COVID-** crisis:

The share of electronics is gaining ground in the value of vehicles due to the increasing electrification of mechanisms, the growing connectivity of on-board equipment, and the rise of safety devices (***). The penetration of electronics in top-of-the-range cars or SUVs The automotive ...

2.3 The democratization of connected objects and the IoT is driving demand for electronic components

The digital wave is ushering in a period of profound transformation in all sectors of the economy, both services and industry. Within this wave, connected objects and the Internet of Things (***) is the most important market for connected objects and represents **% of the market value. The industrial sector represents **% of the value of this market, while the transport sector represents **% of the market.

Connected objects market in France, by type France, ****, as a % of total Roland Berger

profound transformations in consumer habits

has increased more than **-fold between **** and ****

The French B*C market for connected objects France, **** - ****, in millions of euros Fnac - GfK

3 Market structure

3.1 Simplified diagram of the market structure

The value chain of electronic components is broken down into four stages as shown in the diagram above:

The suppliers: they will provide the manufacturers with raw materials. The most used is certainly silicon. They can either provide the raw material or offer it in the form of processed products; Research and development (***): it is necessary to go through this stage to design innovative and efficient products; Manufacturing: some manufacturers, also called integrated manufacturers, will ensure the production of electronic components without suppliers. Other manufacturers will choose to delegate to suppliers; Distribution: manufacturers can distribute themselves or delegate to specialized distributors.

The value chain is also characterized by its international integration and the predominant role of Asian countries. Indeed, ASEAN countries are strongly integrated into the global electronics value chains, dominated by China. The fragmentation of production, led by firms from developed countries (***), is facilitated by the high modularity of products and their high value/weight ratio.

China (***), ASEAN, Korea, Taiwan and Japan accounted for more than two-thirds of global electronics exports in ****, with China's share amounting to **% and ASEAN's to **%.

3.2 The production of electronic components is concentrated in Asia

Producing electronic components therefore implies an important basic investment in order to benefit from the best infrastructures. The quality of an electronic component will determine the success of its manufacturers. The complexity of manufacturing makes it particularly difficult for newcomers to enter. The French market is therefore dominated by major players such as STMicroelectronics or Thales. As we can see below, the French manufacture of electronic components (***) comes second in Europe in terms of production value. Indeed, if German production remains the most important with a value of ** billion euros in ****, French production was *.* billion euros, ahead of Italian and English production.

The largest producers of electronic components in Europe EU**, ****, value of production in million euros Eurostat

However, the production of electronic products, which is highly fragmented, has developed mainly in East Asia. The miniaturization (***) outsource these production and sourcing activities to contract manufacturers.

East Asia has emerged as the major production center for global electronics, with countries positioned at different levels of the value chain. The most labor-intensive stages of production are conducted in ASEAN and China, taking advantage of the abundance of cheap labor. Taiwan has specialized in outsourcing production activities, hosting the most notorious contract manufacturers (***).

3.3 Global distribution of electronic components

Because electronic components are both fragile and valuable, the choice of distributors is particularly important. The distribution channels are often integrated into the network of the main manufacturers. The distributors offer a wide choice of products from different producers.

In ****, forecasts for the turnover of electronic components distributors indicated an increase of *.*%. For reference, it had been *.*% in ****. Sales therefore reached a record *,*** million euros in ****. This is mainly due to the sale of active electronic components. These increases can be explained by the strong demand for electronic components. In addition, distributors have chosen to offer more services and thus gain visibility and revenue.

Today, the world is going through an unprecedented shortage of electronic components, notably due to the complexity of the distribution chain for these products. Indeed, the automotive industry, for example, is suffering from this unprecedented shortage of electronic components, particularly semiconductors. As a result, the production of vehicles is directly affected, and this all over the world. As a direct consequence of this shortage, one million vehicles will not be produced in the first quarter of ****. These various shortages threaten to paralyze automotive production and directly impact OEMs. For observers, the situation, which is certainly evolving according ...

4 Analysis of the offer

4.1 The typology of electronic components

Electronic components can be divided into several categories. First of all, there are the active components. The purpose of this electronic component is to increase the power of a signal (***). We find the following most common semiconductors :

The diode: nonlinear and polarized dipole (***); The transistor: based on a system of three active electrodes, its purpose is to control the current or voltage that will affect the output electrode; The integrated circuit: also known as an electronic chip, it integrates several electronic components in order to reproduce an electronic function.

Other less common components exist: voltage regulators, oscillators, optocouplers, SMD leds, triacs and thyristors.

On the other hand, a passive component does not allow to increase the power of a signal. It is either neutral or, in some cases, can reduce the signal. We find the following components:

The resistor: a widely recognized and used dipole; The capacitor: composed of two electrodes which are separated by a polarizable insulator, the capacitor is intended to store opposite electrical charges on its electrodes; The coil: it is made of a winding of conductive wire.

It is possible to find many other components such as optoelectronics, potentiometers or inductances.

According to the WSTS forecasts for ...

4.2 Price list for electronic components

The prices of electronic components can vary considerably depending on the component. It is therefore important to study them individually. To do so, we have based ourselves on the prices proposed by Go Tronic, a leader in the distribution of components.

For the components considered as active, the prices (***) are as follows:

Diodes: between *.**€ and *.**€; Logic circuit components: between *.**€ and **€; Integrated circuit components: between *.**€ and *.**€; Transistors: between *.**€ and **.**€; Thyristors: between *.**€ and *.**€ Triacs and diac: between *.**€ and *.**€; EPLD circuits: between *.**€ and **.**€.

For the components considered as passive, the prices (***) are as follows:

Capacitors (***): between *.**€ and **.**€; Photoresistors : between *.**€ and *.**€; Potentiometers (***): between *.**€ and *€; Resistor networks: between *.**€ and *.**€; Resistors (***): between *.**€ and *.**€; Varistors: between *.**€ and *.**€.

4.3 French production is booming

The French production of electronic components is booming. Overall, French electronics production has been growing steadily for several years, at a rate of * to *% depending on the sector of activity. Like its German, Italian and Spanish counterparts, which stood at just €*.* billion in ****, it represented nearly €*.* billion in ****, representing a CAGR of *.*% over the period.

In high-volume markets (***) as well as emerging segments, notably communicating objects, are likely to offer increasingly important outlets for French production of electronic components.

French production of electronic components France, **** - ****, in € billion Eurostat

5 Rules and regulations

5.1 Legal framework for the electronic components market

The placing on the market of a product is "the first making available of a product on the market of the Union". Generally, a product is placed on the market when it is sold at the end of its manufacturing phase (***) or when it is imported into the Union. The concept of placing on the market applies to each individual product and not to a product reference or model, regardless of whether it was manufactured individually or in series.

Depending on the nature and technical characteristics of the product, different regulations may apply.

GENERAL REGULATIONS APPLICABLE TO ELECTRICAL AND ELECTRONIC EQUIPMENT

If the product operates at input or output voltages between ** to **** V in alternating current and between ** to **** V in direct current, it is subject to decree n°****-**** of ** August ****, transposition of the new Low Voltage Directive ****/**/EU.

Electromagnetic compatibility

Electromagnetic compatibility has two aspects:

Immunity, which is the ability of an equipment to function properly in the presence of external electromagnetic disturbances (***). If the product includes active electronic components, it falls under decree n°****-**** of August **, ****, transposition of the new Electromagnetic Compatibility Directive ****/**/EU.

ENVIRONMENTAL REGULATIONS

If the product is an electrical or electronic product, it is ...

6 Positioning of the actors

6.1 Segmentation

- STMicroelectronics

- Morpho / Idemia

- Thales DIS (Digital Identity & Security)

- Actia Groupe

- Forecast Electronics

- Itest

- Capacitec

- Plastech

- Schaller Electronic

- Servotechnics

- Nitron

- Composants Electroniques Lyonnais CEL

- Secre Composants Electroniques

- ERCE Européenne de Composants Electroniques

- Samsung Group

- Nexperia

- Lemo

- Omron

- ROHM Semiconductor

- Acal BFi

- AsteelFlash (USI Group)

- TDK Electronics

- A Et P Lithos

- Actia Automotive

- Actia Telecom

- Adex

- Afca V2

- Akuo Industries

- Alliansys

- Alpes Connectique Services Acs

- Alteia

- Amphenol Fci Besancon

- Amphenol Socapex

- Anjou Electronique

- Aptiv Services 2 France

- Arelis

- Asteelflash France

- Asteelflash Technologie

- Avantix

- Beauc Realis Etud Electro Bree (Bree)

- Bh Technologies

- Bms Circuits

- Bourgogne Services Electronique

- C S I Sud Ouest Composants Et Substrats D'Interconnexion Sud O Uest

- Cablages Industriels Materiels Electroni (Cimel)

- Cera

- Cimulec

- Circuits Imprimes De Belleme (Cibel)

- Cobham Microwave

- Cofidur Ems

- Creatique Technologie

- Diconex

- Dinel

- Docaposte Applicam

- Edf Enr Pwt

- Egide

- Eiffage Energie Systemes Electronique (Ees - Electronique)

- Elekto Industrie

- Elpack

- Elvia Printed Circuit Boards

- Eolane Angers

- Eolane Combrée

- Eolane Douarnenez

- Eolane Neuilly En Thelle

- Eolane Saint Agreve

- Eolane Valence

- Esaris Industries Site Ati Interco

- Exxelia

- Fabrication Electronique De Dordogne (Fedd)

- Folan

- Fremach Dieppe (Fremach)

- Garos Crouzet

- Geoconcept

- Geral Construct Electr Et Travaux Indust

- Giesecke+Devrient Mobile Security France

- Harting France

- Hemeria Services

- Hummel Connecteurs

- Id Mos

- Idemia Identity & Security France

- Ion Beam Services

- Jst France

- Kontron Modular Computers

- Maatel

- Matra Electronique

- Merem

- Mersen France Pontarlier

- Microoled

- Microsemi Power Module Products (Mpmp)

- Movea

- Msl Circuits

- Obiou Societe D'Electronique

- Paragon Id

- Petercem

- Phenix Electronique

- Plda

- Presto Engineering Hvm

- Production Logistique Service

- Proto Electronics

- S Industries

- Safe Home Detector (Shd)

- Savoy Technology

- Sdel Controle Commande

- Secre Composants Electroniques

- Seicer

- Selva

- Sequans Communications

- Serma Group (Serma)

- Serma Microelectronics

- Sgame

- Silicon Laboratories France

- Sirail

- Smart Packaging Solutions

- Sofi Groupe

- Soitec

- Sotrem Seo

- Sté D'Etudes Et De Fabrications Electroniques Et Electriques (Sefee)

- Sté Des Condensateurs Record

- Sté Electronique Du Haut Anjou (Selha)

- Sté Etudes Et Realisations (Sté Etudes Et Realisations Electroniques Et Micro Systemes Par Abreviati

- Stae Sous Traitants Assoc Elec (Stae)

- Staymatel

- Steel Electronique

- Stmicroelectronics

- Stmicroelectronics Alps

- Stmicroelectronics Crolles 2

- Stmicroelectronics (Grand Ouest)

- Stmicroelectronics Grenoble 2

- Stmicroelectronics Rousset

- Stmicroelectronics (Tours)

- Stocko Contact

- Sysgo

- Te Connectivity Sensors France

- Techci Rhones Alpes

- Technoprobe France

- Teledyne E2V Semiconductors

- Thales Avs France

- Thales Dms France

- Toppan Photomasks France

- Tresse Metallique J Forissier

- Trimble France

- Tronic'S Microsystems

- Tronico

- United Monolithic Semiconductors

- Unity Semiconductor

- Wind River

- Wisekey Semiconductors

- X Fab France

All our studies are available online in PDF format

Take a look at an example of our research on another market!

Choosing this study means :

Choosing this study means :

Access to more than 35 hours of work

Our studies are the result of over 35 hours of research and analysis. Using our studies allows you to devote more time and added value to your projects.

Benefit from 6 years' experience and over 1,500 industry reports already produced

Our expertise enables us to produce comprehensive studies in all sectors, including niche and emerging markets.

Our know-how and methodology enable us to produce reports that offer unique value for money.

Access to several thousand articles and paid-for data

Businesscoot has access to all the paid economic press as well as exclusive databases to carry out its market research (over 30,000 articles and private sources).

To enhance our research, our analysts also use web indicators (semrush, trends, etc.) to identify market trends and company strategies. (Consult our paying sources)

Guaranteed support after your purchase

A team dedicated to after-sales service, to guarantee you a high level of satisfaction. +44 238 097 0676

A digital format designed for our users

Not only do you have access to a PDF, but also to a digital version designed for our customers. This version gives you access to sources, data in Excel format and graphics. The content of the study can therefore be easily retrieved and adapted for your specific needs.

Our offers :

Our offers :

the market for electronic components | France

- What are the figures on the size and growth of the market?

- What is driving the growth of the market and its evolution?

- What is the positioning of companies in the value chain?

- Data from several dozen databases

Pack 5 études (-25%) France

- 5 études au prix de 74 €HT par étude à choisir parmi nos 1200 titres sur le catalogue

- Conservez -25% sur les études supplémentaires achetées

- Choisissez le remboursement des crédits non consommés au terme des 12 mois (durée du pack)

Consultez notre catalogue d’études sectorielles