Detailed content of our market study

Inforamtion

Inforamtion

- Number of pages : 35 pages

- Format : Digital and PDF versions

- Last update :

Summary and extracts

Summary and extracts

1 Market overview

1.1 Definition and presentation

In recent years, the gin market in France has undergone a remarkable renaissance, evolving from a niche segment to a major pillar of the spirits industry. This market study aims to provide an in-depth understanding of the current dynamics, emerging trends, and future prospects of the French gin market. Based on the most recent data available, this study explores various aspects, including production, consumption, consumer preferences and the strategies of key market players.

French gin production has grown exponentially, and those despite rising inflation in France in 2023, with a significant increase in the number of craft distilleries. These distilleries focus on quality and innovation, incorporating unique local ingredients and experimenting with distinctive flavor profiles. This approach has strengthened the appeal of French gin, not only on the local market, but also on international markets, with the sector recording a trade surplus of almost 20 million euros, with the USA leading the way as the largest consumer of French gin, absorbing almost 20% of exports.

In terms of consumption, gin has gained in popularity among French consumers, especially among young adults. This trend is largely attributed to gin's versatility in cocktails, as well as a growing awareness of artisanal and quality products. In addition, targeted marketing campaigns and consumer awareness initiatives have played a key role in the growth of this segment.

Current trends also point to increased interest in premium and ultra-premium gins, with consumers willing to pay more for premium spirits. This move upmarket reflects changing tastes and a search for unique tasting experiences.

In conclusion, the gin market in France is booming, driven by product innovation, growing demand for quality spirits and a favorable economic environment. This market study aims to provide valuable insights for market players, identifying opportunities, challenges and key strategies for successfully navigating this evolving landscape.

1.2 Global trends in an increasingly popular spirit drink

Gin is an alcoholic spirit which, in recent years, has gained in popularity across the globe thanks to the cocktail craze [***]. We begin by outlining the trends in the spirits market in which it is situated, before explaining the particular success of gin.

By ****, the global spirits market was valued at $*** billion. According to data from The Business Research Company, this market is set to grow at an average annual rate of *.*% over the coming years..

Global spirits market size World, ****-*****, in billions of US dollars Source: ****

The global market is mainly driven by expansion in developing countries and their growing populations, but also by market premiumization, digitalization and innovation in line with new consumer expectations, particularly regarding environmental and health concerns.

Conversely, the main challenges facing the global market are restrictions on alcohol advertising, high taxation, strict rules and regulations in certain regions, and health problems linked to excessive alcohol consumption.

As for gin, global growth is strong, estimated at *.*% over the period ****-****. This means that global sales will rise from **.* billion euros in **** to **.* billion in ****.

Gin market growth World, ****-****, in billion euros Source: ****

By ****, gin consumption will be mainly concentrated in Europe, where it will ...

1.3 Gin increasingly appeals to French consumers

Between **** and ****, the gin market in France experienced remarkable growth, with its market value more than doubling. The size of this market increased from ** million euros to *** million euros, reflecting a growing craze for this spirit. This substantial increase reflects the growing popularity of gin among French consumers, stimulated in part by trends such as premiumization and the rise of micro-distilleries.

Gin market sales growth France, ****-**** Source: ****

As part of the highly dynamic spirits market, this sector is enjoying a moment of grace with French consumers. Growth in the gin market is mainly driven by a move upmarket, increasing the added value of the products sold. Gin's appeal can be explained by the popularity of cocktails in pop culture.

Difficulties in the spirits sector due to complex economic contexts.

Despite very good figures for the sector as a whole, a third of French spiritscompanies, including many SMEs, recorded negative results in the last financial year, a rate similar to that of the Covid year. The situation looks set to be difficult, withcosts for glass on the rise (***). Faced with these challenges, companies are having to dip into their cash reserves, affecting **% of them in the first half. Sales also fell ...

1.4 International trade

We will use the data collected on the UN Comtrade website. French gin exports very well internationally, where its premium dimension is recognized and appreciated. So much so, in fact, that the balance of trade is largely in surplus, amounting to **.* million euros in **** . In ****, the balance will be in surplus by **.* million euros, an increase of **% in * years.

Foreign trade in gin France, ****-****, US$ million Source: ****

This vigorous export performance is driven by an ever-increasing diversification of destination countries, with the United States, Italy and Spain in first place, where French gin is perceived as a luxury product, creative and a bearer of new flavors.

Share of gin exports by country France, ****, in percent Source: ****

France's trade balance on this market is in deficit only with the Netherlands, the historic home of gin, the United Kingdom, where gin has been popular for centuries and which has played a major role in spreading it throughout the world, and with Germany and Japan, which offer original, high-end gins that are highly appreciated. Proportionally, however, gin is mainly imported from the UK, as summarized in the table below. This can be explained by the fact that gin is central to British popular ...

2 Demand analysis

2.1 Hangover in France: structural decline in spirits consumption by volume

Consumption of spirits has fallen sharply in recent years. In ** years, per capita consumption of pure alcohol has fallen from *.** liters per person in **** to *.** liters per person in ****, under the influence of public policies to raise awareness of the dangers of alcohol. Consumers of spirits are becoming increasingly reasonable, and are increasingly choosing quality over quantity.

Spirits consumption per person France, ****-****, liters per person aged ** or over Source: ****

In terms of frequency of consumption, older people and men are the most frequent drinkers, with men over ** showing the highest rate of daily consumption (***). Similarly, over half of men aged ** to ** claim to drink at least one glass a week, ** points more than women in the same age category. Conversely, women are more likely not to drink spirits: **.*% of them say they don't drink alcohol, compared with **.*% of men. [***]

However, in the midst of this general decline, gin among the"white spirits" represents **% of the market in France, and is doing well: its consumption in volume has increased by **% in **** compared to ****, and by **% in value [***].

Breakdown of white spirits sales France, ****, in Source: ****

Among spirits as a whole, however, gin still ranks *th among French consumers' favorite beverages:

Top ...

2.2 Sustained growth in premium products

The curve below highlights the premiumization of the French spirits market, with prices up **% since ****. What's more, the sharp rise in **** is the result of the Egalim law of October ****, which raised the prices of certain spirits by between *% and *%. As distributors need to better remunerate farmers and producers, they have passed this increase on to prices. [***]

Consumer price index for spirits and liqueurs France, ****-****, base *** in **** Source: ****

Premiumization is the most significant market trend. For **% of volume sold, premium gins create **% of total value. From **** to ****, the premium segment grew in value by **%, and the superpremium segment by **.*%. The beverage has strong potential to continue this move upmarket, given the diversity of flavors and ingredients that can make it up.

Weight of the three segments in volume and value France, ****, % (***) Source: ****

In the supermarket and convenience store segment, Hendrick's, famous for its rose and cucumber-infused gin, is focusing on attracting new premium gin enthusiasts. This strategy includes the annual launch of exceptional limited editions, such as Flora Adora in ****, distinguished by its unusual floral infusion. European Union regulations concerning gin, which is traditionally a neutral spirit based mainly on cereals, juniper berries and coriander, offer considerable scope for creativity ...

2.3 Interest in mixology and cocktail culture

Over the years, cocktail culture has become increasingly popular in France. The practice was revived in the **s, and its success has continued ever since. In ****, **% of the French population were cocktail drinkers[***].

This culture is growing (***), although the cocktail trend is still lagging behind the French interest in wine and beer, as shown in the following graph showing the proportion of the population consuming each of the following alcohol categories in **** and ****. All categories except cider are growing.

Share of French people consuming different alcohols and change vs. **** France, ****, in Source: ****

Within this trend, gin in particular is inseparable from mixology [***]. Bars that dedicate their menus to gin-based cocktails are multiplying. Gin is well suited to the world of mixology, since it conjures up images of sophistication, creative recipes, travel and terroir.

It should be noted, however, that while the proportion of French people consuming cocktails is on the rise, interest in mixology as such is declining, with **% of French people taking an interest in ****, down * points on ****.

The new market for ready-to-drink cocktails

after the first confinement in ****, Stephan Tenhaef, President of Bacardi Martini France, notes a craze for ready-to-drink cocktails [***]. This formula, offered by bars, is becoming increasingly ...

2.4 Demand is strongly supported by a seasonal effect

The demand for gin is marked by seasonality, which largely supports demand:

Trends in interest in gin on Google France, ****-****, base *** Source: ****

The graph above represents the proportion of searches for a given keyword́ in a region and for a specific period, in relation to the time when the rate of use of this keyword́ was highest (***). Thus, a value of ** means that the keyword was used half as much in the region concerned, and a value of * means that the data for this keyword is insufficient.

We can see that there are two peaks of interest for the drink in France, a strong interest reflected by searches on Google in summer, certainly explained by the consumption of cocktails in summer. and a second surge of interest at the end of the year for Christmas and New Year's Eve.

3 Market structure

3.1 Value chain

The French gin industry brings together several different players involved in one or more stages of the value chain. The value chain comprises * main phases:

The first is the extraction of agricultural raw materials, in this case juniper berries, as well as the other natural elements that will flavour the drink. These raw materials are then processed to obtain the desired alcohol, notably by fermentation and distillation. Packaging refers to the bottling and packaging of the beverage. Finally, the finished products are distributed through a variety of channels (***)

Source: ****

***,***

However, in ****, we estimate spirits sales at around *.* billion, based on data from the French National Institute for Statistics and Economic Studies (***). Indeed, using the NAF code for spirits, **.**Z, we find: sales index **** * sales **** / sales index **** = ***.* * *.* / ***.* = *.* billion euros in ****. As we have seen, in that year the gin industry produced a value of *** million euros. Gin therefore represents around *% of the spirits market, so we can estimate that it creates around *,*** jobs, dividing all the results obtained by ***.

Jobs supported by the gin industry France, ****, in full-time equivalent jobs over one year Source: ****

3.2 Leading brands

The main companies buying gin are in the CHR (***) and nightclub segments, where this drink is very popular. indeed, in addition to offering music and a dance floor, nightclubs are also drinking establishments, whose wide range of spirits represents a significant part of their business.

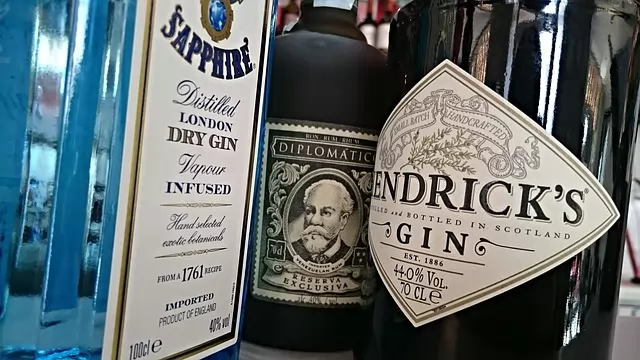

In France, the three historical players are Gibson's, marketed by La Martiniquaise, Gordon's from Diageo and Bombay Sapphire, marketed by Bacardi. However, in ****, Hendrick's took advantage of the market's confinement and premiumization to win market share.

Market share by gin brand France, ****, % (***) Source: ****

3.3 Distribution

In-store distribution

In B*C spirits sales, hypermarkets and supermarkets accounted for three-quarters of sales volume in ****.

Convenience stores are losing ground. In fact, their share of sales halved from **% to *.*% between **** and ****, to the benefit of generalist e-commerce platforms, which rose from *.*% (***).

Breakdown of spirits and champagne supermarket sales by channel France, ****, as % of sales Source: ****

CHR and nightclub distribution

Market share by brand is not evenly distributed within the CHR network. The Beefeater brand, owned by Ricard, has a low profile in supermarket sales, but dominates the on-trade segment. It sells **,*** liters of gin on the out-of-home market, corresponding to a market share of over **% [***]. Gin is particularly strong in nightclubs, where the legendary gin and tonic has a large following.

However, growth in this distribution channel was severely hampered in **** and **** by the Covid-** crisis, which led to the closure of all establishments in the sector. Despite a loss of over *.* billion euros and the permanent closure of one in ten establishments in ****, the market should stabilize again in ****, with the removal of restrictions [***].

The CGA by NielsenIQ study indicates that, in the first six months of ****, gin recorded a *.*% increase in its market share in the CHR ...

4 Offer analysis

4.1 Gin price details

Historically, gin was very successful in Holland and England, and more recently in the rest of the world, because it was cheap to produce and easy to make. Gin doesn't need to age, which makes it easier to manage stocks and cash flow [***].

However, with the growing popularity of this white spirit, the product is becoming available in ever more premium spirits, making it necessary to distinguish between three categories of gin in terms of price:

In ****, **% of companies faced price increases from their suppliers, a trend that continues in ****. Moreover, **% of companies consider that inflation leads to a **-**% increase in their cost price.

Inflation-driven cost price increases for spirits France, ****, in Source: ****

The Fédération Française des Spiritueux (***) reports that inflation continues to affect production costs in the spirits and aperitif wine sector. After a difficult ****, **** follows the same trend, with worrying prospects for ****. Despite efforts to maintain the purchasing power of the French, any drop in prices would jeopardize the survival of these sectors. Although some production costs have stabilized, they remain high. Other costs, such as sugar and glass bottles, have risen by ** to **%. Labor costs have also climbed, as companies seek to preserve their ...

4.2 Development of gin production in France and categorization of its varieties.

French production:

Gin production in France is not rooted in any tradition, and the first brands are barely twenty years old. However, it has grown considerably. In ****, French gin exports continued to grow at a rate of **%.

As for the model adopted, these dozens of young brands rely on artisanal distilleries and liquoristeries, where they craft their very bold creations in small volumes. Production has been made possible in particular by the proliferation of whisky micro-distilleries, which are seeking to diversify by expanding into gin.

This trend is driven by the desire to consume locally, but also by the demand of international customers to discover original flavors. French producers are seeking to enhance the French wine tradition by infusing grape flavors into the drink. Such is the case with G'Vine, created in ****, which in just a few years has become a benchmark in the field, taking second place worldwide in the super-premium gin segment [***]. Indeed, according to the President of Maison Villevert, in a wine country like France, "grapes ennoble spirits".

Some French gins are enjoying great international popularity, such as Citadelle (***), used by a famous Spanish chef in his gin and tonic recipe. They are particularly successful in the United ...

4.3 The role of taxes in pricing

The tax burden on spirits is overwhelming for the industry. These spirits will account for **% of tax revenues in **** (***).

Breakdown of consumer price for a bottle of spirits sold at €**.** France, ****, amount in € Source: ****

Revalued each year in line with inflation, tax on spirits in France accounts for **% of revenues.

By comparison, wines represent **% of volumes but *.*% of tax revenues in ****.

5 Regulations

5.1 An increasingly strict regulatory framework

France is concerned by European regulations. In particular, the following regulations are central: Regulation (***) No ***/**** of the European Parliament and of the European Council of January **, **** on the definition, description, presentation, labeling and the protection of geographical indications of spirit drinks; In connection with this regulation, regulations ****/*** and ***/**** update the aforementioned framework. In addition, there is a comprehensive national legislative framework. given that spirits are alcohols of at least **º and that the majority of products have an alcohol content well above the average, spirit drinks are highly regulated. Below is a non-exhaustive list of laws and regulations relating to alcohol (***) in France: Production Bottles of alcohol must be strictly labeled with the following information: type of beverage, ingredients, alcohol content, capacity, allergens, "Zero alcohol during pregnancy" pictogram. Regulation of certain products to obtain the AOC (***) label, as in the case of Genièvre Flandre Artois, a traditional gin produced in the Hauts-de-France region. In all, there are ** products with the AOC acronym in France. [***] Distribution Retailers need a Licence IV to sell spirits in the CHR (***) circuit. Anyone operating a drinks establishment must undergo training to obtain a "permis d'exploitation". There are often restrictions on the hours during which liquor outlets ...

6 Positioning the players

6.1 Different gin recipes

- La Martiniquaise Bardinet

- Diageo

- Bacardi

- William Grant and Sons

- Beam Suntory

- Distillerie de La Roche-Guyon

- Arduenna Gin

- Bombay Sapphire

- Drinks and Spirit

- Ellustria

- Gibson's

- MXO Spirit

- Spirits Station

All our studies are available online in PDF format

Take a look at an example of our research on another market!

Choosing this study means :

Choosing this study means :

Access to more than 35 hours of work

Our studies are the result of over 35 hours of research and analysis. Using our studies allows you to devote more time and added value to your projects.

Benefit from 6 years' experience and over 1,500 industry reports already produced

Our expertise enables us to produce comprehensive studies in all sectors, including niche and emerging markets.

Our know-how and methodology enable us to produce reports that offer unique value for money.

Access to several thousand articles and paid-for data

Businesscoot has access to all the paid economic press as well as exclusive databases to carry out its market research (over 30,000 articles and private sources).

To enhance our research, our analysts also use web indicators (semrush, trends, etc.) to identify market trends and company strategies. (Consult our paying sources)

Guaranteed support after your purchase

A team dedicated to after-sales service, to guarantee you a high level of satisfaction. +44 238 097 0676

A digital format designed for our users

Not only do you have access to a PDF, but also to a digital version designed for our customers. This version gives you access to sources, data in Excel format and graphics. The content of the study can therefore be easily retrieved and adapted for your specific needs.

Our offers :

Our offers :

The gin market | France

- What are the figures on the size and growth of the market?

- What is driving the growth of the market and its evolution?

- What is the positioning of companies in the value chain?

- Data from several dozen databases

Pack 5 études (-25%) France

- 5 études au prix de 74 €HT par étude à choisir parmi nos 1200 titres sur le catalogue

- Conservez -25% sur les études supplémentaires achetées

- Choisissez le remboursement des crédits non consommés au terme des 12 mois (durée du pack)

Consultez notre catalogue d’études sectorielles