Summary of our market study

The French medical device market is estimated at between 25 and 35 billion euros

The global medical devices market, valued at over$500 billion, is expected to grow at an average annual rate of 5.5%.

Dominated by the United States with a 43% market share, the market has seen an increase in demand for a variety of equipment due to an aging population and a rise in chronic diseases.

The French medical equipment market grew by 10% between 2017 and 2021, propelled by exports, which rose by 4.3% in 2021.

Dynamics of the French medical equipment market

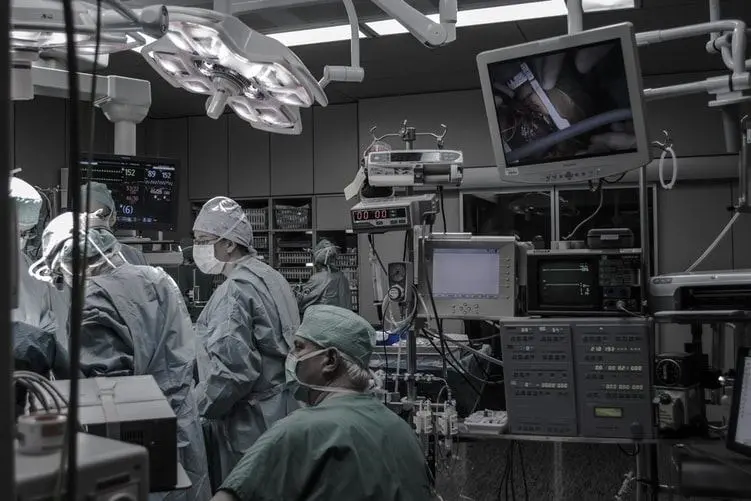

The sector encompasses a wide range of products, from hospital equipment and diagnostic devices to cutting-edge e-health solutions.

France occupies an important place in the global landscape, with a market estimated at between 25 and 35 billion euros, representing around 5 to 6.5% of the world market.

The market covers devices for individual use, non-active implants, in vitro diagnostics and online health monitoring systems.

The proportion of people aged over 60 is expected to reach between 28% and 31% within one or two decades. Per capita healthcare expenditure is between €4,500 and €5,000.

The French medical device market is fragmented, with over 1,400 companies operating in this field. The majority of these are small and medium-sized enterprises (SMEs).

France is a net importer of medical devices, with import values of between 5 and 7 billion euros and export values of between 3.5 and 4 billion euros. The gap between imports and exports has tended to widen in recent years.

Complete sales, rental and service solutions

- La Vitrine Médicale

- Distri Club Medical

- Bastide

- Harmonie Medical Service

National SMEs

- Beaulieu Médical

- BVS Médical

- Chemineau

Mutinationals

- BioMérieux

- Johnson & Johnson

- Medtroni

to understand this market

Detailed content of our market study

Inforamtion

Inforamtion

- Number of pages : 35 pages

- Format : Digital and PDF versions

- Last update :

Summary and extracts

Summary and extracts

1 Market overview

1.1 Market overview and definition

A medical device ("MD", also known as medical equipment) is defined as "an instrument, apparatus, equipment or software intended by its manufacturer for use in the diagnosis, prevention, control or treatment of disease or injury, or for other purposes". [ANSM]

MDs are very diverse, which means that a wide range of products are included within the scope of this product category. In France, there are between 800,000 and 2,000,000 product references. Generally speaking, medical devices can be segmented as follows, according to their use :

- Medical devices for individual use (hospital equipment, anesthesia or respiratory equipment, etc.);

- Equipment (non-active implants, dental equipment, etc.).);

- In vitro diagnostics (pregnancy tests, glucometers, etc.);

- E-Health (real-time monitoring of physiological parameters at home).

The global medical devices market is largely dominated by the United States (43.5% market share), although demand is increasingly turning towards Asian countries.

The medical devices market is heavily impacted by European and French regulations, which may contribute to a slowdown in growth in the future due to the high cost of complying with standards for companies in the sector. Medical equipment was also in great demand during the pandemic, albeit unevenly. Since 2021, the market has been challenged by rising raw material prices, which in some cases have more than doubled.

Nevertheless, the French market is enjoying solid growth(+9.6% between 2017 and 2021), driven by an aging population and longer life expectancy, and this trend is set to continue in the future. The market is highly fragmented, with a large number of players involved in the production and marketing of different products.

All our studies are available online in PDF format

Take a look at an example of our research on another market!

Choosing this study means :

Choosing this study means :

Access to more than 35 hours of work

Our studies are the result of over 35 hours of research and analysis. Using our studies allows you to devote more time and added value to your projects.

Benefit from 6 years' experience and over 1,500 industry reports already produced

Our expertise enables us to produce comprehensive studies in all sectors, including niche and emerging markets.

Our know-how and methodology enable us to produce reports that offer unique value for money.

Access to several thousand articles and paid-for data

Businesscoot has access to all the paid economic press as well as exclusive databases to carry out its market research (over 30,000 articles and private sources).

To enhance our research, our analysts also use web indicators (semrush, trends, etc.) to identify market trends and company strategies. (Consult our paying sources)

Guaranteed support after your purchase

A team dedicated to after-sales service, to guarantee you a high level of satisfaction. +44 238 097 0676

A digital format designed for our users

Not only do you have access to a PDF, but also to a digital version designed for our customers. This version gives you access to sources, data in Excel format and graphics. The content of the study can therefore be easily retrieved and adapted for your specific needs.

Our offers :

Our offers :

the medical equipment market | France

- What are the figures on the size and growth of the market?

- What is driving the growth of the market and its evolution?

- What is the positioning of companies in the value chain?

- Data from several dozen databases

Pack 5 études (-25%) France

- 5 études au prix de 74 €HT par étude à choisir parmi nos 1200 titres sur le catalogue

- Conservez -25% sur les études supplémentaires achetées

- Choisissez le remboursement des crédits non consommés au terme des 12 mois (durée du pack)

Consultez notre catalogue d’études sectorielles