Summary of our market study

The European insulin pump market is worth around 2.4 billion.

The worldwide market for insulin pumps is estimated at $6 billion.

The world's diabetic population is growing fast, and now exceeds 550 million.

The French market has an average annual growth rate of 7%.

Expenditure on diabetes care by the French health insurance system is around 10 billion euros.

More than 4 million people are treated, and an alarming estimate is that almost a million French citizens remain undiagnosed.

Type 2 diabetes accounts for 92% of cases, with the remainder made up of type 1 and rarer forms. Those most affected are the over-65s, who account for over 60% of the diabetic population, with men slightly outnumbering women.

In France, nearly 860,000 people are on insulin therapy. Only 2% to 5% of diabetics use insulin pumps, compared with 25% in the United States. However, this landscape is changing. The number of insulin pump users among French diabetics has almost quadrupled to 82,000.

Innovations and the introduction of advanced insulin pump models, such as Medtronic's Minimed 780G, Omnipod DASH and Tandem's t:slim X2, are meeting the needs of a growing diabetic population.

Large entities such as Medtronic, Roche and others dominate the scene, focusing on connected technologies and more patient-friendly solutions.

Main manufacturers dominating the insulin pump landscape

- Medtronic Medtronic is a pioneer in the field of insulin pumps. abetes.

- Roche is a pillar of the insulin pump market under the banner of its Accu-Chek brand,

- Medtronic and Abbott

- Insulet is renowned for its revolutionary Omnipod device,

- Ypsomed has made its mark on the market with the myLife Ypsopump

- Cellnovo Smaller player

to understand this market

Detailed content of our market study

Inforamtion

Inforamtion

- Number of pages : 35 pages

- Format : Digital and PDF versions

- Last update :

Summary and extracts

Summary and extracts

1 Market overview

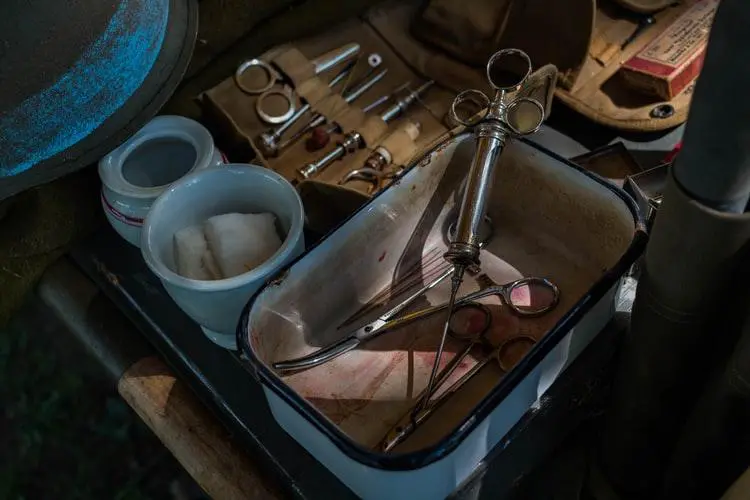

1.1 Insulin pump market overview and definition

The insulin pump is a treatment method for diabetics. It is an an interesting alternative to multi-injection therapy insulin injections, helping to maintain better glycemic control. Mimicking the functioning of a normal pancreas, it is an artificial device that delivers insulin at a variable rate to an insulin-dependent diabetic requiring insulin on a permanent basis.

Theinsulin pump can be implanted (rarely prescribed by physicians) or external (subcutaneous injection) . Operation is straightforward, with in-hospital training and regular follow-up with the diabetologist and pump vendor.

The global insulin market is growing, dominated by a handful of very powerful laboratories offering insulin pens and oral medications. Insulin pump sales constitute one segment of the insulin treatment market.

The insulin pump market segment is also growing, and is set to remain so for years to come, driven by the various innovations proposed by traditional and emerging players. This global market is estimated atUS$5.67 billion in 2022, andshould reach US$9.4 billion in 2028 (at aCAGR of 8.8%). [GrandViewResearch]

Indeed, in 2021, there will now be 537 million diabetics in the world, 3.5 times more than in 2000. Between 2019 and 2021, for example, the number of diabetics rose by 74 million. To date, Asia-Pacific has the highest number of people with diabetes (206 million), but the increase is expected to beparticularly strong in Africa (+134% in 2045 compared with 2021) [DiabetesAtlas]

France is one of Europe's biggest consumers of diabetes treatments, with healthcare expenditure linked to this disease amounting to over 22 billion euros in 2021[DiabetesAtlas]. As a result, the insulin pump market is highly dynamic, and is expected to grow at a CAGR of 6.58% over the period 2023-2028. [Mordor Intelligence]

The market for diabetes treatment is very closely linked to the regulations and healthcare system in place. For example, the French social security system allows insulin pump treatment to be reimbursed, and regularly updates the new pumps that are eligible for reimbursement.

1.2 The global market

The global insulin pump market is estimated at US$*.** billion in ****, and is expected to continue growing over the next few years at a CAGR of *.*%, reaching US$*.* billion in ****.

Insulin pump market size World, **** - ****, in billions of USD Source: GandViewResearch (***) : projection

Global market growth drivers include the rising number of people with diabetes, the increase in obesity and overweight, technological developments, and the growing adoption of insulin pumps by patients in both developed and emerging countries[***].

IDF (***) published a report in **** with key figures on diabetes worldwide. As the **** and **** reports have not yet been published, we will use the **** data to gain a better understanding of this market.

Over the past two decades, the number of people with diabetes has risen steadily, from *** million in **** to *** million in ****, a considerable increase of ***% over the period. In ****, compared with ****, the number of diabetics has risen by **% (***).

Number of diabetics worldwide World, **** - ****, in millions Source: ****

And this trend is set to continue, as DiabetesAtlas forecasts that the number of diabetics will reach *** million in **** and *** million in ****.

This increase will be particularly strong in Africa (***) and North America will experience more moderate growth.

to date, Asia-Pacific has the highest ...

1.3 Growth in the French market

The following graph shows the evolution of diabetes-related healthcare expenditure in France. This figure includes all diabetes-related expenses in France. It includes, for example, all the costs of insulin therapy, visits to healthcare professionals and equipment, as well as all the resources devoted to prevention, nutrition and so on. It also includes all public and private expenditure. Although the scope of this expenditure goes beyond the insulin pump market alone, these figures do underlinethe buoyant context in which the insulin pump market is evolving. Indeed, the diabetes-related market in France, which was stable between **** and ****, has been very dynamic since **** (***). Diabetes-related healthcare expenditure in France France, **** - ****, in USD billion Source : DiabetesAtlas The European insulin pump market, expected to reach over $*.* billion in ****, is being driven by a sharp rise in the number of diabetics in the region. In ****, there were around ** million diabetics in Europe, and this figure is expected to rise to ** million by ****. [***] AlongsideGermany and the UK, France is one of Europe's biggest consumers of insulin pumps. In fact, the French insulin pump market is expected to grow at a CAGR of +*.**% over the period ****-****. [***]

2 Demand analysis

2.1 The profile of diabetes patients

The number of diabetics under care is trending upwards in France, rising from *.* million in **** to * million in ****, an increase of **% in just * years. However, by ****, the number of people in care would have fallen by ***,***, before rising again by ***,*** in ****, to around *.* million.

People treated for diabetes in **** (***) France, **** - ****, in millions of people Source: ****

However, in ****, according to the European Center for the Study of Diabetes (***), nearly * million French people are unaware that they have diabetes and have not been diagnosed.

What's more, between **** and ****, the average annual growth rate (***) in the number of people treated for diabetes was *.**%. The gross annual change in prevalence between **** and **** is *.** points. [***]

There are * main types of diabetes[***]:

type * diabetes, due to a lack of insulin secretion by the pancreas; type * diabetes, due to poor utilization of insulin by the body's cells. It develops very gradually, insidiously over many years.

Type * diabetes is the most widespread(***). Type * diabetes accounts for *% of cases. The remaining *% are rarer types of diabetes, such as MODY, LADA or secondary diabetes resulting from certain illnesses or medications. Breakdown of the proportion of diabetics by type France, ****, in % Source: Federation of Diabetics Men (***).

Breakdown of the proportion of ...

2.2 Obesity and overweight as risk factors

Obesity and diabetes are two closely related diseases. In fact, according to the Pasteur Institute in Lille, obesity is the leading risk factor for diabetes, and **% of obese people also suffer from diabetes. The increase in obesity and overweight is the main reason for the sharp rise in the number of diabetics worldwide.

In ****, Oxoda, in conjunction with several partners, carried out a new edition ofthe "Obépi-Roche study", a national epidemiological survey on overweight and obesity for the Ligue contre l'Obésité. It gathers data from **** to ****, but has not been updated since. However, Le Monde confirms that obesity will continue to affect more and more French people in ****, while overweight will stabilize.

In France, between **** and ****, the proportion of the population who were overweight or obese rose by *%, from **.*% to **.*%. However, the proportion of overweight and obese people will not change between **** and ****. In detail, the proportion of overweight people has changed little over the period (***) and multiplied by * for people with massive obesity. [***]

Trends in obesity and overweight in the French population France, **** - ****, in Source: ****

The following map and table show the prevalence of obesity by region. Overall,the northern part of France is more affected by ...

2.3 Insulin pump users among diabetics

Of the *,***,*** diabetic patients who were treated in ****, (***).

According to Has-Santé, the population of French patients using external insulin pumps stood at **,*** in ****. This would mean that only *% of diabetics would be using this device. According to lvlmedical, however, *% of diabetics will be using an insulin pump. by way of comparison, this proportion rises to **% among American diabetics.

According to Sécurité Sociale, **,*** French people used an insulin pump in ****. So, in * years, the number of diabetics using an insulin pump would have almost multiplied by * (***) underlining a trend that is the growing use of insulin pumps. What's more, since summer ****, three new insulin pump models have entered the market and benefit from ***% reimbursement by the Assurance Maladie[***] :

the Minimed™ ***G insulin pump - Medtronic, the Omnipod DASH ™- Insulet insulin pump, the t :slim X* insulin pump - Tandem.

This initiative is therefore in line with the trend of increasing use of insulin pumps.

Two types of pump can be distinguished:[***]

pumps with tubing (***) Patch: Pod and remote control.

In ****, **% of patients will use a "patch" pump, since **,*** pump users use pumps without external tubing. Pumps with tubing thus represented **,*** users, or **% of pumps. [***]

What's more, Insulin pumps are mainly ...

3 Market structure

3.1 The central role of health insurance and reimbursements

The French Assurance Maladie plays a central role in the insulin pump market, as it does for many drugs, treatments and medical equipment. As diabetes is classified as a long-term condition (***), costs are ***% covered by the French health insurance system, whether for diabetes-related care or for complications: ocular, vascular, renal or neurological complications, hypertension, resulting from diabetes. [***]

The reimbursements granted each year for French healthcare considerably broaden access to certain equipment or devices that can be costly, as is the case for insulin pumps (***)

Of the *** billion euros of social security expenditure in ****, *,*** million euros, or *.*% of social security expenditure, is allocated to diabetes care. expenditure therefore rose by **.*% between **** and ****, from *,*** million to *,*** million euros.

Expenditure reimbursed by Assurance Maladie for diabetes France, ****, in millions of euros Source: ****

Of this expenditure, in ****, *,*** million euros will be for outpatient care(***).

Breakdown of diabetes-related expenditure France, ****, in Source: ****

Average annual reimbursed expenditure per diabetic patient is estimated at *,*** euros per person in ****. This figure has not changed since ****. So, although total expenditure due to diabetes rose between **** and **** as a result of the increase in the number of diabetics, expenditure per patient remained the same.

Moreover, on average, this equates to a ...

3.2 The main players in the diabetes treatments market

The global market for anti-diabetic treatments is not very fragmented, and is dominated by a handful of large international groups. Evaluate Pharma provides annual reports on the global pharmaceutical market, but only the **** report focuses on the anti-diabetic market.

In ****, the top ** groups accounted for over **% of total market value, including Novo Nordisk (***). In particular, the report stated that the Novo Nordisk group's strong presence should continue to grow by ****, to reach over **% market share in anti-diabetics worldwide.

Market share of diabetes treatments World, ****, in Source: ****

Market share of diabetes treatments World, ****, in Source: ****

3.3 Leading insulin pump manufacturers

The French insulin pump market is highly fragmented and dominated by a handful of industry giants .

Medtronic

Sales of the Medtronic group's Diabetes division have grown steadily in recent years, from $*.** billion in **** to $*.** billion in ****. A world leader in medical technologies, the group has a very strong presence in the insulin pump segment, with highly specialized expertise (***).

However, the Group has announced that it will cease production of this internally implanted pump in ****, as it is not sufficiently profitable according to the Group, and concerns very few patients in France (***). This announcement has caused considerable concern among patients. [***]

The main Medtronic model on the French market is the MiniMed ***G.

Sales of Medtronic's diabetes division World, **** - **** * Source: ****

Roche

In ****, sales for the Diabetes Division of the Roche pharmaceutical group reached *.*** billion euros (***). Roche Diabetes Care France recorded sales of ***.* million euros in ****. The Diabetes division is represented by the Accu-Chek brand, created in **** when Roche acquired the insulin therapy/self-monitoring of blood glucose division of Boehringer Mannheim. [***]

Although the Roche group is number * in insulin pumps in France, it is under intense competitive pressure from specialist players such as Medtronic and Abbott. The group is therefore seeking to revive ...

4 Offer analysis

4.1 Insulin pump typology

Insulin pumps are medical devices used in the treatment of diabetes (***). Compared with multi-injection therapy, the insulin pump enables patients to maintain a freer, more flexible lifestyle, with greater flexibility in mealtimes, as well as better monitoring of blood glucose levels, and therefore a lower risk of complications.

The insulin pump delivers precise doses of insulin continuously, at a rate programmed by the user. The insulin pump is equipped with an infusion device (***). [***]

The main models available in France and their characteristics

Source: ****

Overview of market prices

According to NHC, insulin pumps are reimbursed up to a maximum of €*,*** incl. VAT. There is also the option of renting. In this case, the pump costs around €*.** (***) are reimbursed up to €**.** per replacement.

According to the Diabète Infos website, the complete Medtronic MiniMed® ***G system, which includes a pump, Enlite sensors and a Guardian * Link transmitter, generates an annual cost of €*,*** incl. VAT, fully reimbursed by Social Security.

By way of comparison, the Diabetes.co. uk website references the purchase price of the main insulin pumps in the UK. These range from £**** to £****, or €**** to €****. The same site tells us that consumables cost between £**** and £**** a year, or between €**** and €****.

4.2 Product innovation on the market

Digital technology in diabetes treatment

Manufacturers in the insulin therapy market are increasingly investing in the connected objects segment to meet consumer expectations. For example, Abbott and Sanofi, as well as Medtronic and Novo Nordisk, have signed alliances in **** to advance in the connected pen segment.

In particular, Abbott has launched the Free Style Libre device on the French market, enabling continuous blood glucose measurement using a subcutaneous sensor whose data can then be retrieved and read on smartphones. For Abbott, the aim of the partnership with Sanofi is to be able to take advantage of Sanofi's other platforms and cloud data, to move towards interoperability. [***]

Patch" or "pod" insulin pumps

This new type of pump is smaller and lighter. They also have a practical advantage in that they can be stuck to the skin, with the insulin reservoir directly connected to the catheter, a small cannula inserted under the skin.the insulin reservoir is directly connected to the catheter, a small cannula inserted under the skin, thus doing away with the sixty-centimeter tubing usually found on other models. [***]. Two patch/pod models are currently available: La Cellnovo and My Life Omnipod.

Closed-loop pumps

For insulin pumps, the "closed-loop" system consists ...

5 Regulations

5.1 Supervision of insulin pump therapy

Prescriptions[***]

Insulin pumps are reimbursed by the French national health insurance scheme (***) for type * and type * diabetes which cannot be controlledby insulin therapy using multiple subcutaneous injections of insulin.

The initial prescription for an external insulin pump (***) must be made in an initiating center. This prescription is valid for a maximum of * months. Renewal of this prescription, also for * months, is carried out bya doctor specializing inendocrinology and metabolism,or by a doctor qualified in diabetology and nutrition, working in consultation with thewith the initiating center. Next, are-evaluation of the appropriateness of continuing treatment must be carried out by a physician specializing in endrinology and metabolismevery year in an initiatinginitiating center.

The prescription must specifythe make and model of the pump, as well asmake and model of consumables, and the number required per month.

In addition, any prescription for a pump change must be madebe made at an initiating center. According to the registration decree , this change cannot take place before * years have elapsed. However, the social security organization may cover the cost of renewal before the expiry of this period, on the advice ofthe medical advisor.

Patient and provider training

Theorder of June **, **** frames the terms and conditions for reimbursement ...

6 Positioning the players

6. Segmentation

- Medtronic

- Cellnovo

- Roche Diabetes Care (Roche Groupe)

- Insulet

- Ypsomed Group

- ISIS diabète (Isis Médical)

- Physidia

- Nova Medical Center

- Medtrum

- Apex Wellell

- Open APS

- Eli Lilly

- TreeFrog Therapeutics

- Boydsense

- Diabeloop

All our studies are available online in PDF format

Take a look at an example of our research on another market!

Choosing this study means :

Choosing this study means :

Access to more than 35 hours of work

Our studies are the result of over 35 hours of research and analysis. Using our studies allows you to devote more time and added value to your projects.

Benefit from 6 years' experience and over 1,500 industry reports already produced

Our expertise enables us to produce comprehensive studies in all sectors, including niche and emerging markets.

Our know-how and methodology enable us to produce reports that offer unique value for money.

Access to several thousand articles and paid-for data

Businesscoot has access to all the paid economic press as well as exclusive databases to carry out its market research (over 30,000 articles and private sources).

To enhance our research, our analysts also use web indicators (semrush, trends, etc.) to identify market trends and company strategies. (Consult our paying sources)

Guaranteed support after your purchase

A team dedicated to after-sales service, to guarantee you a high level of satisfaction. +44 238 097 0676

A digital format designed for our users

Not only do you have access to a PDF, but also to a digital version designed for our customers. This version gives you access to sources, data in Excel format and graphics. The content of the study can therefore be easily retrieved and adapted for your specific needs.

Our offers :

Our offers :

the Insulin Pump Market | France

- What are the figures on the size and growth of the market?

- What is driving the growth of the market and its evolution?

- What is the positioning of companies in the value chain?

- Data from several dozen databases

Pack 5 études (-25%) France

- 5 études au prix de 74 €HT par étude à choisir parmi nos 1200 titres sur le catalogue

- Conservez -25% sur les études supplémentaires achetées

- Choisissez le remboursement des crédits non consommés au terme des 12 mois (durée du pack)

Consultez notre catalogue d’études sectorielles