Summary

The global electric motor market has seen significant fluctuations, notably due to the impact of the COVID-19 pandemic. In 2020, the market contracted by 9.6%, but is expected to rebound with a compound annual growth rate of 7% between 2021 and 2028, with an expected market value of 181.89 billion USD by 2028. The French market reflects this trend, but is poised for a 9% recovery in 2021, returning to pre-pandemic levels. The main drivers of market growth are the boom in the electric vehicle sector, where registrations have increased significantly in France, and the growing demand for energy-efficient electric motors against a backdrop of rising electricity costs.

The sector is also facing regulatory changes, with the introduction of stricter efficiency standards (IE3 or IE4). Major companies such as Siemens, ABB and Schneider Electric continue to dominate the market, while the transition to electric vehicles is opening up opportunities for new entrants and forcing traditional automotive players to adapt and invest in the production of electric motors

changing demand dynamics

Demand for electric motors in the observed market has been significantly influenced by several key trends. One of the main factors driving this demand is the boom in vehicle production, particularly electric vehicles, sales of which have increased considerably. Indeed, sales of electric vehicles have soared by over 150%. This escalation can be linked to the growing environmental awareness of consumers, who are increasingly turning to less polluting products and clean energy solutions.

Rising fuel prices have only added to the appeal of electric vehicles and therefore electric motors. In addition, the growing emphasis on energy efficiency has boosted demand for high-efficiency electric motors. This is partly due to the implementation of strict electricity consumption standards, and to a growing awareness of the need to reduce electricity costs, which are significant in the industrial and tertiary sectors. In France, for example, electricity consumption accounts for 70% and 33% of total energy consumption in the industrial and tertiary sectors respectively.

Electric motors, as core components, are not only relevant in automobiles, but have also found their way into electric urban mobility devices such as scooters, hoverboards and personal vehicles, which have seen explosive growth in sales. The market value of these devices doubled from around 134 million euros to 278 million euros. What's more, industry powerhouses and consumers alike showed an inclination to purchase complete motor solutions rather than stand-alone motors, revealing a preference for integrated, comprehensive offerings.

In terms of figures, the French electric motor market presents optimistic projections where, despite a dip in 2020 due to the pandemic with a drop in sales of over 10%, a rebound of the same magnitude is forecast for the following year. This could potentially return the market to pre-pandemic levels, suggesting resilience and continued interest in the electric motor market. This overview indicates that demand for electric motors is being influenced by a confluence of technological advances, changes in consumer behavior and economic factors. Combined, these elements are precipitating a significant market transformation, heralding a phase of robust growth driven by innovation, environmental considerations and efficiency.

Key players shaping the electric motor market landscape

As the electric motor market continues to expand and evolve, a wide range of companies are vying for leadership in this fast-growing sector. From electrical equipment specialists to diversified industrial equipment suppliers and automotive manufacturers, the market is characterized by a mix of established giants and newcomers.

- Siemens is a giant in the electrical equipment sector. Known for its extensive portfolio of electric motors and related services, Siemens has been instrumental in driving innovation and technological advances in the sector.

- ABB, another heavyweight known for its pioneering solutions in electrification, robotics and motion products. ABB motors are key components in a multitude of applications, exemplifying efficiency and reliability.

- Schneider Electric is a leading name in energy management and automation solutions. Its product range, which includes electric motors, is aimed at industrial efficiency and is at the heart of its broader vision of sustainable energy use.

- Nidec Motor Corporation, a notable player, not only offers a comprehensive range of electric motors, but also prioritizes energy-saving and environmentally-friendly products, aligning itself with global demand for sustainable industrial applications.

- Sew Eurodrive offers a range of drive technologies, including electric motors, and emphasizes the importance of system solutions that improve efficiency and productivity in a multitude of industrial contexts.

- ATB may not have the scale of some of its larger counterparts, but it has carved out a niche in the market by offering a wide range of electric motors for numerous fields and applications.

- Thales and Parker Hannifin fit into the electric motor space with their range of industrial components and systems, many of which incorporate electric motors in their functional design.

- Kohler and Jeumont may vary in their commercial footprints and offerings, but their involvement in the electric motor market testifies to the diversity of applications and sectors for which these motors are intended.

- BMW, Renault and Tesla are at the forefront of electric vehicle innovation. These companies don't just produce cars, they are an integral part of the advancement of electric mobility, a sector in which the electric motor is absolutely central.

- The democratization of electric motors is also paving the way for new entrants, as exemplified by Tesla.

to understand this market

Detailed content

Inforamtion

Inforamtion

- Number of pages : 30 pages

- Format : Digital and PDF versions

- Last update : 22/11/2021

Summary and extracts

Summary and extracts

1 Market overview

1.1 Market definition and delimitation

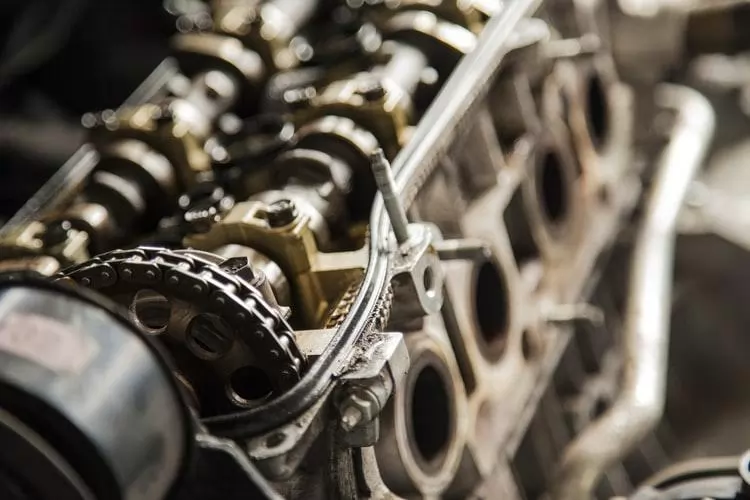

An electric motor is a machine that converts electrical energy into mechanical energy, as opposed to a heat engine that transforms thermal energy obtained during a combustion process. This electric motor is less polluting than the thermal engine during its operation by a reduced emission of polluting gases, but the process of its manufacture remains today very polluting in itself.

An electric motor can be powered in two different ways:

- Thanks to an alternating current: electric influx which circulates in a direction then in another. It requires an alternator whose turbine will create current to produce electricity

- Direct current: flows in one direction only, from the positive pole to the negative, and is produced by a generator such as a battery or a cell. To integrate this production into the distribution network, an inverter is used to transform the direct current into alternating current.

The main markets for electric motors are industry, transmission and distribution networks and power generation. The automotive sector is a particularly strong market, especially since the market for electric vehicles has been growing quickly in recent years. The global market for electric motors is worth more than 100 billion euros and its annual growth rate is estimated at 7% between 2021 and 2028.

French production has been fairly stable since the 2010s, with a few years marked by a negative growth rate. The French production market faces competition from foreign players, but the know-how and quality of the French industry gives the country a privileged position in the global market. In 2020, the sector was strongly affected by the coronavirus crisis, with sales falling by 10.4% that year. However, the recovery is estimated at 9.0% for 2021.

List of charts

List of charts

- Evolution of the electric motors market sales

- The different types of electric motors in the industry

- Evolution of the turnover of the activity related to the NAF code 27.11Z

- Breakdown of production in value by product category

- French imports and exports of electric motors and generators

All our studies are available online in PDF format

Take a look at an example of our research on another market!

Latest news

Companies quoted in this study

This study contains a complete overview of the companies in the market, with the latest figures and news for each company. :

Choosing this study means :

Choosing this study means :

Access to more than 35 hours of work

Our studies are the result of over 35 hours of research and analysis. Using our studies allows you to devote more time and added value to your projects.

Benefit from 6 years' experience and over 1,500 industry reports already produced

Our expertise enables us to produce comprehensive studies in all sectors, including niche and emerging markets.

Our know-how and methodology enable us to produce reports that offer unique value for money.

Access to several thousand articles and paid-for data

Businesscoot has access to all the paid economic press as well as exclusive databases to carry out its market research (over 30,000 articles and private sources).

To enhance our research, our analysts also use web indicators (semrush, trends, etc.) to identify market trends and company strategies. (Consult our paying sources)

Guaranteed support after your purchase

A team dedicated to after-sales service, to guarantee you a high level of satisfaction. +44 238 097 0676

A digital format designed for our users

Not only do you have access to a PDF, but also to a digital version designed for our customers. This version gives you access to sources, data in Excel format and graphics. The content of the study can therefore be easily retrieved and adapted for your specific needs.

Our offers :

Our offers :

the electric motor market | France

- What are the figures on the size and growth of the market?

- What is driving the growth of the market and its evolution?

- What is the positioning of companies in the value chain?

- Data from several dozen databases

Pack 5 études (-15%) France

- 5 études au prix de 75,6€HT par étude à choisir parmi nos 800 titres sur le catalogue France pendant 12 mois

- Conservez -15% sur les études supplémentaires achetées

- Choisissez le remboursement des crédits non consommés au terme des 12 mois (durée du pack)

Consultez les conditions du pack et de remboursement des crédits non consommés.

Schneider Electric has had the best year in its history - 16/02/2024

Schneider Electric has had the best year in its history - 16/02/2024

Tesla: green light from China for Elon Musk's giant battery factory - 22/12/2023

Tesla: green light from China for Elon Musk's giant battery factory - 22/12/2023

BMW to sell its cars without dealerships - 30/10/2023

BMW to sell its cars without dealerships - 30/10/2023