Summary of our market study

In France, the VOD market reached €2 billion in 2023.

The market was €185 million in 2011.

The global video-on-demand (VOD) market is worth over €40 billion.

Illegal streaming remains a problem, with only 43% of consumers of streaming services using exclusively legal sources.

Television is the predominant medium for VOD consumption, used by 88% of the French public.

The main players in the French market are Netflix, Amazon Video and Canal Play. Internet service providers play a central role as distributors, controlling over 40% of market share in 2017.

38% of respondents consider price to be the primary criterion for choosing a platform.

Demand dynamics in the French video-on-demand market

Three distinct offerings define video-on-demand services: limited-access rentals, permanent purchases and unlimited access by subscription, known as SVOD.

The under-40s account for almost a third of subscribers to services offering an unlimited range of series and films. Only 7% and 14% respectively of the over-40s have similar subscriptions.

The VOD offer has grown from 6,000 to 7,000 films in 2011 to over 10,000 in 2017. At the same time, overall legal online film and video consumption has risen substantially, from around 30% to 50% of the population between 2012 and 2018.

Video-on-demand player

- Netflix

- Amazon Video

- Google Play

- Apple ITunes

- Filmo TV

- Vidéo Futur

- Canal Play

- MyTF1 VOD & TFOU Max

to understand this market

Detailed content of our market study

Inforamtion

Inforamtion

- Number of pages : 35 pages

- Format : Digital and PDF versions

- Last update :

Summary and extracts

Summary and extracts

1 Market overview

1.1 Presentation and definition of video on demand

The video-on-demand(VOD) market is made up of offers enabling viewers to watch a film at home without having to rent or buy a DVD. In most cases, it's a digital offering via the Internet.

In reality, video on demand refers to three types of offer:

- Access to a film/series for a limited time (rental).

- Definitive acquisition of the rights to view a film/series (purchase).

- A subscription for unlimited access to films/series in the catalog (subscription). This third offer is called SVOD (from subscription video on demand) and refers to players such as Netflix.

In the VOD market, players are all striving to offer the widest possible choice of films and series. The trend is to adapt the model from simple video-on-demand to SVOD subscriptions, offering an unlimited catalog and choice of films and series to be viewed at any time during the subscription period. Players on the French market are gearing up to compete with international players with their eye on the market, such as Netflix and Amazon Video.

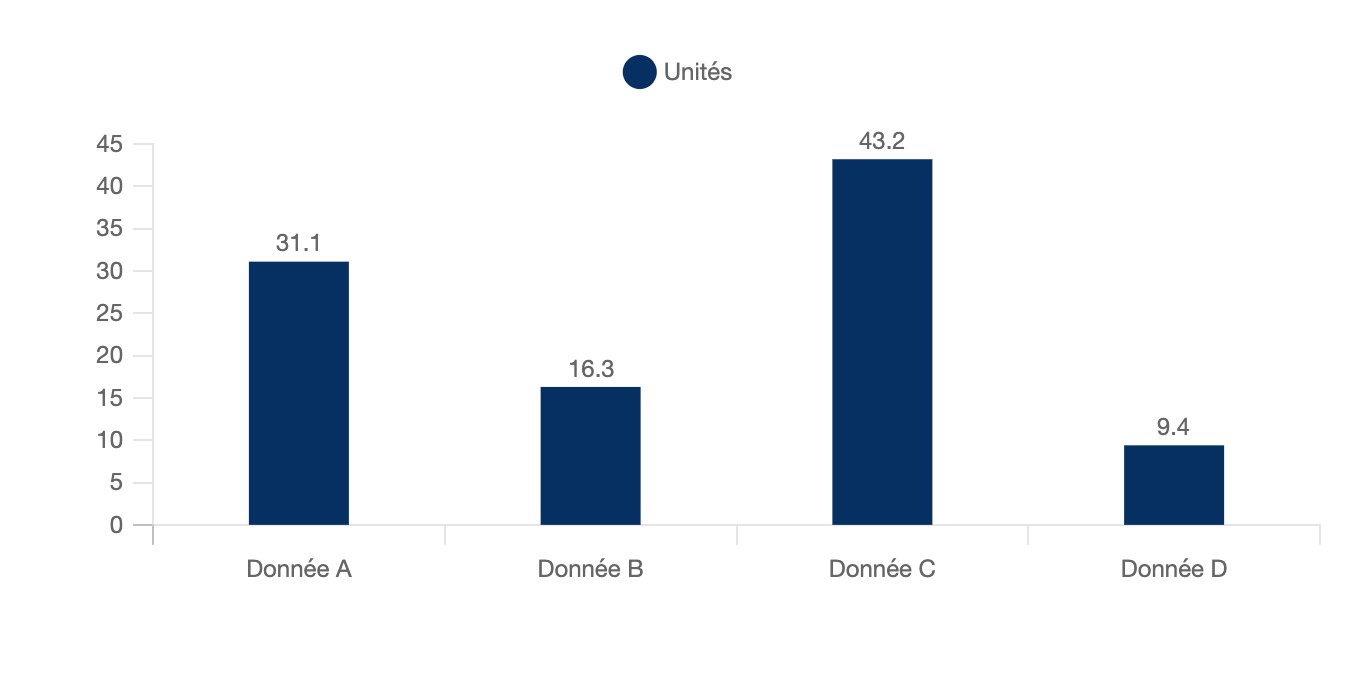

Nationality of films available on video-on-demand in France

France, year, units

Consult the study for figures and sources on the SVOD market in France

1.2 Strong growth in the global market

According to IDATE DigiWorldthe global video-on-demand market was worth ** billion euros in **** and will be worth **.* billion euros in ****. The global market is driven by subscription at nearly ** billion euros in ****, followed by digital rental and sales.

Video-on-demand market value by segment Worldwide, ****-****, in € billions Source: ****

1.3 The video-on-demand market in France is growing

According to the Center National du Cinéma et de l'Image Animéethe overall video-on-demand market in France has grown rapidly in recent years. It rose from *** million euros in **** to *** million euros in ****. Even so, the economic weight of video-on-demand in France remains limited compared with the weight of linear pay TV in France, estimated at *.* billion euros by the same source.

According to the Center National du Cinéma et de l'Image Animéewith *** million euros generated in ****, representing growth of almost **% on the previous year, subscription video-on-demand (***).

The "Transactional VOD" segment, which includes film rental for a limited time and film purchase, has been stagnant since **** and recorded moderate growth of +*.*% in ****.

SVOD market France, ****-****, in millions of euros Source: ****

In addition, according to the Center National du Cinéma et de l'Image Animéethe number of films actively offered on video-on-demand in France has risen sharply since ****, from *,*** films in **** to **,*** films in ****. This trend reflects the market's resilience and the growing popularity of video-on-demand in France.

Number of films on active VOD offer France, ****-****, in units Source: ****

2 Demand analysis

2.1 Overall consumption of films and videos online on the rise in France

According to iFOPthe overall consumption of films and videos legally in France increased between **** and ****, rising from **% of French people in **** to **% in ****.

Overall consumption of online videos and films France, ****-****, in % Source: ****

2.2 The French are spending more and more on film and video-on-demand services

According to IVFconsumer spending on video-on-demand in France rose sharply between **** and ****, from **.* million euros to ***.* million euros. By ****, this spending had fallen slightly to ***.* million euros.

Consumer spending on VOD France, ****-****, in millions of euros Source: ****

However, the increase in French consumer spending on films on demand in France was much more marked between **** and ****, rising from ***.* million euros in **** to almost *** million euros in **** according to european Audiovisual Observatory.

Consumer spending on films on demand France, ****-****, millions of euros Source: ****

2.3 Demand for video-on-demand is very high among the under-40s

The video-on-demand market in France is driven by the under-**s segment. According to CREDOCwhile almost **% of people under ** have a subscription allowing them to watch series and films on an unlimited basis in France, only **% of **-** year-olds and *% of over-**s have one.

Proportion of individuals with a subscription to watch unlimited video on demand, series or filmsFrance, ****, inSource: ****

2.4 More and more French people are equipped with Internet access at home, which is driving the emergence of video-on-demand platforms

According to a survey conducted by CREDOCthe rate of home Internet access in France has risen from **% in **** to **% in **** (***).

Rate of home Internet access France, ****-****, in Source: ****

2.5 The share of illegal streaming in France is high, hindering the development of VOD platforms in France

According to the SNEPonly **% of consumers of streaming services are exclusively legal in France. There is therefore a significant shortfall for the remaining **% of consumers who use illegal streaming to watch films and series. France is also poorly positioned compared to the UK and Sweden in Europe.

Share of exclusively legal streaming consumers in selected countries World, ****, in Source: ****

According to ALPApiracy is down in France (***), but illegal streaming is at its peak and has been growing steadily since ****, increasing by **% between **** and ****. Each year, *** million videos are consumed via illegal streaming.

Number of pirates per computer protocol France, ****-****, in thousands **** : Estimate for peer-to-peer Source: ****

2.6 France's favorite VOD companies

The graph below is based on OpinionWay's survey of French people's favorite brands in March ****. These are respondents' answers to the question "Do you like this or that VOD company?" for each brand, with the percentage corresponding to the proportion of respondents who answered "yes".

Netflix is the French people's favorite VOD company, with **.*% of respondents saying they like it. Canal+ is the least popular VOD company, with only **.*% of respondents saying they liked it.

French people's favorite VOD companies France, March ****, in Source: ****

The graph below compares the rating of VOD companies according to the age category of respondents. For the * VOD companies, the appreciation rate decreases with the age of the respondents. **.*% of respondents aged ** to ** appreciate Netflix, compared with only **.*% of respondents aged over **. Comparison of VOD company ratings by age category France, March ****, in Source: Opinionway French Favourite Brand survey conducted in March **** - Base: representative sample of *,*** French Internet users aged ** and over The graph below compares the approval rating of VOD companies according to respondents' socio-professional category. Respondents in the lowest socio-professional category are proportionally more likely to say they like Amazon Prime: **% versus **% for respondents in the highest socio-professional category. For Canal+, the opposite ...

3 Market structure

3.1 Most video-on-demand consumption is via television

According to the Center National du Cinéma et de l'Image Animée**.*% of French people say they watch video-on-demand films and series on television, compared with only **% on their computer and **% on their cell phone.

Breakdown of paid video-on-demand consumption France, ****, in Source: ****

This trend is being used by TV producers marketing Smart TVs integrating VOD services: for example, Filmo TV is available on Samsung, LG and Philips smart TVs.

3.2 Players in the French video-on-demand market

In France, some sixty players share the video-on-demand market, * times more than in **** according to the Center National du Cinéma et de l'Image Animée:

Box operators generally offer VOD: this is the case for Orange, SFR, Free and Bouygues. In addition, other players linked to television or the Internet are active on the market, such as Vidéo Futur with its box offer for viewing films and series on demand, as well as the operator Canal+ with its Canal Play service (***), as well as FilmoTV, GulliMax and TFOUMax. With regard to the new, highly coveted digital SVOD model, the main market players are Netflix (***) and Amazon, which recently entered the market and is now the main outsider.

Breakdown of subscription video-on-demand platforms France, ****, in Source: ****

As the chart below, proposed by Statista, shows, Netflix is the most solicited VOD service in France, just ahead of Amazon Video and Canal Play, with more than half of respondents saying they had solicited Netflix in the last ** months.

Which of the following video-on-demand providers have you solicited as a paying customer in the last ** months? France, ****, in % Source: ****

According to figures from Center National du Cinéma et de l'Image Animéenetflix ...

3.3 Distribution of VoD platforms: the key role of ISPs

According to the Center National du Cinéma et de l'Image Animéetelevision is the primary mode of consumption for video on demand, internet service providers are among the leading distributors of VoD platforms, with a **% share of the distribution market in ****. ISPs market these offerings via "triple and quadruple play " offers. Amazon, however, sees its platform as a "loss-leader" to its online retail business, and does not attempt to market the product via ISPs.

This central role for ISPs is explained by the fact that only *% of French households have a cable OTT box (***), whereas **% have an Internet box, according to the same source.

Breakdown of VOD services by distribution mode France, ****, in Source: ****

4 Offer analysis

4.1 Price is decisive in the purchasing decision

Price is a major component of the video-on-demand market in France: according to a survey conducted by the CNCsurvey, **% of French people believe that what would encourage them to use pay-per-view video-on-demand services more regularly would be "to lower the price of the films and series available ". This is the most important request of all the possible choices, showing that the price factor is decisive in the decision to buy a video-on-demand subscription in France.

Which of the following propositions would most encourage you to use paid video-on-demand services more regularly? France, ****, in Source: ****

However, according to the Centre National du Cinéma et de l'Image Animéevideo-on-demand services are offered at lower prices than pay-TV, with an average price of around €**.

Breakdown of active video-on-demand services France, ****, in Source: ****

Offers at €* are generally linked to thematic or niche services such as youth, documentary or manga offerings, while more expensive offers approaching €** are linked to generalist services such as Canal Play, Netflix and SFR Play.

In addition to the subscription price, service prices vary according to the number of screens that will be used to view the content: according to the same source, Netflix offers higher prices the more screens can ...

4.2 Replay services dominate

According to european Audiovisual Observatoryin ****, the video-on-demand offer in France was dominated by TV Replay services with *** platforms, followed by film, sports and children's services.

Number of legal video-on-demand services France, ****, in units Source: ****

For video rental, films (***), while TV programs represent less than *% of sales.

Breakdown of value sales by program type for VOD rentals France, ****, % Source: ****

In terms of titles offered for rental, films accounted for only **% of titles in ****, television represented **% and adult films grouped together the largest number of titles offered with almost **% of the supply.

Breakdown of rentals in value by program type France, ****, in Source: ****

The majority of films offered by video and film-on-demand platforms, according to the Center National du Cinéma et de l'Image Animéeare American (***).

Breakdown of films on active VOD offer France, ****, in Source: ****

4.3 Content diversification benefits platforms

Platforms are no longer content to provide users with content produced by other companies, but are themselves investing in the production of original creations. This allows them to free themselves from national legislation on broadcasting rights, and to offer exclusive content that will encourage users to choose their platform. On the other hand, even if much of this content is criticized by the very closed circles of so-called "auteur" cinema (***).

In ****, Netflix offered no fewer than *** original programs, with *** in the pipeline, for an investment of **.* billion euros, compared with * billion for Amazon Prime Video and * billion for Apple (***). According to a Goldman Sachs study, Netflix's spending on original content production could reach $**.* billion by ****. This spending is leading to substantial losses - Netflix generated negative cash flow of $* billion.

Source: ****

4.4 News

The growth of the SVOD market is attracting new entrants aiming, ultimately, to dethrone Netflix. In fact, from November ****, Apple and Disney will launch their respective platforms on the US market at very attractive prices (***).

The SVOD platform market is thus increasingly competitive. The explosion in costs seems to indicate that the model to follow in order to survive does not involve substantial margins, since, as we saw earlier, price remains a determining factor in consumer choice. As a result, many industry experts seem to believe that a price war is brewing(***), which will determine which platforms dominate the market.

5 Regulations

5.1 Current regulations

In France, the legal framework is a cornerstone of the market, since companies have to wait a certain number of months after the release of a film before adding it to the video-on-demand catalog: ** months for a paid offer and ** for a free offer. This period should be reduced to ** months for a paid offer. This should enable players to offer new releases more quickly, which is currently a weak point in video-on-demand.

6 Positioning the players

6.1 Segmentation

6.2 SVOD company website traffic in France

Web traffic of the other main SVOD sites in France France, ****-****, in thousands of visits Source: ****

- Netflix

- Prime Vido (Amazon)

- Google Play

- Filmo TV

- VideoFutur

- Canal Plus Groupe (MyCanal)

- France Télévision

- Orange Groupe

- SFR (SFR Play)

- Free (Iliad)

- TF1 Groupe

- Apple TV

- M6 Groupe

- Antenne Réunion Télévision

- Arte France

- Bfm Tv

- Bsmart Tv

- C8

- Canal + International

- Canal Plus Guyane

- Canal+Séries

- Canal+ Thématiques

- Chérie Hd

- Cineplume

- Clique Tv

- Cstar

- Edi Tv

- Eurosport

- Extension Tv

- Fcgb Training School

- France Médias Monde

- France Télévisions

- Game One

- Hdp Interactive

- Histoire

- Jeunesse Tv

- Métropole Télévision

- M6 Communication

- M6 Génération

- M6 Shop

- M6 Thématique

- Mediawan Thematics

- Monte Carlo Participation (Mcp)

- Moselle Tv

- Ocs

- Paris Première

- Planète + Crime

- Smr6 (Sté Exploitation Multiplexe R6 Smr6)

- Sté D'Edition De Canal Plus

- Sté D'Exploitation D'Un Service D'Information

- Sté Edition Programmes Thématiques (Sedi Tv)

- Sté Paneuropeenne D'Edition Et D'Exploitation De Documentaires

- Télévision Bretagne Ouest (Tebeo)

- Télévision Francaise 1

- Tfx

- Touraine Télévision

- Tv 8 Mont Blanc

- Tv Breizh

All our studies are available online in PDF format

Take a look at an example of our research on another market!

Choosing this study means :

Choosing this study means :

Access to more than 35 hours of work

Our studies are the result of over 35 hours of research and analysis. Using our studies allows you to devote more time and added value to your projects.

Benefit from 6 years' experience and over 1,500 industry reports already produced

Our expertise enables us to produce comprehensive studies in all sectors, including niche and emerging markets.

Our know-how and methodology enable us to produce reports that offer unique value for money.

Access to several thousand articles and paid-for data

Businesscoot has access to all the paid economic press as well as exclusive databases to carry out its market research (over 30,000 articles and private sources).

To enhance our research, our analysts also use web indicators (semrush, trends, etc.) to identify market trends and company strategies. (Consult our paying sources)

Guaranteed support after your purchase

A team dedicated to after-sales service, to guarantee you a high level of satisfaction. +44 238 097 0676

A digital format designed for our users

Not only do you have access to a PDF, but also to a digital version designed for our customers. This version gives you access to sources, data in Excel format and graphics. The content of the study can therefore be easily retrieved and adapted for your specific needs.

Our offers :

Our offers :

the svod market | France

- What are the figures on the size and growth of the market?

- What is driving the growth of the market and its evolution?

- What is the positioning of companies in the value chain?

- Data from several dozen databases

Pack 5 études (-25%) France

- 5 études au prix de 74 €HT par étude à choisir parmi nos 1200 titres sur le catalogue

- Conservez -25% sur les études supplémentaires achetées

- Choisissez le remboursement des crédits non consommés au terme des 12 mois (durée du pack)

Consultez notre catalogue d’études sectorielles