Summary of our market study

The gene therapy market is experiencing significant growth.

worldwide, the regenerative medicine sector, which includes gene therapy, numbered over 1,000 companies. North America leads the way with over 530 companies, followed by Europe with over 230.

The global gene therapy market is estimated at over $7 billion. It is attracting record amounts of funding. This figure is set to rise to $13 billion by 2024.

France is a historic pioneer in gene therapy

Demand for gene therapy in France

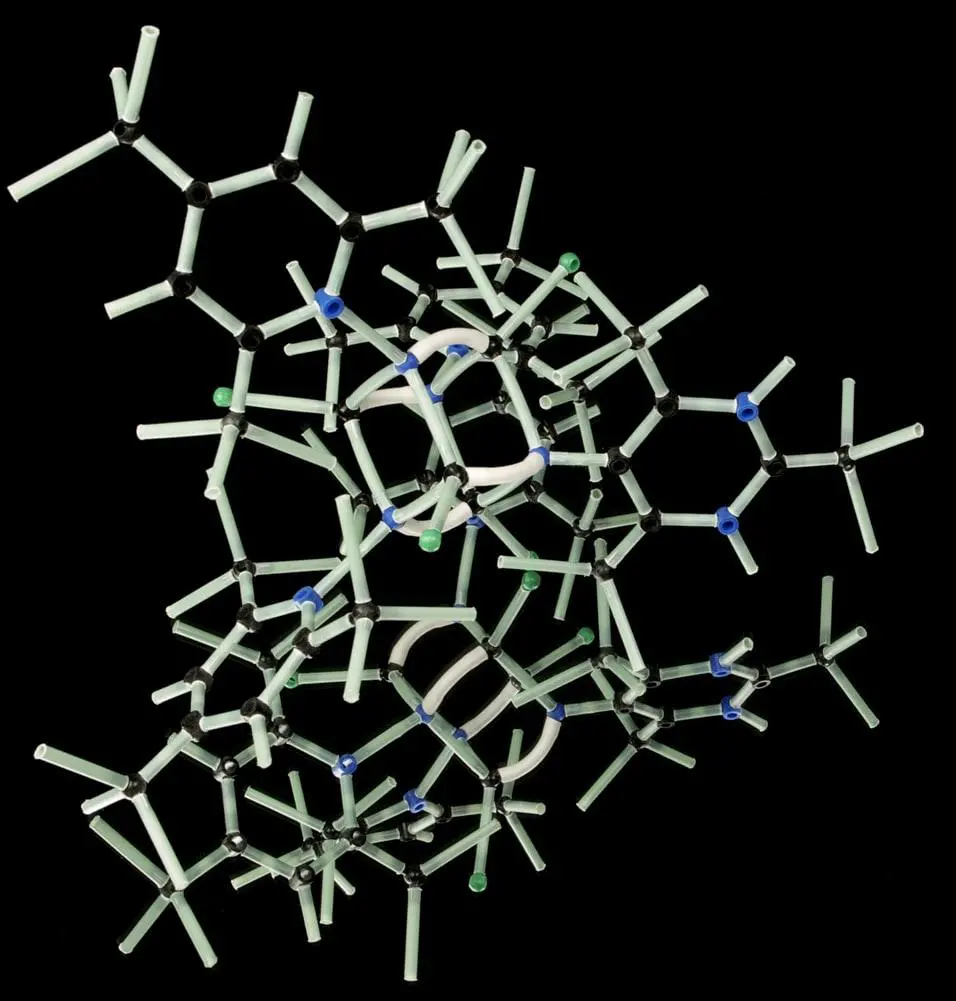

Gene therapy aims to cure rare and complex diseases by modifying genes in diseased cells.

France is seeking to become a key player in gene therapy, particularly in the field of rare diseases neglected by laboratories.

Demand for gene therapy in France is stimulated by the immense treatment potential of numerous diseases, including cystic fibrosis, which affects between five and seven thousand people, sickle cell anemia, which affects around ten thousand individuals, hemophilia, which affects seven thousand patients, muscular dystrophy, which affects three thousand people, and cancer, which registers over 380,000 cases per year.

France has more than 36 companies developing 100 programs for 84 unique gene therapy products. These companies are active in gene therapy and cell development in association with leading research centers such as Inserm, CNRS and AP-HP. More than thirty drugs in the final stages of development

High development costs and stringent safety protocols established by major regulatory bodies such as the FDA in the US and the EMA in the UK, have led to the development of more than 30 new products.and the EMA in Europe, the risks and ethical considerations associated with gene transfer remain significant, and are slowing the pace at which these therapies enter the market.

Gene therapy players

Cellectis: A spin-off from the Institut Pasteur, Cellectis focuses on targeted DNA modification. Pfizer finances and holds a stake in the company, which uses TALEN technology licensed from the University of Minnesota.

Généthon: World leader in the biomanufacturing of gene therapy drugs.

Gensight Biologics: Founded in 2012, the company focuses on eye diseases,

Établissement Français du Sang (EFS): a pioneer in the production of advanced therapeutic drugs and the world's leading producer of clinical trials

to understand this market

Detailed content of our market study

Inforamtion

Inforamtion

- Number of pages : 35 pages

- Format : Digital and PDF versions

- Last update :

Summary and extracts

Summary and extracts

1 Market overview

1.1 Definition and scope of study

The therapy gene has a simple goal, to cure rare diseases by changing genes. The principle of gene therapy consists of inserting modified genes via a vector into a diseased cell in order to modify its functioning. The reality is more complex and the processes are multiple. Its aim is to deal mainly with genetic diseases, but also with new diseases, cancers and cardiovascular diseases.

Gene therapy drugs are part of the MTI (advanced therapy medicinal products) is a medicinal product manufactured from cells, or human genetic material, to treat cellular or genetic abnormalities.

The market demands investments colossal for results that are still very random. Although a first drug based on gene therapy was first developed in China in 2003, it was not until 2011 that a Dutch company became the first to offer such a drug in the West. On the other hand, the development possibilities are very promising because research is progressing. The United States is unquestionably the market leader, with some 15 companies, each listed at several billion dollars. Indeed, in a sector where investment is crucial, the major resources deployed by the United States give it a leading position

In the area of rare diseases gene therapy is relatively new. The first trials only date back to the 1990s. For a long time, these diseases did not arouse the interest of laboratories because they affect only 5 people out of 10,000 . Today, the stakes are high and many laboratories are working on these issues. Thus, competition is becoming more structured, but still remains weak because of the numerous fields of application and ethical controls.

A former pioneer with the pastoral institute, the France is a promising country of gene therapy in Europe. Various ITMs are currently being developed by companies such as Cellectis, Genethon, Gensight and Horama in private or public production sites (AP-HP, EFS). Today, France seems to be back in the race: the State has emphasized the importance of regaining a leading position in the sector, because the country that develops an ITM, has a good chance of producing it and therefore putting it on the market. The risk for France is that it will not be able to develop its ITNs quickly enough, and that in a few years' time it will be dependent on ITNs from the United States.

Numerous research labs are therefore publicly funded . In the absence of direct economic spin-offs, there are few companies and public-private synergies are frequent. The first treatment marketed in Europe by Uniqure has an estimated cost per patient of more than one million euros. Faced with such a sum, research and human tests can only be financed by governments, or by partnerships with private companies (often foreign)

All our studies are available online in PDF format

Take a look at an example of our research on another market!

Choosing this study means :

Choosing this study means :

Access to more than 35 hours of work

Our studies are the result of over 35 hours of research and analysis. Using our studies allows you to devote more time and added value to your projects.

Benefit from 6 years' experience and over 1,500 industry reports already produced

Our expertise enables us to produce comprehensive studies in all sectors, including niche and emerging markets.

Our know-how and methodology enable us to produce reports that offer unique value for money.

Access to several thousand articles and paid-for data

Businesscoot has access to all the paid economic press as well as exclusive databases to carry out its market research (over 30,000 articles and private sources).

To enhance our research, our analysts also use web indicators (semrush, trends, etc.) to identify market trends and company strategies. (Consult our paying sources)

Guaranteed support after your purchase

A team dedicated to after-sales service, to guarantee you a high level of satisfaction. +44 238 097 0676

A digital format designed for our users

Not only do you have access to a PDF, but also to a digital version designed for our customers. This version gives you access to sources, data in Excel format and graphics. The content of the study can therefore be easily retrieved and adapted for your specific needs.

Our offers :

Our offers :

the gene therapy market | France

- What are the figures on the size and growth of the market?

- What is driving the growth of the market and its evolution?

- What is the positioning of companies in the value chain?

- Data from several dozen databases

Pack 5 études (-25%) France

- 5 études au prix de 74 €HT par étude à choisir parmi nos 1200 titres sur le catalogue

- Conservez -25% sur les études supplémentaires achetées

- Choisissez le remboursement des crédits non consommés au terme des 12 mois (durée du pack)

Consultez notre catalogue d’études sectorielles