Market overview

1.1 Presentation and definition of the sushi market in Germany

Sushi is a dish of Japanese origin based on vinegared rice (shari), and another ingredient (neta), most often raw fish (tuna, salmon etc.). The recipe is extremely popular in the world.

There are different types of sushi but the main ones are :

- Makis - roll-shaped sushi wrapped in seaweed

- Temaki - the preparation is similar to maki, in the form of a cone

- Nigiri - a slice of raw fish on an oval shaped rice ball

Sushi is mainly served in restaurants, but the current dynamism of the sector is mainly due to the popularity of this dish around the world as a star of ready-to-eat. Thus, it is increasingly distributed in supermarkets and hypermarkets (GMS) and offered for delivery.

The global market is growing rapidly, driven by the dynamism of Japanese restaurants in all regions of the world, led by Asia and North America.

In Germany, sushi was viewed with skepticism a few years ago, but today it is highly sought after and available almost everywhere. Sushi is no longer only available in high-end Japanese restaurants, but also in supermarkets. Sushi is now also an important part of the delivery service and is ensuring rapid growth in the restaurant sector. Today, there are more than 1000 official sushi shops in the country.

1.2 A dynamic global market

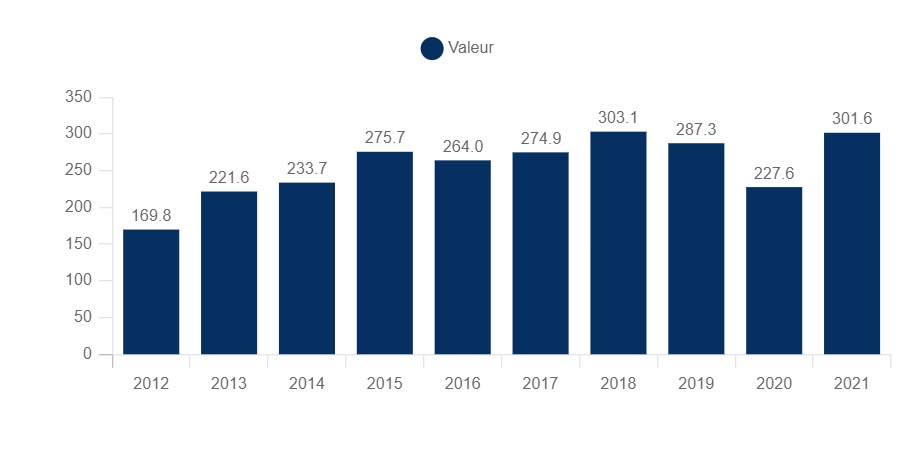

Sushi is strongly rooted in Japanese culture and this is strongly reflected in the revenues generated by fish exports in Japan. Revenues were slightly impacted by the health crisis in 2020. In general, the trend has been upward since 2012 and will reach 301 billion yen in 2021 with an increase of 78% in 9 years.

Evolution of the value of exports of fishery products

Japan, 2012 to 2021, in billion yen

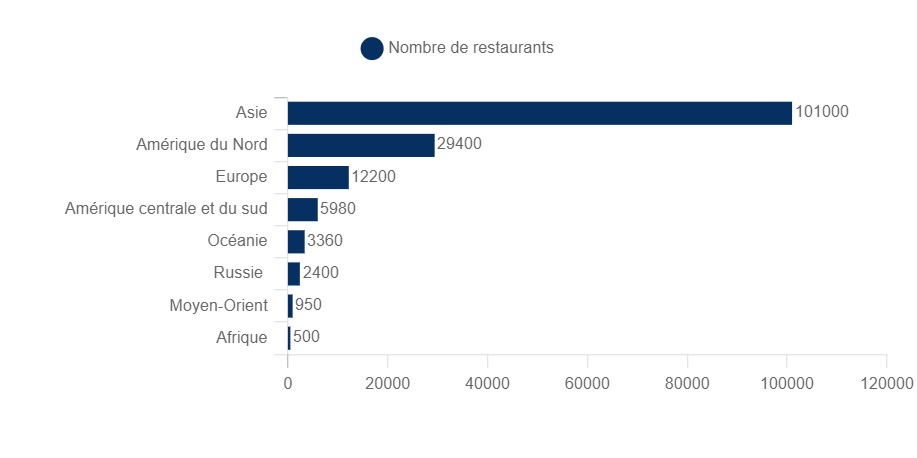

In 2019, there were approximately 156,000 Japanese restaurants outside of Japan, a growth of about +30% compared to 2017. Since 2006, the number of Japanese restaurants abroad has increased 6.5 times. Asia has seen the strongest growth (+50% in 2 years), driven by a sharp rise in average incomes making Japanese food more accessible. The number of Japanese restaurants grew by +40% in Oceania, +30% in Latin America and +20% in North America. [Asia Nikkei]

Number of Japanese restaurants by geographic area

World, 2019

1.3 German market shows resilience

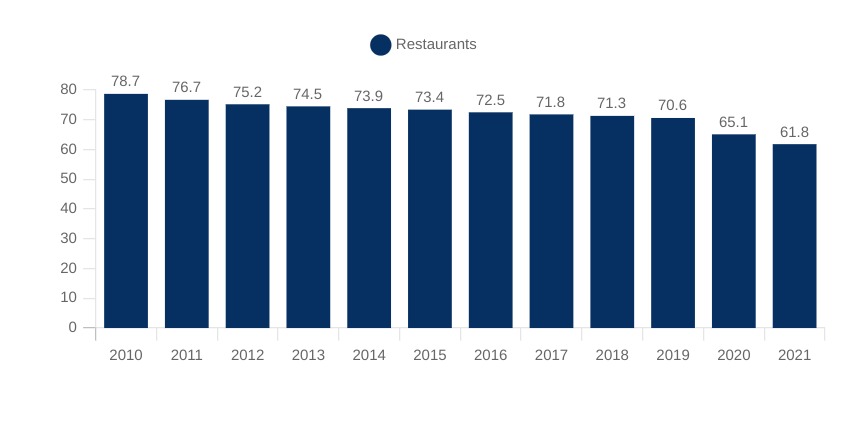

The number of restaurants subject to tax in Germany has been in sharp decline for the past decade having lost more than 7,000 restaurants between 2011 and 2019. The year 2020 marked by Covid only reinforced this finding, decreasing the number by 5,000 restaurants and reaching 65,000 restaurants.

Number of restaurants subject to tax

Germany, 2010 to 2020, in thousands

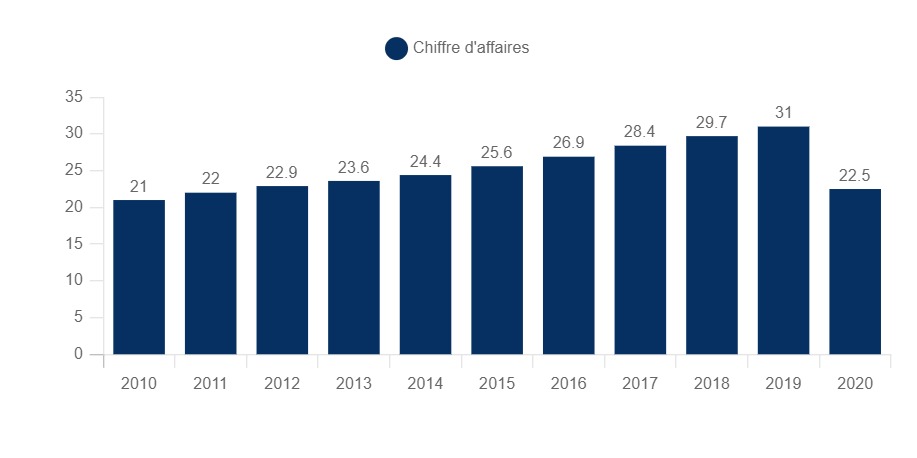

Surprisingly, the restaurant market in terms of turnover has been a steadily growing market for many years and reaching 31 billion euros in 2019. In 2020, with the consequences of the crisis, this figure has dropped to 22.5 billion euros.

Revenues of taxable catering companies

Germany, 2010 - 2018, billion euros

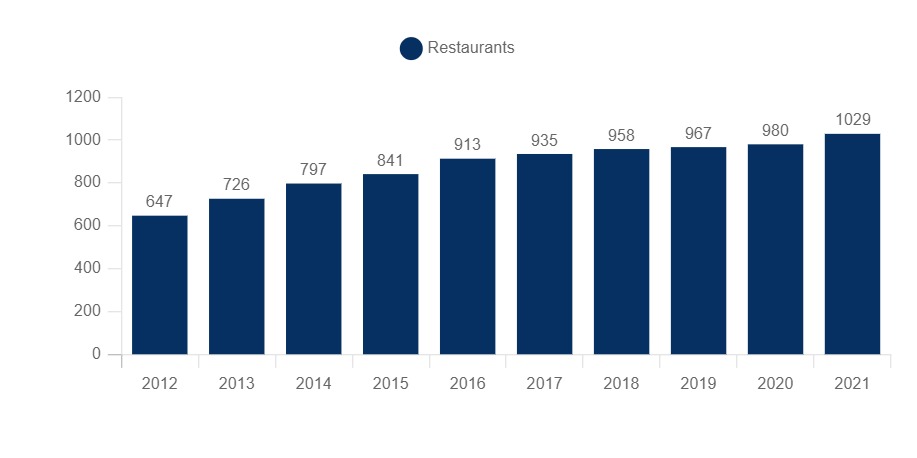

According to Food Service, which uses data from Bold Data, the number of sushi restaurants will only surpass the symbolic 1000 mark in 2021, reaching 1029 restaurants. Out of these 1,000 brands, two types of restaurants can be distinguished:

- Traditional Japanese restaurants: about 100 in Germany serving authentic Japanese cuisine;

- Non-traditional Japanese restaurants: which claim to serve Japanese cuisine but are less careful in terms of traditions and methods;

Number of sushi restaurants

Germany, 2012 to 2021, in units

To determine the size of the sushi market in Germany, we will make an estimation using the available data: first we estimate the number of Japanese restaurants in Germany in 2019 (A) which we then divide by the number of restaurants in Germany (B). We then obtain the share of Japanese restaurants in the total number of restaurants. Finally we multiply this value by the sales of German restaurants in 2019 (C). We use 2019 data because 2020 is a biased year.

- (A/B)xC = Total sales of sushi restaurants in Germany

A: 967; B: 70,619; C: 31 (€ billion)

Thus, we estimate the sushi market in Germany to be worth €424.45 million in 2019.

However, this estimate has several weaknesses: first of all the number of Japanese restaurants is between 1000 and 2000 according to the website chefswonderland, which does not allow us to be sure of the value used here (967). Secondly, this calculation only takes into account restaurants (full and limited service), and therefore omits the sushi of the mass-market, which represent a significant part of the market.

So it is quite possible that this market estimate is lower than the real size. Nevertheless, we can use this same system to estimate 2020 which reaches 338.76 million euros.

1.4 A market in transition that is adapting

A market that has managed to avoid the saturation of its French neighbor:

The German sushi market is a market that, like its European counterparts, has evolved enormously in recent years. On many points, it can be said that it has followed the developments of its French neighbor with a little delay. In the latter, sushi has experienced an explosion over 15 years until 2015 with a multiplication of sales outlets, "you opened a restaurant, and it worked every time" reports a professional of the sector for Le Monde.

The difference, however, was the saturation encountered by the French market in the following years. It does not seem that the German market was saturated. This can be explained by the fact that it was less developed at the time. We can also assume a lesser investment of investment funds, which in France were betting on the fact that sushi would become a mass product like pizza.

And in this respect, they have reinvented themselves:

The Frankfurter Rundschau reports in 2017 the evolution that the market has experienced: The sector has experienced an increase in the price of raw materials (salmon in particular). As a result, non-traditional restaurants had to fall back on a lower quality. For Ellen Kartenbeck, the managing director of the pioneer sushi-factory (a company that has been present in Germany since 1998), the price increase has prevented the realization of a large-scale coverage of the territory, and has concentrated the market in the cities.

Other observers such as Wolfgang Adlwarth, a consumer expert at GfK, instead claimed in 2017 that an increase in sushi outlets across the country could be expected in the future." We are seeing strong growth in the retail sector, especially in the last year - double-digit growth figures that clearly exceed the usual growth rates for food."

Still, in 2020 the German market was able to reinvent itself, including making sushi more affordable through its ingenious supermarket distribution, which we'll discuss later.

Analysis of the demand

2.1 A rapidly growing demand

The demand for sushi is indeed more significant among a young population. In a context of more and more individual households and a very mobile society, consumption habits have changed in favor of the "ready-to-eat" food industry. Sushi has an ideal format to meet the demand of a young population, which values fresh and good quality food, but also efficiency.

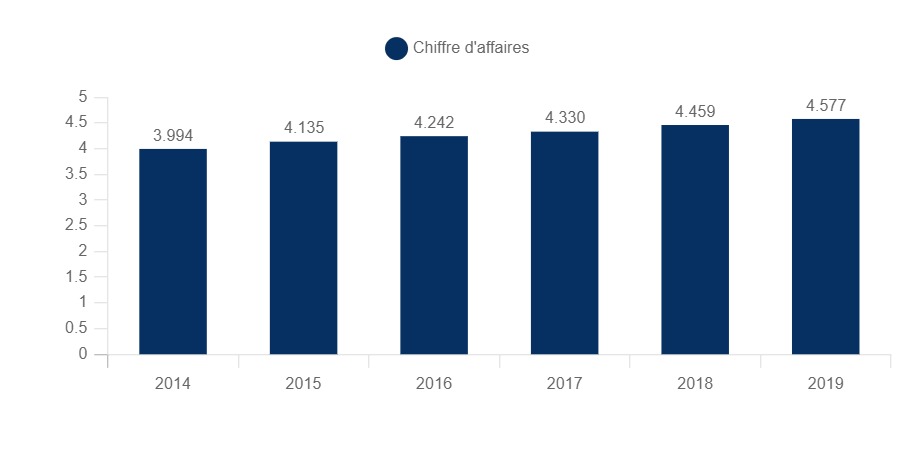

Ready-to-eat recipes

Germany, 2012-2019, US$ million

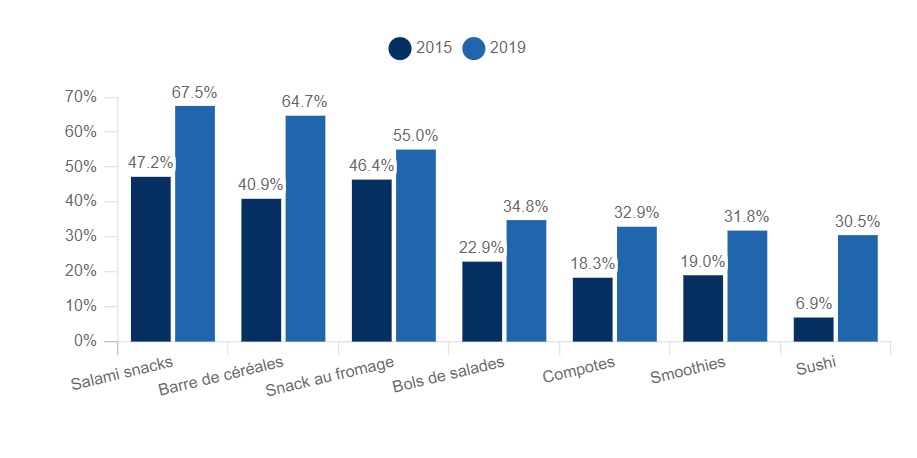

As we can see from the following graph, the penetration of sushi in the snack market is growing strongly in 2019 compared to 2020, from 6.9% to 30.5%. This is also the strongest growth (343%) among the different snacks proposed here.

Development of the market penetration of snacks

Germany, 2015 to 2019, in percent

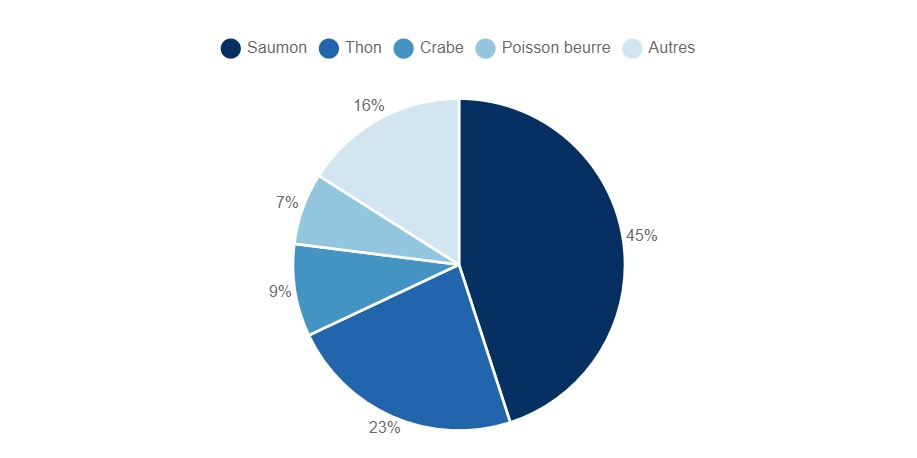

2.2 Salmon and tuna, kings of demand

In Germany, salmon is the most popular fish (45%) and consumed in sushi. Closely followed by tuna, these two fish alone account for 68% of German preferences. Although this data dates back to 2014, this preference does not seem to have particularly changed in recent years.

Preferred fish of Germans in sushi

Germany, 2016, %

Seafood Studie also reports that salmon in sushi is consumed less in Germany than in its European neighbors. This can be explained by the somewhat less developed market as mentioned earlier. Thus, in Germany, in 2016 on average a person consumes 0.02 kilograms of salmon in sushi per year, a figure that rises to 0.06 in England.

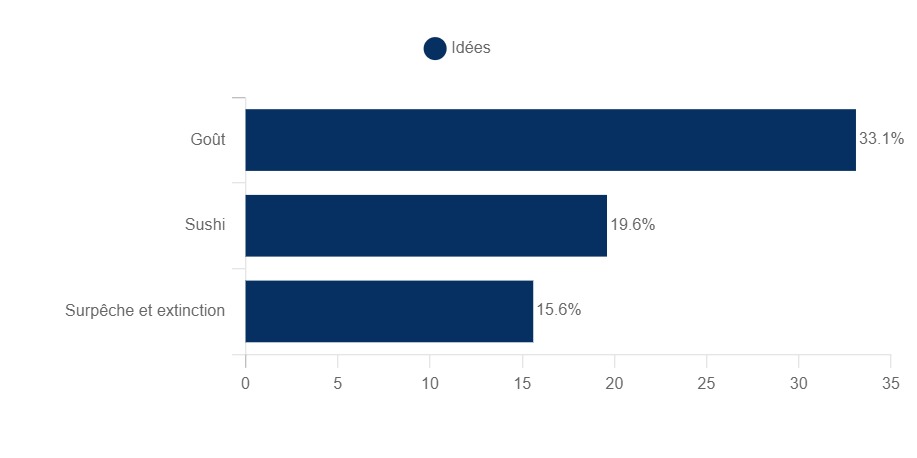

A significant proportion of tuna production is destined for sushi production, and the demand associates it with this production, as shown in the graph below. Sushi is one of the first foods that come to mind when Germans think of tuna. This demand is therefore real and these two fish have seen their fishing and their prices increase significantly in recent years.

First Thing That Comes to Mind When Thinking About Tuna

Germany, 2019, by %

2.3 The profile of the sushi consumer

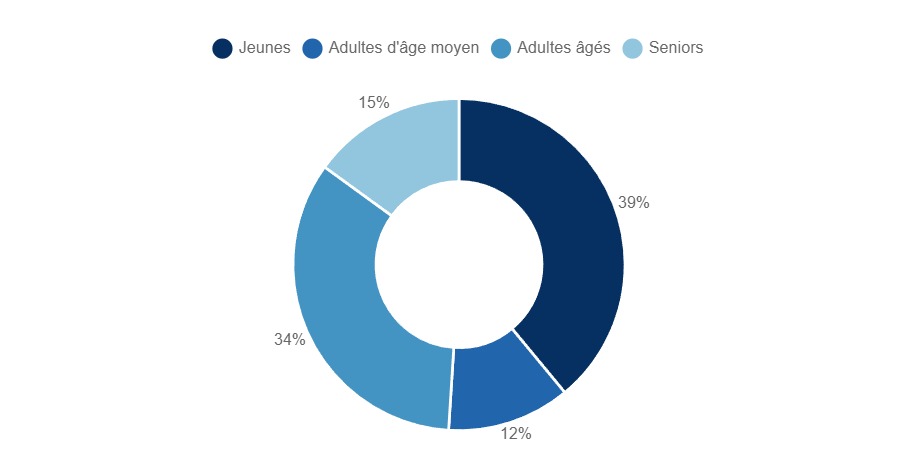

The following graph shows the different age categories according to their consumption of sushi. It is not surprising to see that young people are the biggest consumers and represent almost 39% of the total consumers. Surprisingly, middle-aged adults are the ones who consume the least sushi among the 4 categories proposed.

Age category of sushi consumers

Germany, 2019, in percent

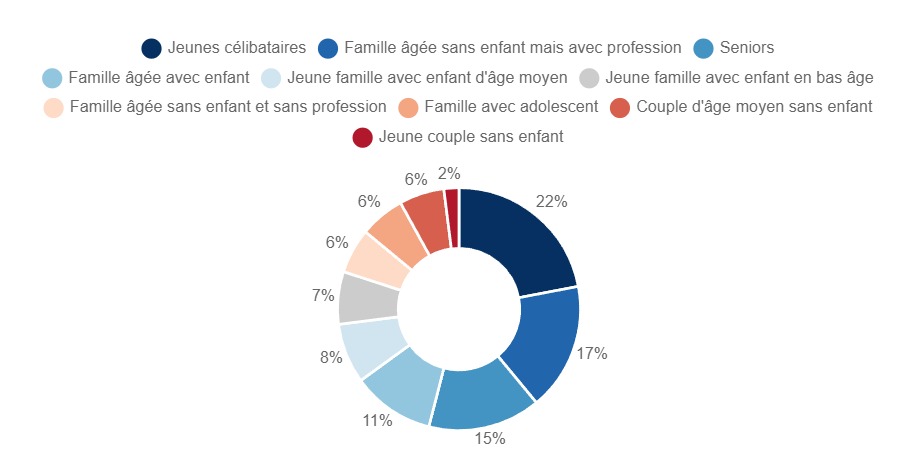

When analyzing this data in more detail, it can be seen that young singles represent more than one in five consumers.

Precise profile of sushi consumers (age/family)

Germany, 2019, in percent

2.4 A demand which turns to the GMS

In 2014 the penetration rate of sushi in German supermarkets was only 1.6%. [Seafood Study, So essen die Deutschen]

But for the past 6 years in Germany, sushi has become a staple in supermarket shelves. The target group is young people who love sushi and are looking for freshness, long shelf life and, above all, a sushi box that is more affordable than the one in restaurants.

The introduction of sushi boxes at German discounters has led to a significant price reduction of 11.8% for sushi.

In this respect, the brands that distribute in supermarkets, such as the giants, Sushi daily, Eat happy and Natsu food, focus their communication on the concerns of young consumers : respect for the environment, product quality, freshness and finally price. Thus the word "quality" is found 8 times in the story section of the natsu website, while the notion of "freshness" is found 6 times in the about us of the site of Eat happy.

Market structure

3.1 The salmon supplier segment

The production of salmon: the Norwegian quasi monopoly

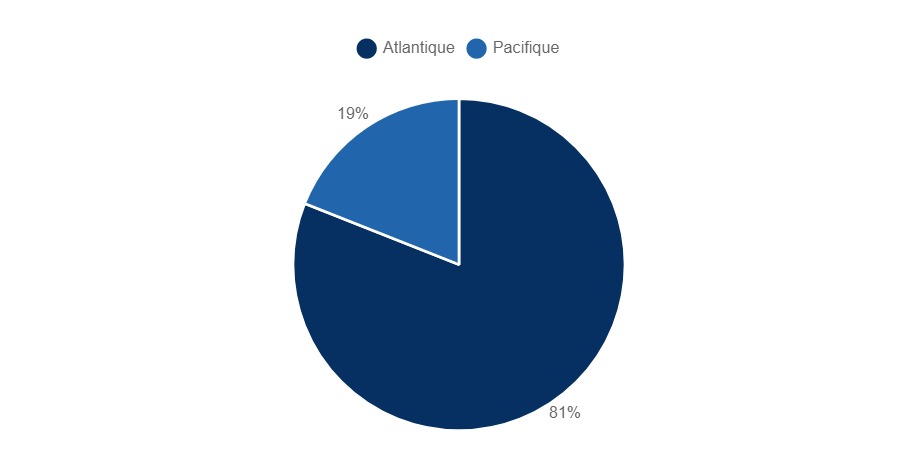

The sushi market is highly dependent on fish, the main raw material for sushi. According to the Seafood Study, So essen die Deutschen 81% of the salmon in sushi comes from the Atlantic Ocean.

Origin of salmon in sushi

Germany, 2016 %

The study adds that of these, 90% of the salmon consumed for sushi in Germany comes from Norway, specifically from salmon farming. In 2019, the site notre-planete-info reports that, while the number of salmon farming facilities has decreased by 40% in 10 years (although their size has increased), the total annual production of farmed salmon has multiplied.in contrast, total annual production of farmed salmon has increased 40-fold over the past 20 years and has increased by nearly 40% in just 3 years .(2016-2019)

The price of salmon has nevertheless increased significantly: according to indexmundi, in June 2015 a kilo of salmon was worth an average of €4.6, in June 2017 this price was €7.2. In November 2021, this price goes down to 5.7€ per kilo.

Salmon suppliers, in direct link with the market:

The leader in supermarkets, Sushi Daily buys all processed fish in Germany from Deutsche See- a supplier that guarantees fish from sustainable and socially responsible sources, which exclusively sources Norwegian fish. Intermediary players, such as Deutsche See, represent an important segment of the market in that they act as a link between the salmon producers and the food processing industry that processes them. Deutsche See is the market leader in Germany, with more than 35,000 customers in the food retail and catering industries.

3.2 Distribution channels

There are 3 main distribution channels.

- Japanese restaurants, independent (on site, take away or delivery);

- Restaurant chains offering sushi (on site, take away or delivery);

- Supermarket departments.

In 2016, 29.2% of Germans prefer traditional independent Japanese restaurants to enjoy their sushi on site or to take away. Next come sushi found in Asian all-you-can-eat restaurants, and sushi found in the shelves of hypermarkets and supermarkets. [cdh-expert]

To meet the demand for more affordable sushi, the number of outlets in supermarkets has increased. If in the first years, these sushi are denigrated because their image of freshly prepared products does not remain in the shelves. The strategy finally paid off. Indeed, to give back this image of freshness, more and more large supermarkets in the country have set up bars and stands, shop in shop, where employees prepare fresh sushi in front of customers and pack them in boxes "to go". The forerunner of this trend, Suhi daily, has nearly 700 sushi bars in supermarkets throughout Europe.

The success of theshop-in-shopconcept, such as the Rewe to go concept in the Rewe to go supermarkets, goes hand in hand with the ready-to-eat trend, which sushi is perfectly suited to.

3.3 Delivery is key to the development of the market

Still insignificant in 2014, the share of food ordered online in Germany has only increased since. The rise of delivery platforms bodes very well for the sushi market, as sushi stands out as one of the most suitable and popular dishes for delivery (see market structure). In addition, the share of the population that sees sushi as a convenient and healthy dish to eat at home is perfectly reflected in this offer

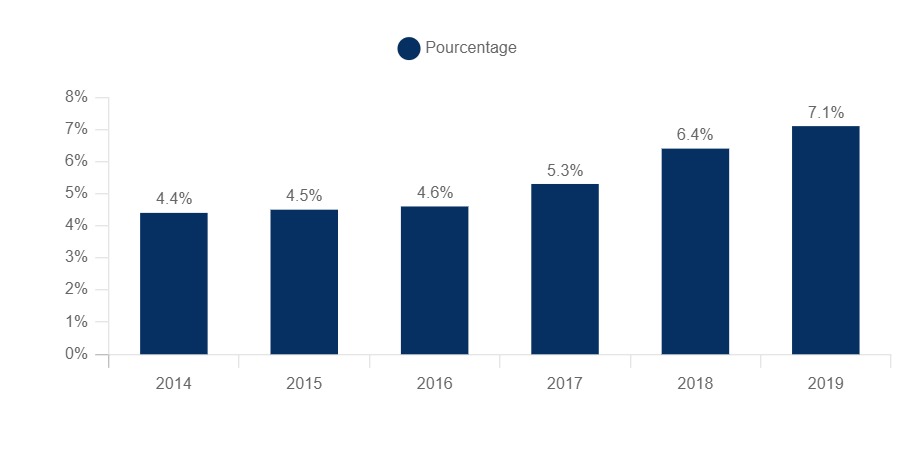

Development of the share of home-delivered food in consumption patterns (foodservice)

Germany, 2014 to 2019, in percent

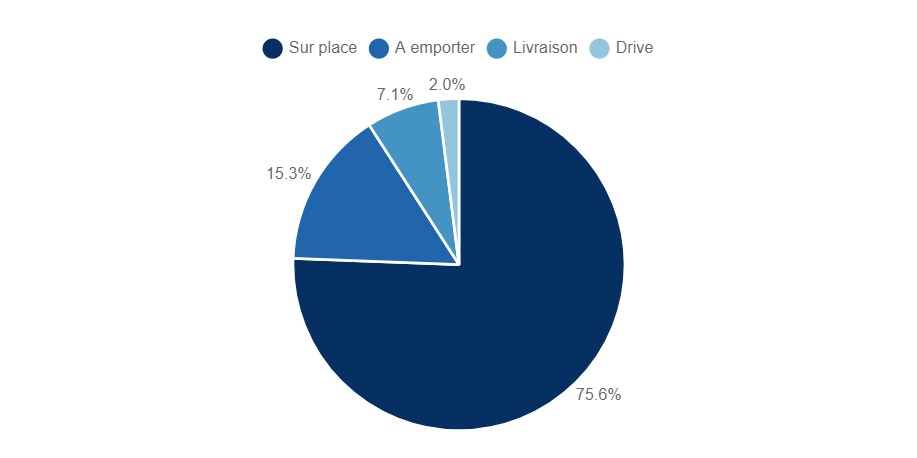

On-site consumption retains a large share of the market, 75%, but this decreases year on year to give way to home delivery, while takeaway and drive-through have not changed since 2014. [Euromonitor International] The state of play in 2019 is detailed in the graph below.

Distribution of ways of consuming in foodservice

Germany, 2019, %

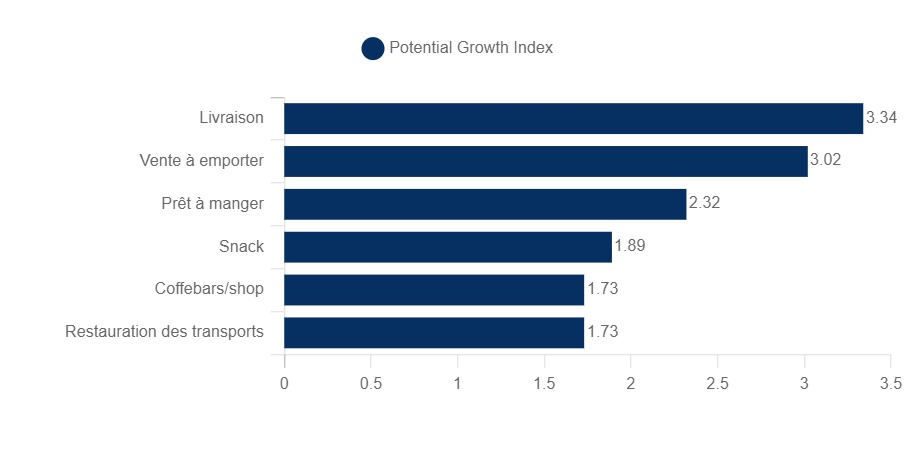

Finally, this trend is set to continue as indicated by the Dehoga Bundesverband's report on gastronomy in Germany in 2018. According to the report, the delivery sector has the best growth prospects, followed closely by the ready-to-eat sector mentioned earlier.

Most Promising Sectors

Germany, 2018, base 0, max 5, min -5

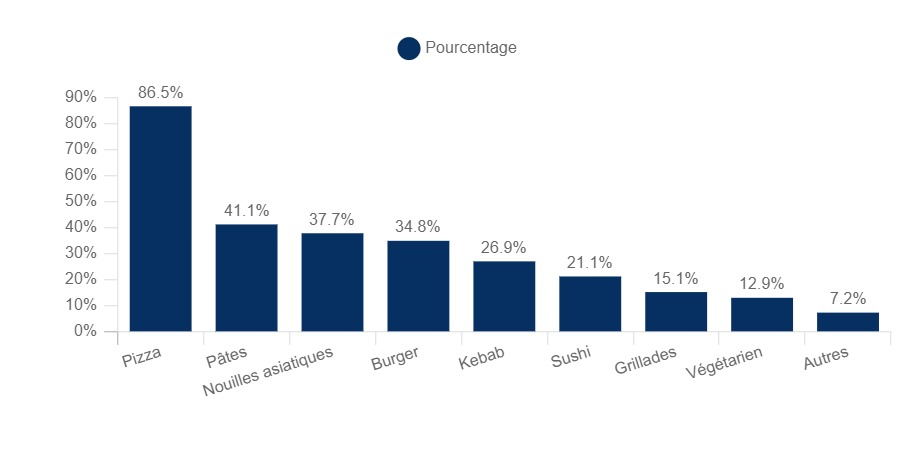

Regarding the place of sushi among the delivered products, we find it in 6th place with almost 21.1%, or more than one in five Germans (who usually order) who say they like to order it. Pizza remains unchallenged with nearly 86.5% of regular delivery customers still being big consumers.

The most ordered dishes by delivery

Germany, 2019, in percent

Analysis of the offer

4.1 Average price per type of sushi

The price of sushi varies depending on the distribution channel, the type of sushi but also the additional ingredient (neta). In addition, restaurants usually offer platters or packages with an assortment of sushi which again increases the price range at which sushi is sold.

The table below gives the order of magnitude of prices of sushi when sold by a chain or a kiosk in a supermarket (6 pieces for maki, one piece for terimaki, 8 pieces for sashimi, 2 pieces for nigiri/sushi). The prices of sushi sold in supermarkets are relatively similar.

| Type of sushi |

Price |

| Maki |

4-5€ |

| Terimaki |

5€ |

| Sashimi |

6-7€ |

| Nigiri/Sushi |

4-5€ |

The prices in non-chain restaurants are more difficult to describe. Indeed, restaurants propose different offers (all-you-can-eat, à la carte), with different prices depending on the quality of the product sold.) But we must also keep in mind that the consumer is often ready to pay more in a restaurant than in a supermarket.

4.2 The different types of sushi

The German market includes all the traditional sushi known on the European market, the demand for it is roughly similar in each country and therefore the offer is not more or less varied than in one of its neighbors.

- Makis - roll-shaped sushi wrapped in seaweed

- Temaki - similar to maki, in the form of a cone

- Nigiri - a slice of raw fish on an oval-shaped rice ball

- California Roll - maki that contains avocado, crab and cucumber (e.g., cucumber)

- Spring Roll : a spring roll

- Tataki: a slice of fish lightly cooked and marinated in vinegar

- Chirashi : a bowl of rice with an assortment of toppings

- Tempura: fried seafood or vegetables

There are also different types of fillings:

- Avocado

- sake : salmon cut in pieces

- ebi : shrimp and mayonnaise

- ninjin : finely chopped carrot

- kappa : cucumber (kyuri: Japanese cucumber)

- kampyō : dried pumpkin strips, e.g. Hokkaido pumpkin

- nattō : fermented soybeans

- okra

- Oshinko : Takuan ( pickled daikon or pickled vegetables)

- pickled radish

- tamago : omelette

- tekka : tuna

- Tofu

- ume : Umeboshi paste (Japanese plum)

Nevertheless, the offers are diversifying and we are beginning to identify an opening towards other Japanese or Asian recipes : bento, ramen or bo bun... New trends are emerging on the horizon.

Regulation

5.1 Supervision of the restoration and sale of shushis

The sale of sushi must follow the regulations for the sale of foodstuffs: in particular, Regulation (EC) No. 853/2004, which sets out the rules to be followed in terms of hygiene for foodstuffs of animal origin. [Eur-Lex] The most important point because structuring the market is that the fish must be frozen before being consumed raw.

The sale of sushi must also follow the EDI regulation on hygiene in food handling (817.024.1). This regulation defines the prerequisites for the preparation of raw fish in Germany, but also the measures to be taken.

Section 44 defines the temperature requirements for processed fish products containing cold rice acidified with rice vinegar < pH 4.5 (sushi). This temperature is 5°C.

Positioning of the actors

6.1 Segmentation

| German Companies |

Turnover |

| Eat Happy |

300 million euros (2021) |

| Natsu Shop |

3.8 billion euros (2019) / NC (2021) |

| European leaders |

Turnover |

| Sushi Daily |

496 million (2019) / NC (2021) |

| WAGAMAMA |

800 million euros (2018) / NC (2021) |

| Yo Sushi |

101.9 million (2021) |

| Planet Sushi |

63 million (2019) / NC (2021) |

| Sushi Shop |

109.3 million (2020) |

| Traditional Japanese restaurant |

Turnover |

| ZENKICHI (Berlin) |

N.C |

| Senju Restaurant (Mannheim) |

N.C |

Unternehmen

Planet Sushi Groupe

DUNS: 477542823

Umsatz:

60 Milionen € (2022)

Beschreibung:

Groupe Planet Suhi ist eine Holdinggesellschaft, die seit 2008 das Planet-Sushi-Franchise in Frankreich entwickelt.

Das Netzwerk erwirtschaftet mit 70 Restaurants ein Umsatzvolumen von 90 Mio. € (2018).

Die Gruppe wurde 2014 in ein Schutzverfahren überführt, das sie 2015 wieder verließ.

Das Unternehmen setzt stark auf Innovationen im Vergleich zu traditionellen Produkten. Planet Sushi bringt zum Beispiel 2002 die Fresh Roll oder 2007 Sushi Nutella auf den Markt.

Man kann die Produkte von Planet Sushi vor Ort essen, mitnehmen, aber auch nach Hause liefern lassen: Das Unternehmen hat 2017 sogar seinen Lieferservice über Nacht eingeführt (By Night-Angebot)

Quelle Website des Unternehmens

Externe Quellen und Nachrichten:

06/03/2023

- Planète sushi placé en liquidation judiciaire

La chaîne de restauration réalise un chiffre d'affaires de plus de 60 millions d€ 900 personnes y travaillent

Daten:

DUNS: 477542823

Juristischer Name: GROUPE PLANET SUSHI

Anschrift: 6 RUE SAULNIER , 92800 PUTEAUX

Anzahl der Mitarbeiter: Entre 20 et 49 salariés (2020)

Kapital: 6 104 780 EUR

Finanzielle Daten:

| Jahr |

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

2015 |

| Umsatz |

- |

- |

- |

- |

- |

- |

- |

| Bruttogewinnspanne (€) |

- |

- |

- |

- |

- |

- |

- |

| EBITDA (€) |

- |

- |

- |

- |

- |

- |

- |

| Betriebsgewinn (€) |

- |

- |

- |

- |

- |

- |

- |

| Nettogewinn (€) |

475 543 |

-1 463 110 |

-4 515 431 |

-3 639 564 |

-4 498 719 |

-1 284 209 |

1 763 112 |

| Umsatzwachstumsrate (%) |

- |

- |

- |

- |

- |

- |

- |

| EBITDA Margin Rate (%) |

- |

- |

- |

- |

- |

- |

- |

| Betriebsmarkenrate (%) |

- |

- |

- |

- |

- |

- |

- |

| Betriebskapital (Umsatztage) |

- |

- |

- |

- |

- |

- |

- |

| Betriebskapitalanforderungen (Umsatztage) |

- |

- |

- |

- |

- |

- |

- |

| Nettomarge (%) |

- |

- |

- |

- |

- |

- |

- |

| Mehrwert / Umsatz (%) |

- |

- |

- |

- |

- |

- |

- |

| Löhne und soziale Gebühren (€) |

- |

- |

- |

- |

- |

- |

- |

| Gehälter / Umsatz (%) |

- |

- |

- |

- |

- |

- |

- |

Manager des Unternehmens:

| Stelle |

Vorname |

Nachname |

Alter |

Linkedin-Profil |

| Président |

Si-Ben, Daoud |

NSER |

48 |

|

Natsu Shop

DUNS: N.C

Umsatz:

3.8 Milliarden € (2019)

Beschreibung:

Natsu shop, bietet Gerichte und Sushi für große Supermärkte an. Er hat seit 2018 eine physische Verkaufsstelle, aber der Schwerpunkt seiner Tätigkeit liegt auf dem Vertrieb von Sushi für große Supermärkte.

Beschreibung des Nastu store: Alle Produkte im Store werden täglich frisch in unserer Fabrik in Neuss produziert. Wie Sie vielleicht schon wissen, legen wir großen Wert auf Nachhaltigkeit. Wir achten darauf, dass unser Fisch aus nachhaltiger Zucht stammt und dass unsere Verpackungen recycelbar und teilweise biologisch abbaubar sind. Unser Besteck zum Beispiel, das wir zum kostenlosen Mitnehmen hinzufügen, wird aus PLA hergestellt. Das bedeutet, dass sie aus erneuerbaren Rohstoffen und nicht aus Erdöl hergestellt werden. Es ist uns auch wichtig, unsere regionalen Wurzeln zu bewahren, sowohl bei der Beschaffung der Rohstoffe als auch bei der Herstellung der Produkte selbst.

Daten:

DUNS: N.C

Anschrift: Berliner Allee 52 40211 Düsseldorf

Eat happy

DUNS: N.C

Umsatz:

300 Milionen € (2021)

Beschreibung:

EatHappy ist in Deutschland Marktführer für tagesfrisches, handgerolltes Sushi und original asiatische Snacks. Als Shop-in-Shop-Konzept im Lebensmitteleinzelhandel betreibt EatHappy über 400 Standorte in Deutschland. In den EatHappy-Filialen bereiten professionelle Sushi-Köche hochwertige asiatische Produkte frisch vor den Augen der Kunden zu. Dieses ultrafrische Konzept ist in Deutschland neu, hat sich aber mittlerweile etabliert und expandiert stark. In Österreich ist EatHappy seit 2015 aktiv und hat mittlerweile fast 300 Standorte (über 30 Shop-in-Shop-Konzepte und über 300 Ladenkisten) und 200 Mitarbeiter.

Daten:

DUNS: N.C

Anschrift: Kaiser-Wilhelm-Ring 13 50672 Köln

Anzahl der Mitarbeiter: 1000 ()

Sushi Daily - KellyDeli

DUNS: 522147271

Umsatz:

146.7 Milionen € (2023)

Externe Quellen und Nachrichten:

20/09/2023

- L’entreprise KellyDeli compte plus de 300 kiosques et vitrines dans les enseignes de la grande distribution sous la marque Sushi Daily

- KellyDeli diversifie une nouvelle fois son offre avec le lancement de 10 recettes de la street food coréenne.

- KellyDeli a été créée en 2009.

- KellyDeli a lancé des concepts de cuisine indienne, de street food d'Asie du Sud-Est et une gamme de produits snacking d'épicerie et de boissons.

- La gamme de cuisine coréenne est lancée sous la marque Sushi Daily.

- En 2021, la vente de produits alimentaires coréens en grande distribution a augmenté de 63%, avec un chiffre d'affaires de 11 millions d'euros.

Daten:

DUNS: 522147271

Juristischer Name: KELLYDELI

Anschrift: 29 RUE JOUBERT , 75009 PARIS 9

Anzahl der Mitarbeiter: Entre 50 et 99 salariés (2020)

Kapital: 30 000 EUR

Finanzielle Daten:

| Jahr |

2020 |

2019 |

| Umsatz |

127 585 985 |

134 472 604 |

| Bruttogewinnspanne (€) |

30 664 768 |

33 501 508 |

| EBITDA (€) |

7 396 308 |

7 719 650 |

| Betriebsgewinn (€) |

5 914 462 |

6 403 589 |

| Nettogewinn (€) |

4 076 510 |

4 193 824 |

| Umsatzwachstumsrate (%) |

-5,1 |

- |

| EBITDA Margin Rate (%) |

5,8 |

5,7 |

| Betriebsmarkenrate (%) |

4,6 |

4,8 |

| Betriebskapital (Umsatztage) |

-17,8 |

-7,9 |

| Betriebskapitalanforderungen (Umsatztage) |

-5,6 |

0,1 |

| Nettomarge (%) |

3,2 |

3,1 |

| Mehrwert / Umsatz (%) |

17,1 |

17,3 |

| Löhne und soziale Gebühren (€) |

3 652 932 |

4 162 643 |

| Gehälter / Umsatz (%) |

2,9 |

3,1 |

Manager des Unternehmens:

| Stelle |

Vorname |

Nachname |

Alter |

Linkedin-Profil |

| Président |

Silvano |

Delnegro |

55 |

|

| Directeur général |

Isabelle |

Bernardot |

46 |

|