Summary

to understand this market

Detailed content

Inforamtion

Inforamtion

- Number of pages : 30 pages

- Format : Digital and PDF versions

- Last update : 01/07/2021

Summary and extracts

Summary and extracts

1 Market overview

1.1 Presentation and definition of video on demand

The video-on-demand(VOD) market is made up of offers enabling viewers to watch a film at home without having to rent or buy a DVD. In most cases, it's a digital offering via the Internet.

In reality, video on demand refers to three types of offer:

- Access to a film/series for a limited time (rental).

- Definitive acquisition of the rights to view a film/series (purchase).

- A subscription for unlimited access to films/series in the catalog (subscription). This third offer is called SVOD (from subscription video on demand) and refers to players such as Netflix.

In the VOD market, players are all striving to offer the widest possible choice of films and series. The trend is to adapt the model from simple video-on-demand to SVOD subscriptions, offering an unlimited catalog and choice of films and series to be viewed at any time during the subscription period. Players on the French market are gearing up to compete with international players with their eye on the market, such as Netflix and Amazon Video.

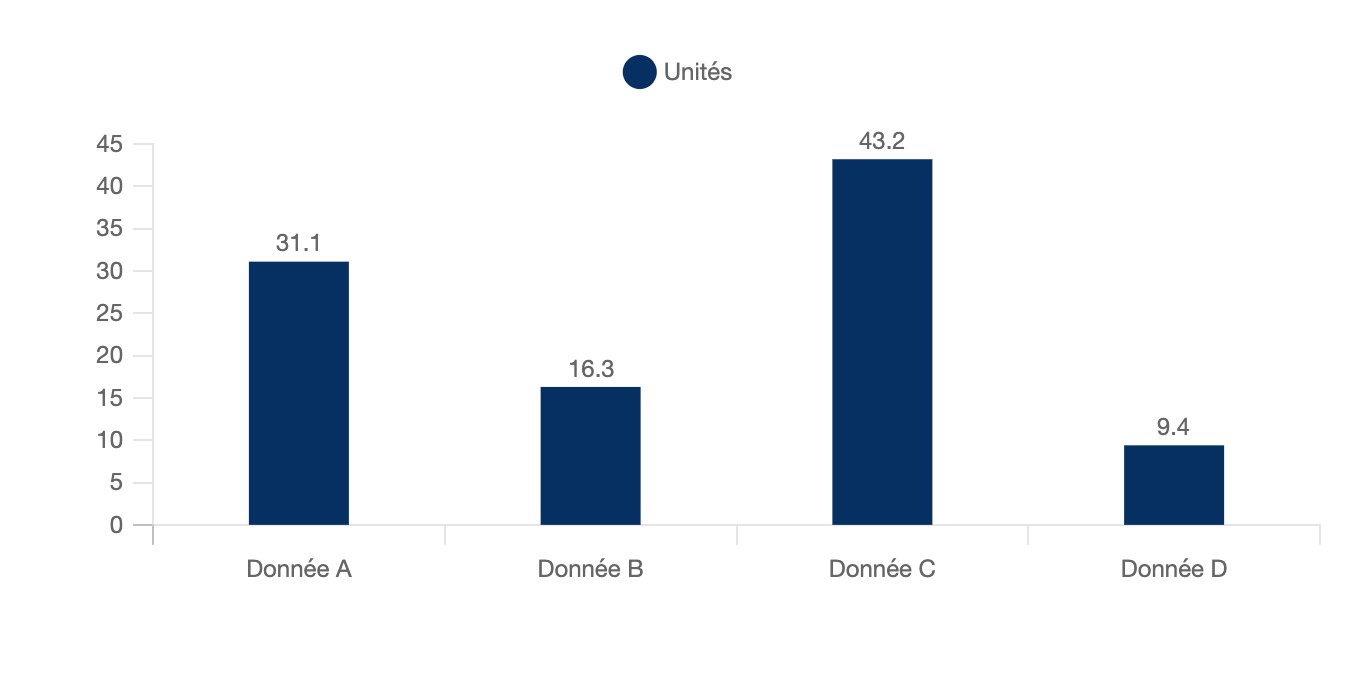

Nationality of films available on video-on-demand in France

France, year, units

Consult the study for figures and sources on the SVOD market in France

1.2 Strong growth in the global market

According to IDATE DigiWorldthe global video-on-demand market was worth ** billion euros in **** and will be worth **.* billion euros in ****. The global market is driven by subscription at nearly ** billion euros in ****, followed by digital rental and sales.

Video-on-demand market value by segment Worldwide, ****-****, in € billions Source: ****

1.3 The video-on-demand market in France is growing

According to the Center National du Cinéma et de l'Image Animéethe overall video-on-demand market in France has grown rapidly in recent years. It rose from *** million euros in **** to *** million euros in ****. Even so, the economic weight of video-on-demand in France remains limited compared with the weight of linear ...

2 Demand analysis

2.1 Overall consumption of films and videos online on the rise in France

According to iFOPthe overall consumption of films and videos legally in France increased between **** and ****, rising from **% of French people in **** to **% in ****.

Overall consumption of online videos and films France, ****-****, in % Source: ****

2.2 The French are spending more and more on film and video-on-demand services

According to IVFconsumer spending on video-on-demand in France rose sharply between **** and ****, from **.* million euros to ***.* million euros. By ****, this spending had fallen slightly to ***.* million euros.

Consumer spending on VOD France, ****-****, in millions of euros Source: ****

However, the increase in French consumer spending on films on demand in France ...

2.3 Demand for video-on-demand is very high among the under-40s

The video-on-demand market in France is driven by the under-**s segment. According to CREDOCwhile almost **% of people under ** have a subscription allowing them to watch series and films on an unlimited basis in France, only **% of **-** year-olds and *% of over-**s have one.

Proportion of individuals with a subscription ...

2.4 More and more French people are equipped with Internet access at home, which is driving the emergence of video-on-demand platforms

According to a survey conducted by CREDOCthe rate of home Internet access in France has risen from **% in **** to **% in **** (***).

Rate of home Internet access France, ****-****, in Source: ****

2.5 The share of illegal streaming in France is high, hindering the development of VOD platforms in France

According to the SNEPonly **% of consumers of streaming services are exclusively legal in France. There is therefore a significant shortfall for the remaining **% of consumers who use illegal streaming to watch films and series. France is also poorly positioned compared to the UK and Sweden in Europe.

Share of exclusively legal ...

2.6 France's favorite VOD companies

The graph below is based on OpinionWay's survey of French people's favorite brands in March ****. These are respondents' answers to the question "Do you like this or that VOD company?" for each brand, with the percentage corresponding to the proportion of respondents who answered "yes".

Netflix is the French people's favorite ...

3 Market structure

3.1 Most video-on-demand consumption is via television

According to the Center National du Cinéma et de l'Image Animée**.*% of French people say they watch video-on-demand films and series on television, compared with only **% on their computer and **% on their cell phone.

Breakdown of paid video-on-demand consumption France, ****, in Source: ****

This trend is being used by TV ...

3.2 Players in the French video-on-demand market

In France, some sixty players share the video-on-demand market, * times more than in **** according to the Center National du Cinéma et de l'Image Animée:

Box operators generally offer VOD: this is the case for Orange, SFR, Free and Bouygues. In addition, other players linked to television or the Internet ...

3.3 Distribution of VoD platforms: the key role of ISPs

According to the Center National du Cinéma et de l'Image Animéetelevision is the primary mode of consumption for video on demand, internet service providers are among the leading distributors of VoD platforms, with a **% share of the distribution market in ****. ISPs market these offerings via "triple and quadruple play ...

4 Offer analysis

4.1 Price is decisive in the purchasing decision

Price is a major component of the video-on-demand market in France: according to a survey conducted by the CNCsurvey, **% of French people believe that what would encourage them to use pay-per-view video-on-demand services more regularly would be "to lower the price of the films and series available ". This is the most ...

4.2 Replay services dominate

According to european Audiovisual Observatoryin ****, the video-on-demand offer in France was dominated by TV Replay services with *** platforms, followed by film, sports and children's services.

Number of legal video-on-demand services France, ****, in units Source: ****

For video rental, films (***), while TV programs represent less than *% of sales.

Breakdown of value sales by ...

4.3 Content diversification benefits platforms

Platforms are no longer content to provide users with content produced by other companies, but are themselves investing in the production of original creations. This allows them to free themselves from national legislation on broadcasting rights, and to offer exclusive content that will encourage users to choose their platform. On the ...

4.4 News

The growth of the SVOD market is attracting new entrants aiming, ultimately, to dethrone Netflix. In fact, from November ****, Apple and Disney will launch their respective platforms on the US market at very attractive prices (***).

The SVOD platform market is thus increasingly competitive. The explosion in costs seems to indicate that ...

5 Regulations

5.1 Current regulations

In France, the legal framework is a cornerstone of the market, since companies have to wait a certain number of months after the release of a film before adding it to the video-on-demand catalog: ** months for a paid offer and ** for a free offer. This period should be reduced to ** months ...

6 Positioning the players

6.1 Segmentation

6.2 SVOD company website traffic in France

Web traffic of the other main SVOD sites in France France, ****-****, in thousands of visits Source: ****

List of charts

List of charts

- Nationality of films available on video on demand in France

- Video-on-demand market value by segment

- SVOD market

- Number of films on active VOD offer

- Global consumption of online videos and films

All our studies are available online in PDF format

Take a look at an example of our research on another market!

Latest news

Companies quoted in this study

This study contains a complete overview of the companies in the market, with the latest figures and news for each company. :

Choosing this study means :

Choosing this study means :

Access to more than 35 hours of work

Our studies are the result of over 35 hours of research and analysis. Using our studies allows you to devote more time and added value to your projects.

Benefit from 6 years' experience and over 1,500 industry reports already produced

Our expertise enables us to produce comprehensive studies in all sectors, including niche and emerging markets.

Our know-how and methodology enable us to produce reports that offer unique value for money.

Access to several thousand articles and paid-for data

Businesscoot has access to all the paid economic press as well as exclusive databases to carry out its market research (over 30,000 articles and private sources).

To enhance our research, our analysts also use web indicators (semrush, trends, etc.) to identify market trends and company strategies. (Consult our paying sources)

Guaranteed support after your purchase

A team dedicated to after-sales service, to guarantee you a high level of satisfaction. +44 238 097 0676

A digital format designed for our users

Not only do you have access to a PDF, but also to a digital version designed for our customers. This version gives you access to sources, data in Excel format and graphics. The content of the study can therefore be easily retrieved and adapted for your specific needs.

Our offers :

Our offers :

the svod market | France

- What are the figures on the size and growth of the market?

- What is driving the growth of the market and its evolution?

- What is the positioning of companies in the value chain?

- Data from several dozen databases

Pack 5 études (-15%) France

- 5 études au prix de 75,6€HT par étude à choisir parmi nos 800 titres sur le catalogue France pendant 12 mois

- Conservez -15% sur les études supplémentaires achetées

- Choisissez le remboursement des crédits non consommés au terme des 12 mois (durée du pack)

Consultez les conditions du pack et de remboursement des crédits non consommés.

TF1 shifts its business model to on-demand television - 21/12/2023

TF1 shifts its business model to on-demand television - 21/12/2023

Canal+ put into orbit to make acquisitions and continue to grow - 14/12/2023

Canal+ put into orbit to make acquisitions and continue to grow - 14/12/2023

Orange fined 26 million euros - 09/11/2023

Orange fined 26 million euros - 09/11/2023

With five million fiber subscribers, Free responds to criticism from the regulator - 18/07/2023

With five million fiber subscribers, Free responds to criticism from the regulator - 18/07/2023