Summary

The essential oils market has continued its upward trajectory since 2020, with France playing a pivotal role as the world's third-largest exporter and second-largest importer. In 2020, despite a 1.3% drop in growth due to the pandemic, the French market recovered in the first half of 2021, with a 7.7% rise in essential oil manufacturing sales. The global market, valued at $21.8 billion in 2022, is expected to grow at a CAGR of 7.9% from 2023 to 2030. Dominated by demand for sweet orange oil, which makes up almost a quarter of the global market, the industry has seen a surge in the spa and relaxation sector, which now accounts for 40.17% of the market. Internationally, India and the United States are the main exporters, capitalizing on their large production of field mint, peppermint, lemongrass and sweet orange. The European market, led by Germany and France, accounts for a significant share of worldwide sales, with both countries experiencing significant growth in essential oil sales.

France has seen a steady increase in the number of companies and employees involved in the manufacture and cultivation of perfumed, aromatic and medicinal plants (PPAM), reflecting the growth potential of this sector. The organic trend continues to influence the market, with a notable increase in certified organic PPAM farms meeting the growing demand for organic essential oils. Regulations remain strict, however, with varying rules depending on the intended use of the oils, guaranteeing consumer safety and quality control.

The craze for natural essences: voracious demand for essential oils in France

When it comes to natural products, essential oils have carved out a special place for themselves in France, reflecting a flourishing market underpinned by a passion for organic, artisanal solutions. These aromatic oils, praised for their multiple uses ranging from culinary applications to cosmetic and wellness benefits, have seen their demand on the French market reach new heights, with steady growth evident across the market as a whole. A glance at demand for essential oils in France reveals a strong penchant for natural, holistic self-care measures, with an astonishing 80-85% of those surveyed favoring these oils as a means of natural self-care. This trend is further reinforced by a consistent pattern of use, with almost two-thirds of users using essential oils more than once a month, signifying a deep-rooted incorporation of these essences into daily routines. To overcome barriers to use, including lack of time for training and fear of incorrect application, the market has responded with hands-on workshops and digital learning platforms, meeting the demand for knowledge and safe applications.

The appeal of essential oils extends to all genders, although women are the main consumers - they account for around 80-85% of the consumer base - reflecting a wider market trend where women tend to be the main purchasers of wellness products. This market is therefore not only significant in terms of size, but also well positioned to respond to a gender-specific approach to marketing and product development. Geographically, French essential oil production makes a significant contribution to market demand, with regions such as PACA, Île-de-France and Occitanie leading the way. These regions grow aromatic plants in abundance, with some 30,000 to 35,000 hectares devoted to lavender and lavandin, which speaks volumes about local appreciation and demand for these natural scents.

Distribution of essential oils in France is mainly through specialist outlets, such as pharmacies, parapharmacies and organic stores. Despite the many options available online, pharmacies and parapharmacies emerge as the primary point of sale, underlining the relationship of trust between consumers and healthcare providers in the context of purchasing decisions for wellness products. Finally, in recognition of the prodigious demand for essential oils, it is worth mentioning the growing quest for organic certification among French producers. This indicates a market sensitive to consumer awareness of health and environmental sustainability, with certified organic plant acreage increasing at a remarkable annual rate, and bringing organic essential oils

In the diverse and dynamic essential oils market, companies are jostling for position, leveraging their unique attributes and specialties to appeal to different consumer segments. From gigantic global corporations to artisanal distilleries with a sense of tradition, the market is driven by the character and vision of its players. Here's a look at some of the notable entities contributing to the dynamism of the essential oils sphere.

- Aroma-zone is a beacon for the do-it-yourselfer and connoisseur of natural products. With an extensive catalog featuring an impressive range of organic essential oils, it meets the growing demand for purity and sustainability. The brand has built up a loyal customer base thanks to its commitment to quality and transparency, offering insight into the origins and properties of its oils.

- Dr Valnet occupies a prominent place in the therapeutic field, a venerable name synonymous with the health-giving virtues of essential oils. A pioneer in the aromatherapy landscape, this company offers a range of scientifically formulated products for well-being, embodying the legacy of its founder who was a forerunner in harnessing the medicinal prowess of botanical extracts.

- Pranarom marks its dominance with a multiplicity of pure, organic essential oils aimed at both health-conscious individuals and passionate teachers of aromatherapy. With an approach based on research and efficacy, Pranarom not only supplies oils but also educates in their judicious use, fostering the creation of a community well-versed in the art of aromatherapy.

- Florane, a relative newcomer to the scene, has quickly made its mark in the organic personal care field with a range of facial products enriched with organic essential oils. Targeting the beauty-conscious with a penchant for organic compositions, Florane's emergence means that the market is evolving towards more specialized, niche offerings. While these companies are just a few key fragments in a kaleidoscopic industry, their positioning reflects the wider spectrum of the essential oils market.

Each player, with its specific focus - be it consumer lifestyle enhancement, health benefits, organic alignment or educational influence - embellishes the market structure with its diversity and depth. as regulations evolve and consumer preferences change, these and many other companies are likely to adapt and innovate, so that the essence of this market remains as dynamic and powerful as the oils they distill.

to understand this market

Detailed content

Inforamtion

Inforamtion

- Number of pages : 30 pages

- Format : Digital and PDF versions

- Last update : 26/04/2023

Summary and extracts

Summary and extracts

1 Market overview

1.1 Presentation and definition of the essential oils market

Essential oils are defined as complex mixtures of natural, volatile and odorous chemical substances contained in all or part of an aromatic plant. Traditionally, these essential oils are extracted by hydro-distillation or cold pressing. Both processes are long and require a certain know-how.

The plants and flowers intended for the production of essential oils are numerous, but we can note as an example the lavender, rosewood, eucalyptus, ylang-ylang, chamomile, tea tree, geranium sweet orange is the most produced essential oil in the world, representing almost a quarter of the market in 2022. It should be noted that the content of essential oils in plants is generally very low, ranging from 0.01% (eg rose petals) to 1% (eg cloves). Thus, to obtain one kilo of pure essential oil, it is necessary to distill between 4 and 7 tons of rose petals, 115 to 200 kg of lavender, or 1 ton of orange blossoms .

There are several players on the market, often with very distinct positions:

- Producers of raw plant materials (flowers and plants for the production of essential oils).

- The producers of essential oils who distill or cold press the flowers and plants. They vary in size, from craftsmen to large industrial groups.

- The consumer companies of essential oils from various industries (cosmetics, pharmaceuticals, food).

- Regulatory and control bodies that check the quality and harmfulness of oils and certify them.

France is a major player in the global market of essential oils since in 2022, it ranked third among exporters and second among importers of the market in value. Notably specialized in the production of lavender essential oil, the French market shows increasing production levels and solid demand, with its 30,000 hectares of lavender and lavandin cultivation in 2020, up 7% compared to 2019. In the first half of 2021, France experienced a 7.7% growth in essential oil manufacturing sales compared to 2020, showing that the dynamism of this market is well present.

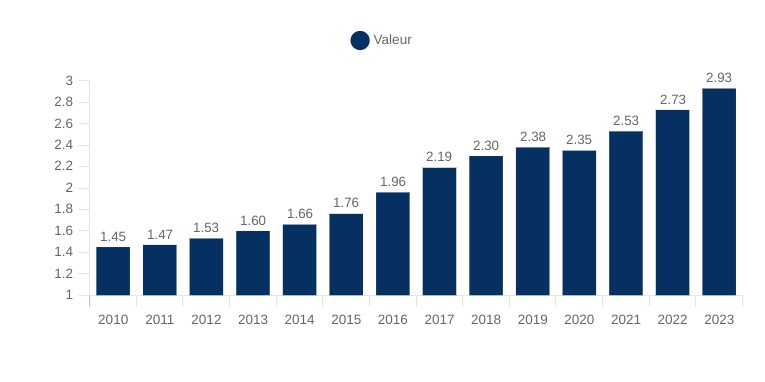

Evolution of the turnover before tax of the NAF code 20.53Z - "Manufacture of essential oils"

France, 2010-2022, in billions of euros

The main outlets for the manufacture of essential oils are thefood industry, perfumes, cosmetics,aromatherapy and cleaning products. Essential oils can be used in different ways: by diffusion, by inhalation, by massage, or in cooking. The world market for essential oils is booming, driven by the trend of organic, natural and homemade products, or by the trend of aromatherapy.

1.2 The growing global market

Global Market:

The global market for essential oils is growing rapidly. It is estimated in **** at $**.* billion according to Grand View Research and is expected to grow at a compound annual rate of *.*% between **** and ****. This results in the following forecast:

Global essential oils market World, ****-****, in billion dollars Source: ...

1.3 France, a major player in the world

NAF code **.**Z "Manufacture of essential oilsEssential oils belong to NAF code **.**Z "Manufacture of essential oils", this NAF code includes the manufacture of essences of natural aromatic products, the manufacture of resinoids (***), the manufacture of compositions based on odoriferous products for perfumery or food.

The turnover HT of the production ...

1.4 Impact covid : essential oils, the new remedy ? No, but...

Considered as a remedy against the COVID-**, essential oils have been talked about during the health crisis, with many French people who wanted to use them, wrongly, in order to clean the indoor air in the house or in cars for example. This information was nevertheless quickly denied by the media, ...

2 Analysis of the demand

2.1 Consumers and essential oils

To understand who were the consumers of essential oils, the website plante-essentielle.com conducted a survey in **** with *** respondents to profile the types of users of essential oils in France. This survey concerns only individual users of essential oils and not industrialists for food or cosmetics.

Profile of consumers

We note ...

2.2 Aromatherapy, a seductive use of essential oils

The previous survey showed that the popularity of essential oils came from the desire to treat oneself naturally, this practice corresponds to aromatherapy, which has been democratized in France in recent years [***]. This method consists of the use of essential oils for medicinal purposes.

According to a Harris Interactive study in ...

2.3 The organic and DIY trend

DIY, Do It Yourself, is a trend that has been taking hold for a while and that has been able to take its mark with the confinement since it has given the French time to discover this activity. Thus in ****, **% of French people would have used at least one DIY activity ...

3 Market structure

3.1 Production and transformation of essential oils

Essential oils come from the production of aromatic plants. These plants can be used in three ways: in aromatic solutions (***)

Value chain of the essential oils market : Production - Processing - Consumption

Source: ****

The essential oil manufacturing market in France is very fragmented and artisanal. This fragmentation of the market is ...

3.2 French production on the rise

NAF code **.**Z "Manufacture of essential oils"As a reminder, essential oils belong to NAF code **.**Z "Manufacture of essential oils".

The number of companies manufacturing essential oils has not changed much in recent years. In ****, *** essential oil manufacturing companies are registered.

Evolution of the number of companies in NAF code ...

3.3 Distribution dominated by specialized channels

In this part, we are interested exclusively in the distribution of essential oils to the general public, and therefore the sale to the final consumer through different distribution channels. The main distribution channel is pharmacies and parapharmacies, followed by the Internet and organic stores according to the file on the market ...

3.4 A market marked by a plurality of players

Players in pharmacies and parapharmacies:

Unit essential oils market share in pharmacies and parapharmacies France, ****, in percentage Source: ****

There is a wide variety of companies in the essential oils sector, and the distribution channel of pharmacies and parapharmacies is no exception. In the sale of pure essential oils, there are predominant ...

4 Analysis of the offer

4.1 The different essential oils and the different uses

Properties of essential oils:

The chemotype is an identity card that allows to differentiate essential oils extracted from the same plant species. Each chemotype allows to identify the characteristics and powers of each essence. It is an essential notion to define the impact and the virtues of an essential oil. It ...

4.2 Prices vary greatly from one essential oil to another

The expert site Ooreka has done an analysis of the average price of essential oils on the market:

Source: ****

We are interested in the average prices of the essential oils most sold in pharmacies in order to highlight the strong disparities. The prices are very different from one EO to another, ...

4.3 A demand for organic products

The consumption of organic products is increasing as seen in *.* and essential oils are no exception, which is why we can observe an increase in the number of certified organic PPAM farms in order to meet the demand:

Evolution of the surface area and the number of certified organic PPAM farms France, ...

4.4 Training in aromatherapy

There is a growing demand for training in aromatherapy, whether for personal use or for professional retraining, such as in reflexology, kinesiology, aromatherapy consulting... There are many jobs related to aromatherapy and essential oils.

Cost of training:It is possible to train face-to-face, online or by reading.The price will depend ...

5 Regulation

5.1 One use, one regulation

The regulations applicable to essential oils depend on the use recommended, some have even been placed in dangerous substances, see here.

Active substances of medicines : - According to the public health code, herbal medicines are exempt from marketing authorization. They are subject to a registration obligation with the National Agency for ...

6 Positioning of the actors

6.1 Segmentation

- Puressentiel France

- Pranarôm (Inula Groupe)

- Mane

- Robertet

- H. Reynaud et Fils

- Dr Valnet Cosbionat

- Florame

- Aroma Zone

- Helpac - Distillerie De Saint Hilaire

- Café michel - Terra Etica

- LABORATOIRES OMEGA PHARMA - Phytosun arôms

- Naturactive (Pierre Fabre)

- DRT

- Biolandes

- IFF International Flavours and Flagrances

- Firmenich

- Symrise

- Givaudan

- Herbarom Groupe

- Alban Muller

- La Distillerie Bleu Provence

- Herbes et Traditions

- Le Comptoir Aroma

- Florihana

- Bioflore

- Biofloral

List of charts

List of charts

- Sales of essential oils by outlet

- Exports of essential oils by country

- Imports of essential oils by country

- Turnover of essential oil manufacturing

- Evolution of the turnover of the manufacture of essential oils

All our studies are available online in PDF format

Take a look at an example of our research on another market!

Latest news

Companies quoted in this study

This study contains a complete overview of the companies in the market, with the latest figures and news for each company. :

Choosing this study means :

Choosing this study means :

Access to more than 35 hours of work

Our studies are the result of over 35 hours of research and analysis. Using our studies allows you to devote more time and added value to your projects.

Benefit from 6 years' experience and over 1,500 industry reports already produced

Our expertise enables us to produce comprehensive studies in all sectors, including niche and emerging markets.

Our know-how and methodology enable us to produce reports that offer unique value for money.

Access to several thousand articles and paid-for data

Businesscoot has access to all the paid economic press as well as exclusive databases to carry out its market research (over 30,000 articles and private sources).

To enhance our research, our analysts also use web indicators (semrush, trends, etc.) to identify market trends and company strategies. (Consult our paying sources)

Guaranteed support after your purchase

A team dedicated to after-sales service, to guarantee you a high level of satisfaction. +44 238 097 0676

A digital format designed for our users

Not only do you have access to a PDF, but also to a digital version designed for our customers. This version gives you access to sources, data in Excel format and graphics. The content of the study can therefore be easily retrieved and adapted for your specific needs.

Our offers :

Our offers :

the essential oils market | France

- What are the figures on the size and growth of the market?

- What is driving the growth of the market and its evolution?

- What is the positioning of companies in the value chain?

- Data from several dozen databases

Pack 5 études (-15%) France

- 5 études au prix de 75,6€HT par étude à choisir parmi nos 800 titres sur le catalogue France pendant 12 mois

- Conservez -15% sur les études supplémentaires achetées

- Choisissez le remboursement des crédits non consommés au terme des 12 mois (durée du pack)

Consultez les conditions du pack et de remboursement des crédits non consommés.

DSM-Firmenich plans to sell its Animal Health & Nutrition division due to volatile vitamin prices - 19/02/2024

DSM-Firmenich plans to sell its Animal Health & Nutrition division due to volatile vitamin prices - 19/02/2024

Rugby World Cup: Puressentiel plays in the shadow of major sponsors - 24/10/2023

Rugby World Cup: Puressentiel plays in the shadow of major sponsors - 24/10/2023

Pranarôm: Experts in essential oils for 30 years - 15/03/2023

Pranarôm: Experts in essential oils for 30 years - 15/03/2023

Food supplements: Herbarom takes over Rodael laboratory - 09/03/2023

Food supplements: Herbarom takes over Rodael laboratory - 09/03/2023